Start Saving With Aetna S Senior Products Plan G

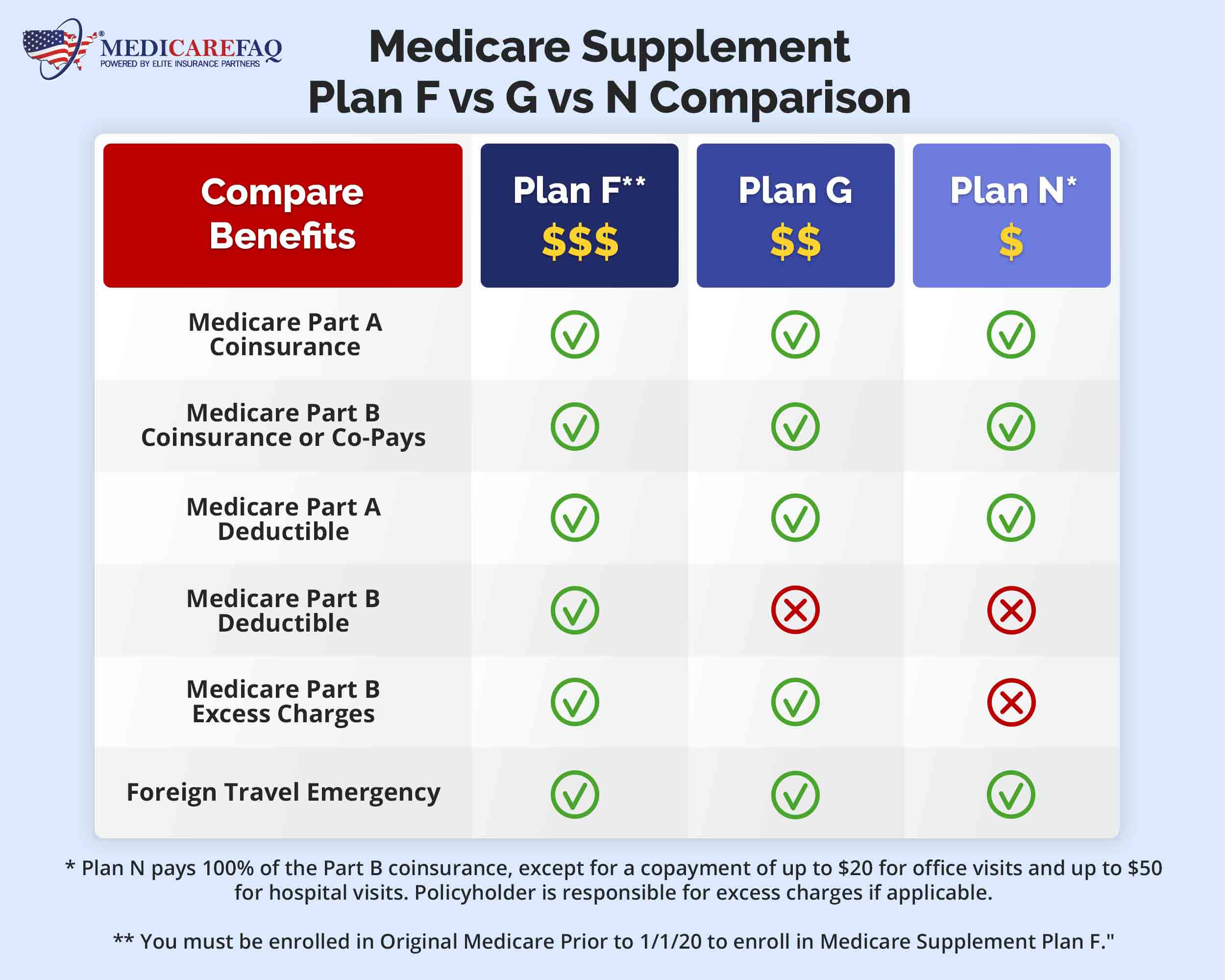

Start Saving With Aetna S Senior Products Plan G San diego, ca (91911) $207.58. philadelphia, pa (19019) $153.77. salt lake city, ut (84092) $135.95. you can request a free quote for aetna medicare supplement plan g by visiting aetna medicareplans . you can find out how much aetna plan g costs where you live, learn about discounts that may be available and more. Medicare supplement insurance plans transcript. ** plan n requires a $20 copayment for office visits and a $50 copayment for emergency room visits. copayments do not count toward the annual part b deductible. *high deductible plan f and plan g are also available; same benefits apply once calendar year deductible is paid.

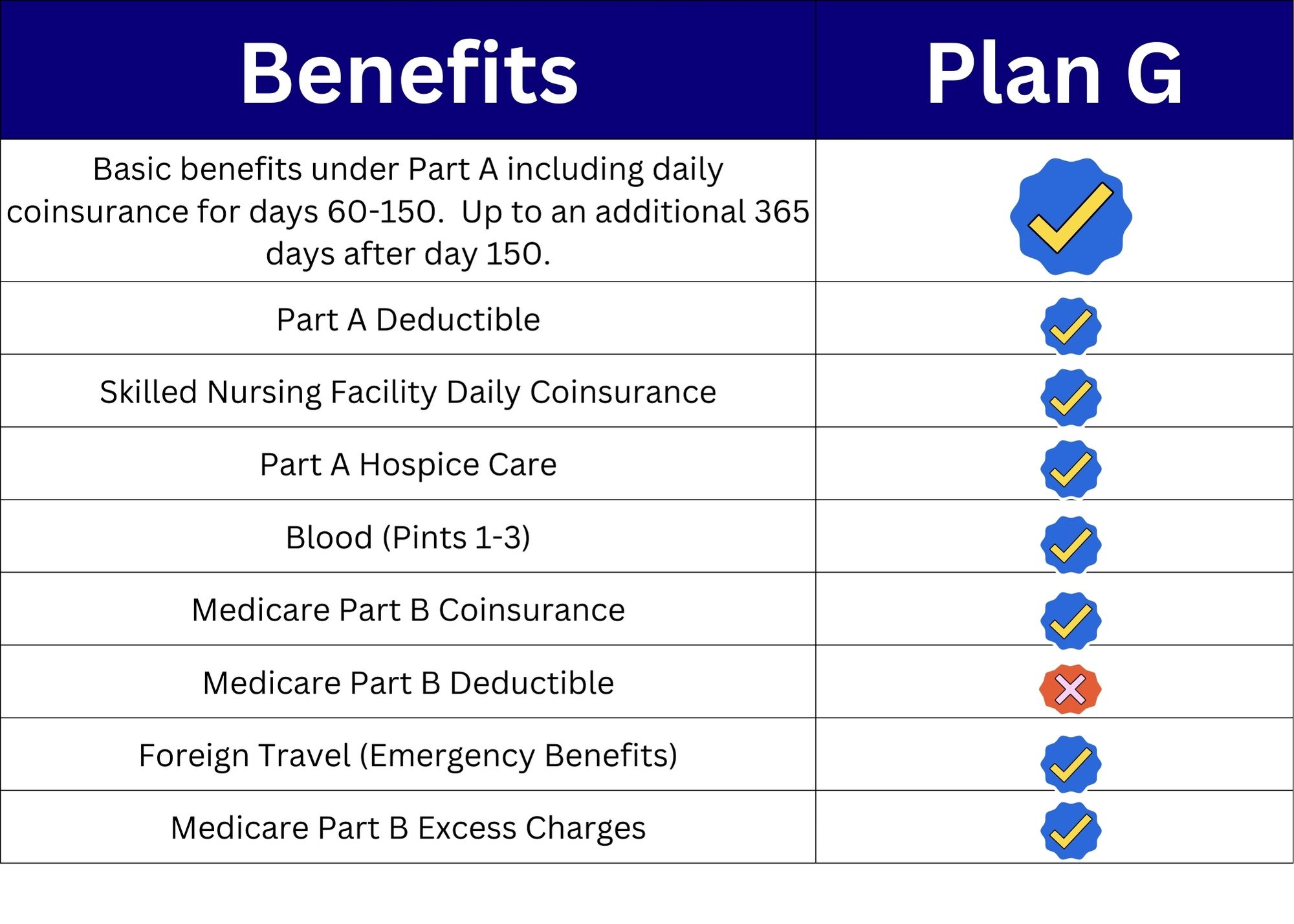

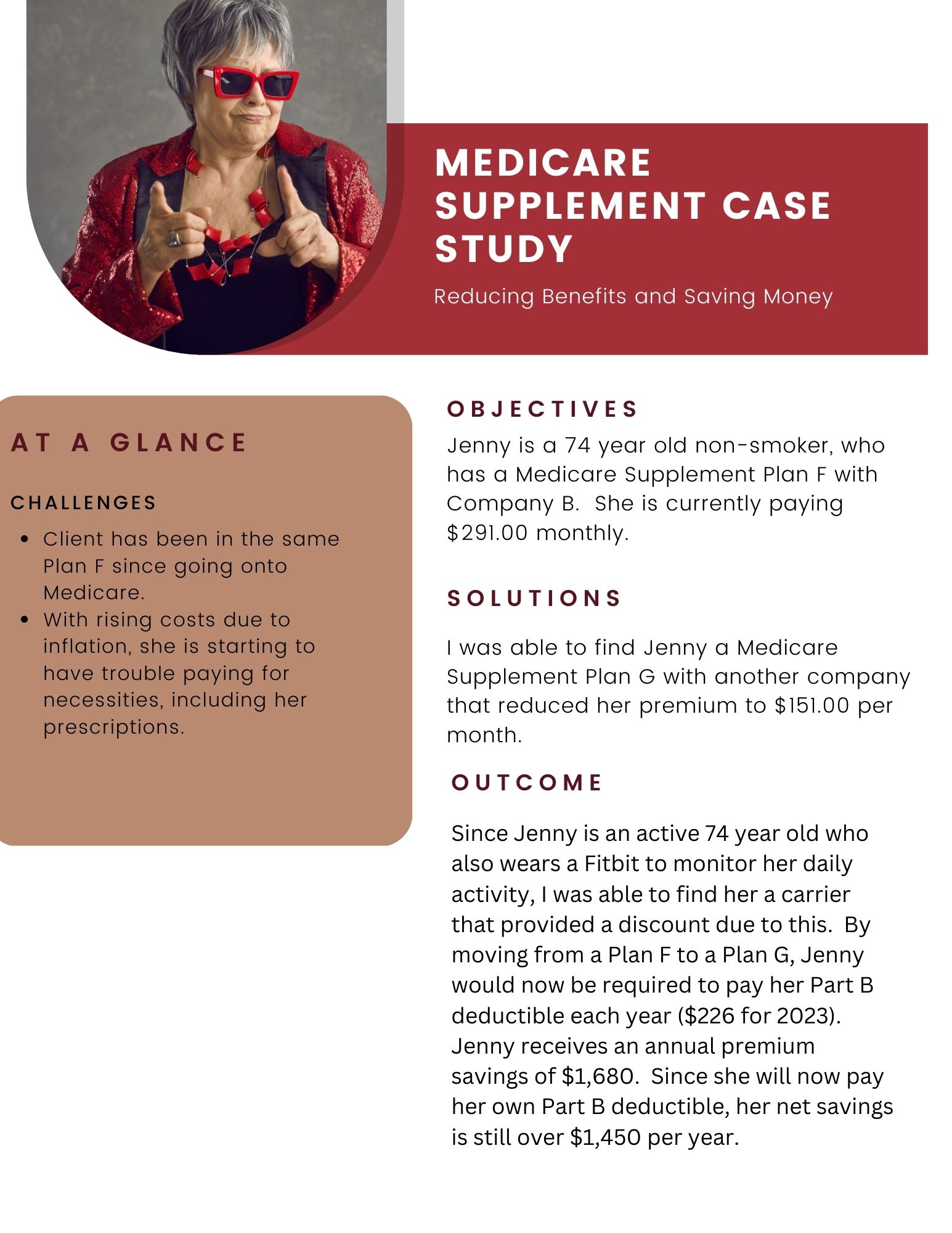

Start Saving With Aetna S Senior Products Plan G Aetna’s senior products plan g is designed to provide coverage for a wide range of healthcare services, including hospitalization, skilled nursing care, and physician services. with plan g, seniors have the freedom to choose their healthcare providers without worrying about the restrictions of a network. in addition, the plan offers coverage. Aetna medicare supplement plan g benefits. medicare supplement plan g offers the most comprehensive coverage. plan g covers: medicare part a hospital coinsurance. inpatient hospital costs up to 365 days after medicare benefits are used. part a hospice care copays or coinsurance. part a deductible. part b preventive office visit coinsurance. Cons. the downside of high deductible plan g can, of course, be your upfront cost before you receive help with out of pocket expenses. assuming you have this high deductible medigap plan and receive a medicare part b covered service, you’ll be responsible for the part b deductible, which is $240 in 2024. then medicare will pay 80% of covered. Cons. higher premiums: because it has high coverage, plan g also tends to have higher premiums. excess charges are rare: one of plan g’s unique features is coverage for part b excess charges.

Start Saving With Aetna S Senior Products Plan G Cons. the downside of high deductible plan g can, of course, be your upfront cost before you receive help with out of pocket expenses. assuming you have this high deductible medigap plan and receive a medicare part b covered service, you’ll be responsible for the part b deductible, which is $240 in 2024. then medicare will pay 80% of covered. Cons. higher premiums: because it has high coverage, plan g also tends to have higher premiums. excess charges are rare: one of plan g’s unique features is coverage for part b excess charges. Fact checked. the bottom line: aetna medicare supplement insurance plans are widely available and come in a decent variety of plan types, but the monthly premiums are sometimes high, and the. Filling in the gaps of original medicare. a medicare supplement insurance plan can help with out of pocket costs that original medicare does not cover. medicare supplement insurance plans give you: freedom to choose any doctor or hospital that accepts medicare. coverage that travels with you anywhere in the u.s. 12 month rate guarantee.

Aetna Medicare Supplement Medigap Plans Fact checked. the bottom line: aetna medicare supplement insurance plans are widely available and come in a decent variety of plan types, but the monthly premiums are sometimes high, and the. Filling in the gaps of original medicare. a medicare supplement insurance plan can help with out of pocket costs that original medicare does not cover. medicare supplement insurance plans give you: freedom to choose any doctor or hospital that accepts medicare. coverage that travels with you anywhere in the u.s. 12 month rate guarantee.

Aetna 2024 Plans Nadia Valaree

Aetna Senior Supplemental Insurance

Comments are closed.