The 7 Types Of Life Insurance Explained A Comprehensive Guide

The 7 Types Of Life Insurance Explained A Comprehensive Guide Types of life insurance – policygenius. life insurance . types of life insurance. the most common types of life insurance are term, whole, universal, variable, and final expense. here’s how each type works and how you can find the right policy for your needs. by. amanda shih amanda shiheditor & licensed life insurance expertamanda shih is. Based on your risk level, the insurer determines your eligibility, premiums, and coverage amount. the table below highlights the core differences between term and permanent life insurance. term.

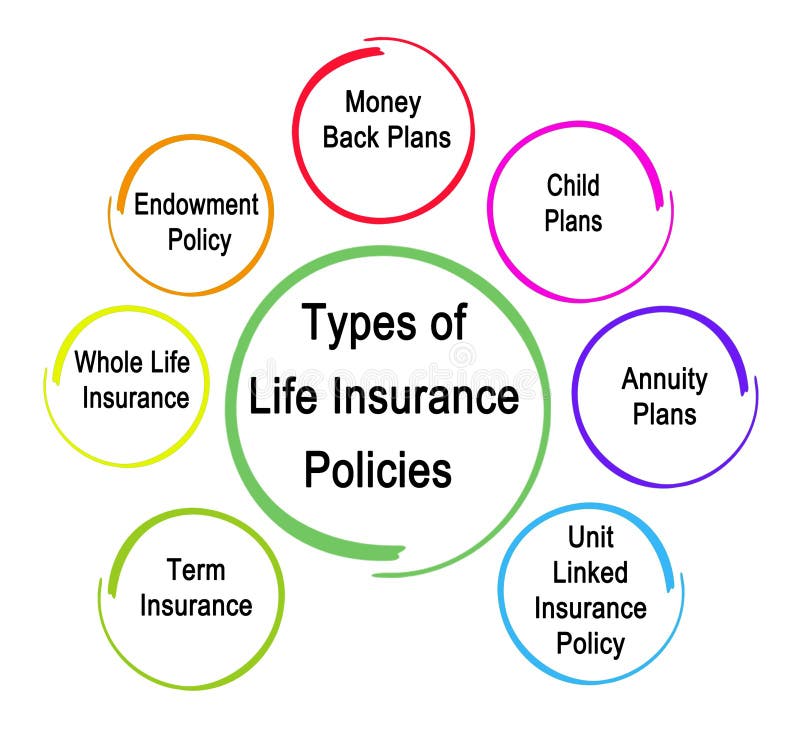

Types Of Life Insurance Policygenius The two major types of life insurance are term life insurance and permanent life insurance. allows you to lock in rates for a specific period of time, such as 10, 15, 20 or 30 years. once the. A life insurance policy is a contract with an insurance company that provides a lump sum payment to beneficiaries you choose in the event of your death. the policy must be in force at the time of. Life insurance is a contract between an insurance company and a policy owner in which the insurer guarantees to pay a sum of money to one or more named beneficiaries when the insured person dies. Learn more about each type of life insurance policy below. term life insurance. this is the most basic level of life insurance one can buy, as it only covers the policyholder for a set number of years; the most common is a ten year term. term life insurance provides a death benefit only without cash value. because of this — along with other.

Types Of Life Insurance Explained Chart Life insurance is a contract between an insurance company and a policy owner in which the insurer guarantees to pay a sum of money to one or more named beneficiaries when the insured person dies. Learn more about each type of life insurance policy below. term life insurance. this is the most basic level of life insurance one can buy, as it only covers the policyholder for a set number of years; the most common is a ten year term. term life insurance provides a death benefit only without cash value. because of this — along with other. Life insurance is a financial contract where an individual pays premiums to an insurance company in exchange for a lump sum payment to their beneficiaries upon their death. written by erik martin. erik j. martin is a chicago area based freelance writer whose articles have been published by aarp the magazine, the motley fool, the costco. When you start looking into life insurance plans, there are two main types: term and permanent. term life covers you for a limited period, while permanent can stay in place for the rest of your.

The Main Types Of Life Insurance Explained Ramsey Life insurance is a financial contract where an individual pays premiums to an insurance company in exchange for a lump sum payment to their beneficiaries upon their death. written by erik martin. erik j. martin is a chicago area based freelance writer whose articles have been published by aarp the magazine, the motley fool, the costco. When you start looking into life insurance plans, there are two main types: term and permanent. term life covers you for a limited period, while permanent can stay in place for the rest of your.

Understanding The Basics Of Life Insurance Real Estate News Central

Demystifying Types Life Insurance Coverage And Benefits

Comments are closed.