The Basic Accounting Journal Entries

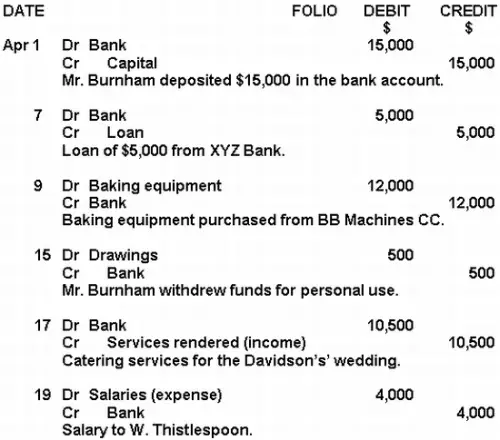

The Basic Accounting Journal Entries Pay makes his first payroll payment. entry #11 — pgs’s first vendor inventory payment is due of $1,000. entry #12 — paul starts giving guitar lessons and receives $2,000 in lesson income. entry #13 — pgs’s first bank loan payment is due. entry #14 — pgs has more cash sales of $25,000 with cost of goods of $10,000. 1. journal entry for the owner investing capital. this is where the owner invests assets in a business. this results in owner's equity and is more specifically known as capital or a capital investment: click here for the full equity example lesson. 2. journal entry for a liability (debt) a liability is simply a debt.

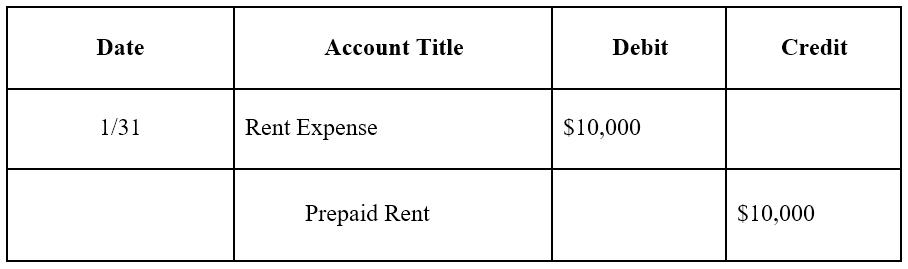

The Basic Accounting Journal Entries Online Accounting A journal entry in accounting is how you record financial transactions. to make a journal entry, you enter the details of a transaction into your company’s books. in the second step of the accounting cycle, your journal entries get put into the general ledger. every journal entry in the general ledger will include the date of the transaction. Capital is an internal liability for the business hence credit the increase in liabilities. example – max started a business with 10,000 in cash. cash a c. 10,000. to capital a c. 10,000. (capital introduced by max in cash for 10,000) related topic – all journal entries on one page. 2. 1. go to accounting > journal entry. add journal entries in deskera books. here, you’ll be able to view, create, and manage all your journal entries. the main attributes displayed for every entry here are the journal entry number, the journal entry date, the journal entry type, and the related document number. Let's start. transaction #1: on december 1, 2021, mr. donald gray started gray electronic repair services by investing $10,000. the journal entry should increase the company's cash, and increase (establish) the capital account of mr. gray; hence: transaction #2: on december 5, gray electronic repair services paid registration and licensing fees.

Basic Accounting Journal Entries Bookkeeping Services Economics 1. go to accounting > journal entry. add journal entries in deskera books. here, you’ll be able to view, create, and manage all your journal entries. the main attributes displayed for every entry here are the journal entry number, the journal entry date, the journal entry type, and the related document number. Let's start. transaction #1: on december 1, 2021, mr. donald gray started gray electronic repair services by investing $10,000. the journal entry should increase the company's cash, and increase (establish) the capital account of mr. gray; hence: transaction #2: on december 5, gray electronic repair services paid registration and licensing fees. Example 1: journal entries of purchase. imagine steff’s supplies sells a kitchen mixer on credit to barry’s bakery on august 15, 2023. barry paid the invoice on september 15, 2023. we will look at the journal entries on barry’s books first. date. An accounting journal entry is the method used to enter an accounting transaction into the accounting records of a business. the accounting records are aggregated into the general ledger , or the journal entries may be recorded in a variety of sub ledgers , which are later rolled up into the general ledger.

Comments are closed.