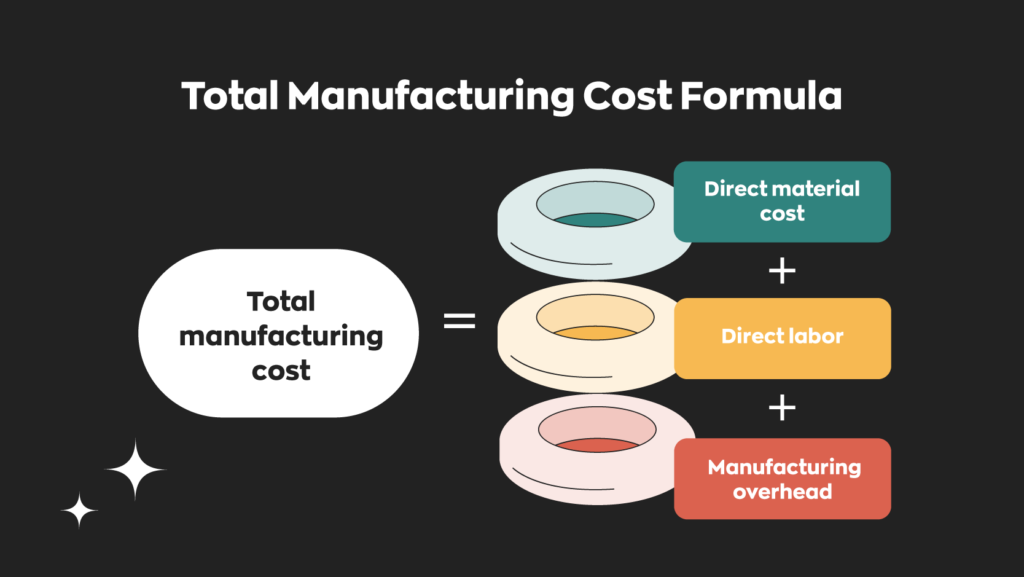

The 3 Manufacturing Cost Direct Material Direct Labor And Manufacturing Overhead

The 3 Manufacturing Cost Direct Material Direct Labor And Figure \(\pageindex{1}\): work in process inventory. direct materials, direct labor, and manufacturing overhead enter the work in process inventory as the costs associated with the products that are in production. once the products are completed, their costs are transferred to the finished goods inventory. Company a is a manufacturer of tables. its product costs may include: direct material: the cost of wood used to create the tables. direct labor: the cost of wages and benefits for the carpenters to create the tables. manufacturing overhead (indirect material): the cost of nails used to hold the tables together.

Ppt Management Accounting A Business Partner Powerpoint Presentation However, even pricing a product as a loss leader requires analysis of the three categories of costs: direct materials, direct labor, and overhead. direct materials. direct materials are those materials that can be directly traced to the manufacturing of the product. some examples of direct materials for different industries are shown in table 4. In this session, i cover the 3 manufacturing cost which are direct material, direct labor and manufacturing overhead. ️accounting students and cpa exam cand. This videos identifies and defines the three types of manufacturing costs: direct materials, direct labor, and manufacturing overhead. the video also provi. The three main types of manufacturing costs are direct materials, direct labor, and manufacturing overhead. understanding manufacturing cost is crucial for a successful business, as it helps a manufacturer determine the selling price of a finished product, identify areas where costs can be reduced, and evaluate the profitability of a product.

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial This videos identifies and defines the three types of manufacturing costs: direct materials, direct labor, and manufacturing overhead. the video also provi. The three main types of manufacturing costs are direct materials, direct labor, and manufacturing overhead. understanding manufacturing cost is crucial for a successful business, as it helps a manufacturer determine the selling price of a finished product, identify areas where costs can be reduced, and evaluate the profitability of a product. The total cost of manufacturing a product has three elements, namely: raw materials used (or direct materials cost) direct labor (or direct wages) production overhead (or factory overhead or works overhead) a manufacturing business maintains separate raw materials purchase accounts for each type of raw material that its factory uses. Manufacturing costs are made up of direct materials costs, direct labor costs and manufacturing overhead, which we’ll get to in greater detail shortly. each of these costs is usually listed as separate line items on an income statement, which is the financial results of the business for a stated period.

3 Types Of Manufacturing Costs Direct Materials Direct Labor The total cost of manufacturing a product has three elements, namely: raw materials used (or direct materials cost) direct labor (or direct wages) production overhead (or factory overhead or works overhead) a manufacturing business maintains separate raw materials purchase accounts for each type of raw material that its factory uses. Manufacturing costs are made up of direct materials costs, direct labor costs and manufacturing overhead, which we’ll get to in greater detail shortly. each of these costs is usually listed as separate line items on an income statement, which is the financial results of the business for a stated period.

Learn How To Use The Total Manufacturing Cost Formula

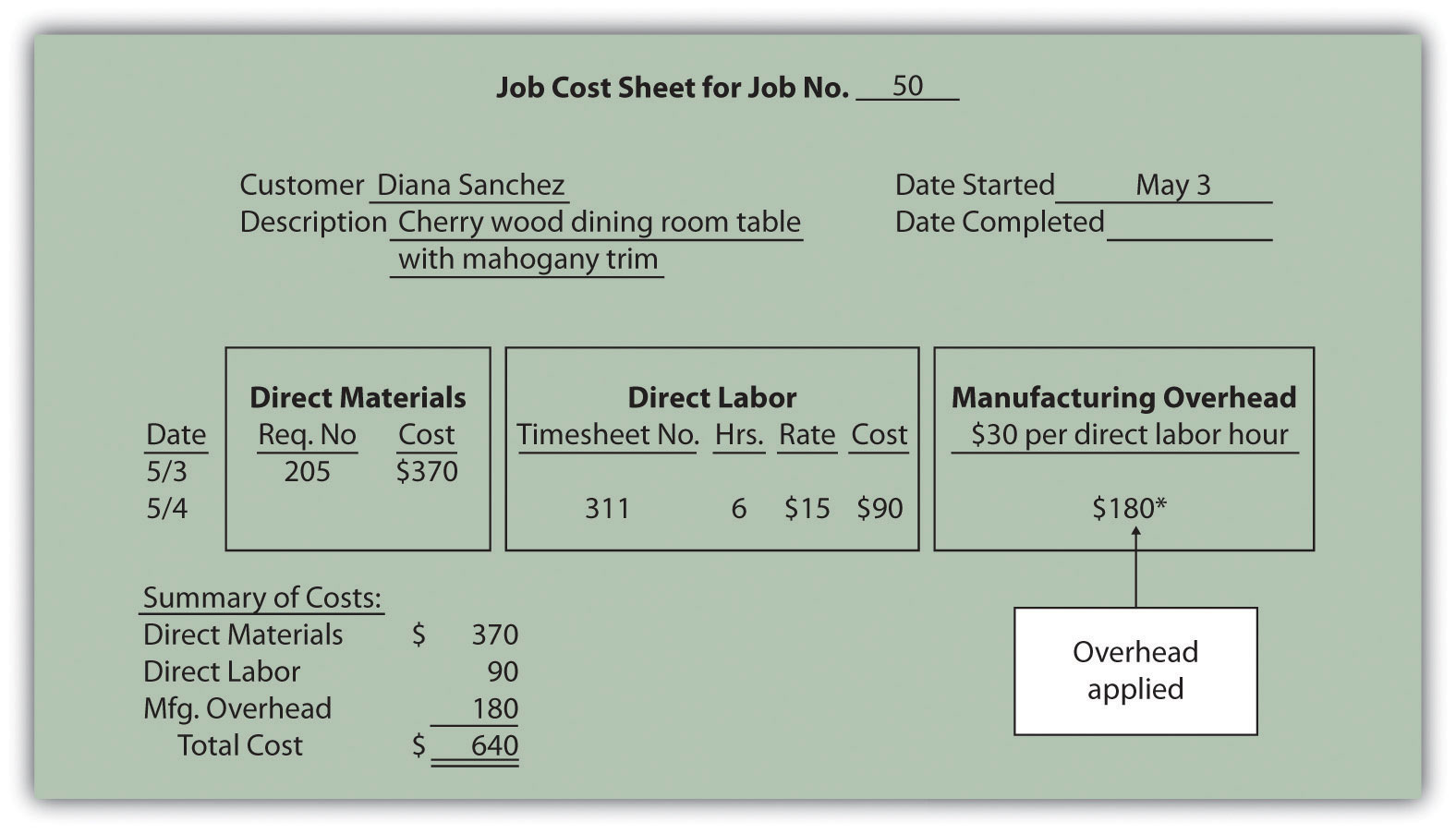

Assigning Manufacturing Overhead Costs To Jobs

Comments are closed.