Steps You Must Take Before Your Bankruptcy Case

Steps You Must Take Before Your Bankruptcy Case Youtube Much of the bankruptcy process is administrative, however, and is conducted away from the courthouse. in cases under chapters 7, 12, or 13, and sometimes in chapter 11 cases, this administrative process is carried out by a trustee who is appointed to oversee the case. a debtor's involvement with the bankruptcy judge is usually very limited. If it's a go, you'll complete and file the completed forms along with your counseling course certificate and the bankruptcy filing fee or a request for a fee waiver. once you file, the automatic stay will stop most creditor collection actions during your case. 6. give your documents to the chapter 7 bankruptcy trustee.

6 Steps To Take Before Filing Bankruptcy Before you file your bankruptcy case before you file for bankruptcy, you must do several things: receive a briefing about credit counseling from an approved agency within 180 days before you file. (if you and your spouse are filing together, each of you must receive a briefing before you file. failure to do so may result in the dismissal of. Individuals filing for chapter 7 bankruptcy must complete a course before filing or, in highly unusual cases, shortly after. you can take the class online or by phone up to 180 days before filing for bankruptcy. here's where you'll learn more about the prebankruptcy credit counseling requirement. 6. fill out and file the chapter 7 bankruptcy forms. Though bankruptcy requires a lot of paperwork and documentation, many people with simple cases file successfully on their own without a lawyer. here are the 10 steps to file your case successfully: 1. collect your documents 2. take the required credit counseling course 3. complete the required bankruptcy forms 4. The chapter 7 bankruptcy trustee. when you file for chapter 7, the bankruptcy court appoints a chapter 7 trustee to administer the case. the trustee's primary duties include verifying the filer's identity and disclosures in the bankruptcy paperwork, as well as finding funds for creditors. you should not send any sensitive or confidential.

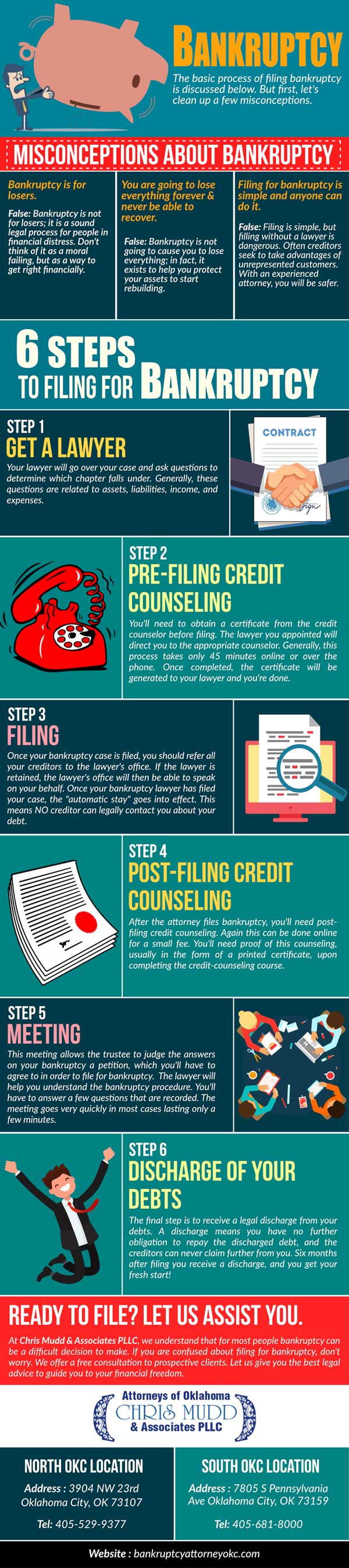

6 Steps To Filing For Bankruptcy Best Infographics Though bankruptcy requires a lot of paperwork and documentation, many people with simple cases file successfully on their own without a lawyer. here are the 10 steps to file your case successfully: 1. collect your documents 2. take the required credit counseling course 3. complete the required bankruptcy forms 4. The chapter 7 bankruptcy trustee. when you file for chapter 7, the bankruptcy court appoints a chapter 7 trustee to administer the case. the trustee's primary duties include verifying the filer's identity and disclosures in the bankruptcy paperwork, as well as finding funds for creditors. you should not send any sensitive or confidential. 6. make sure you have your filing fee. bankruptcy isn’t cheap. on top of attorney fees, you also have to pay a fee just to file for bankruptcy. the total filing fee for a chapter 7 bankruptcy is $335, and for a chapter 13 bankruptcy it’s $310. 2, 3 you’ll have to pay this amount in exact change to the court in person. The chapter 7 bankruptcy trustee has many responsibilities in your chapter 7 case. the chapter 7 trustee is responsible for reviewing the bankruptcy petition and supporting documents for accuracy and potential fraud, checking your identification, examining you, and selling property for the benefit of your creditors.

Bankruptcy Timeline Phoenix Bankruptcy Lawyers Lay Out A Bk Timeline 6. make sure you have your filing fee. bankruptcy isn’t cheap. on top of attorney fees, you also have to pay a fee just to file for bankruptcy. the total filing fee for a chapter 7 bankruptcy is $335, and for a chapter 13 bankruptcy it’s $310. 2, 3 you’ll have to pay this amount in exact change to the court in person. The chapter 7 bankruptcy trustee has many responsibilities in your chapter 7 case. the chapter 7 trustee is responsible for reviewing the bankruptcy petition and supporting documents for accuracy and potential fraud, checking your identification, examining you, and selling property for the benefit of your creditors.

Comments are closed.