Start Up Financing The Benefits Of Venture Capital To Entrepreneurs

Start Up Financing The Benefits Of Venture Capital To Entrepreneurs Venture capital disadvantages. offers access to larger amounts of capital. reduces ownership stake for founders. has no monthly payment requirements. diverts attention from running the business. doesn’t require collateral to secure financing. has funding opportunities that can be competitive. 1. opportunity for expansion: a large amount of capital can be raised. there are many benefits that venture capitalists can bring to your business, but the most obvious one is the amount of funding a startup can receive. as a result of the large capital injection, a company with high growth potential can expand way quicker than a firm without.

Venture Capital Financing Methods Funding Process Features Advantages of venture capital for startups. there are many advantages of venture capital for a startup. startups that receive vc support from venture capitalists can benefit in several ways: 1. access to capital. venture capitalists typically invest large amounts of capital in startups, providing the necessary funds for growth and expansion. Venture capital, sometimes abbreviated as vc, is a form of startup financing and a type of private equity that allows a startup business to offer a large share of their company to an investor or a few investors in exchange for funding or other benefits, like mentorship or talent. venture capital can come with high risks and high rewards for. Venture capital is financing that’s invested in startups and small businesses that are usually high risk, but also have the potential for exponential growth. the goal of a venture capital investment is a very high return for the venture capital firm, usually in the form of an acquisition of the startup or an ipo. 5. “alternative” financing. less discussed are a few other ways for entrepreneurs to access capital for their business. these options are often less dilutive than traditional venture capital.

Venture Capital Financing Overview Types Benefits Venture capital is financing that’s invested in startups and small businesses that are usually high risk, but also have the potential for exponential growth. the goal of a venture capital investment is a very high return for the venture capital firm, usually in the form of an acquisition of the startup or an ipo. 5. “alternative” financing. less discussed are a few other ways for entrepreneurs to access capital for their business. these options are often less dilutive than traditional venture capital. Venture capital firms provide funding for new companies in the early stages of development. there are four types of players in the venture capital industry: entrepreneurs who start companies and. Venture capital. venture capital is a form of private equity financing provided to high potential startups and early stage companies by venture capital firms or individual investors known as venture capitalists. vcs invest capital in exchange for equity or ownership stakes in the company, with the expectation of significant returns on their.

The Benefits Of Venture Capital To Start Ups Capitalize On Your Idea Venture capital firms provide funding for new companies in the early stages of development. there are four types of players in the venture capital industry: entrepreneurs who start companies and. Venture capital. venture capital is a form of private equity financing provided to high potential startups and early stage companies by venture capital firms or individual investors known as venture capitalists. vcs invest capital in exchange for equity or ownership stakes in the company, with the expectation of significant returns on their.

Benefits And Drawback Of Venture Capital For Startups

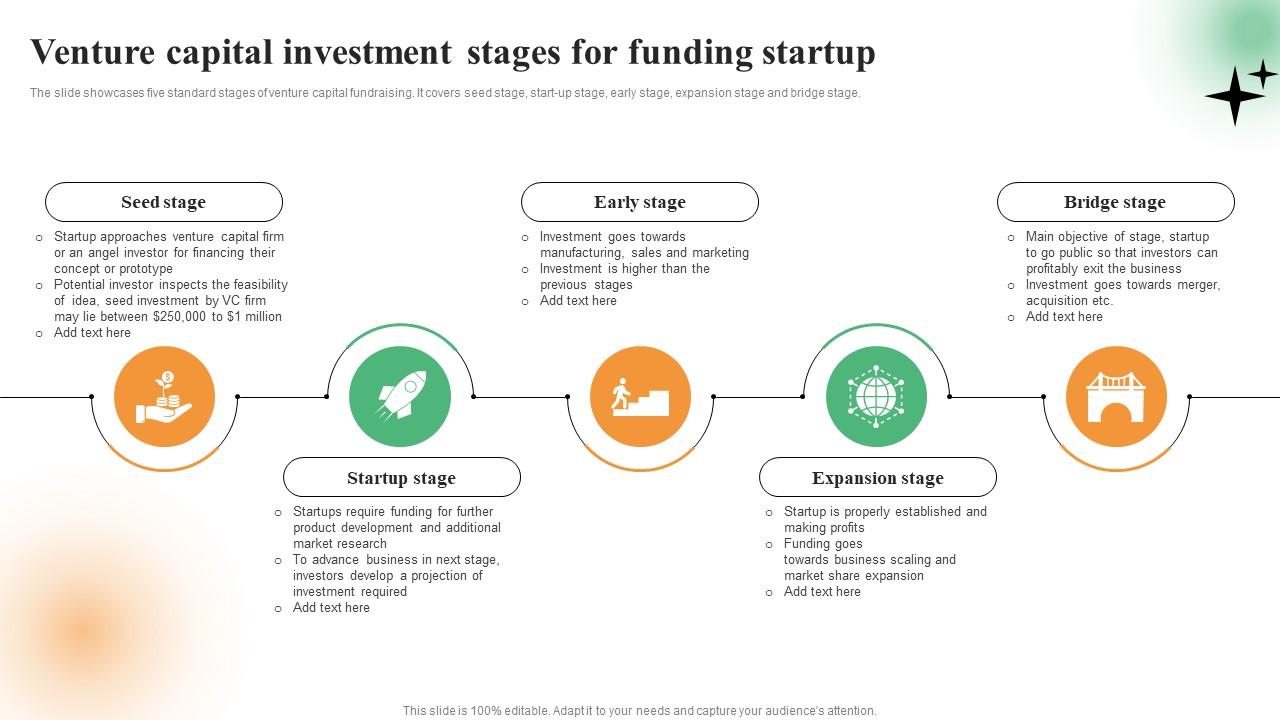

Venture Capital Investment Stages For Funding Startup Ppt Sample

Comments are closed.