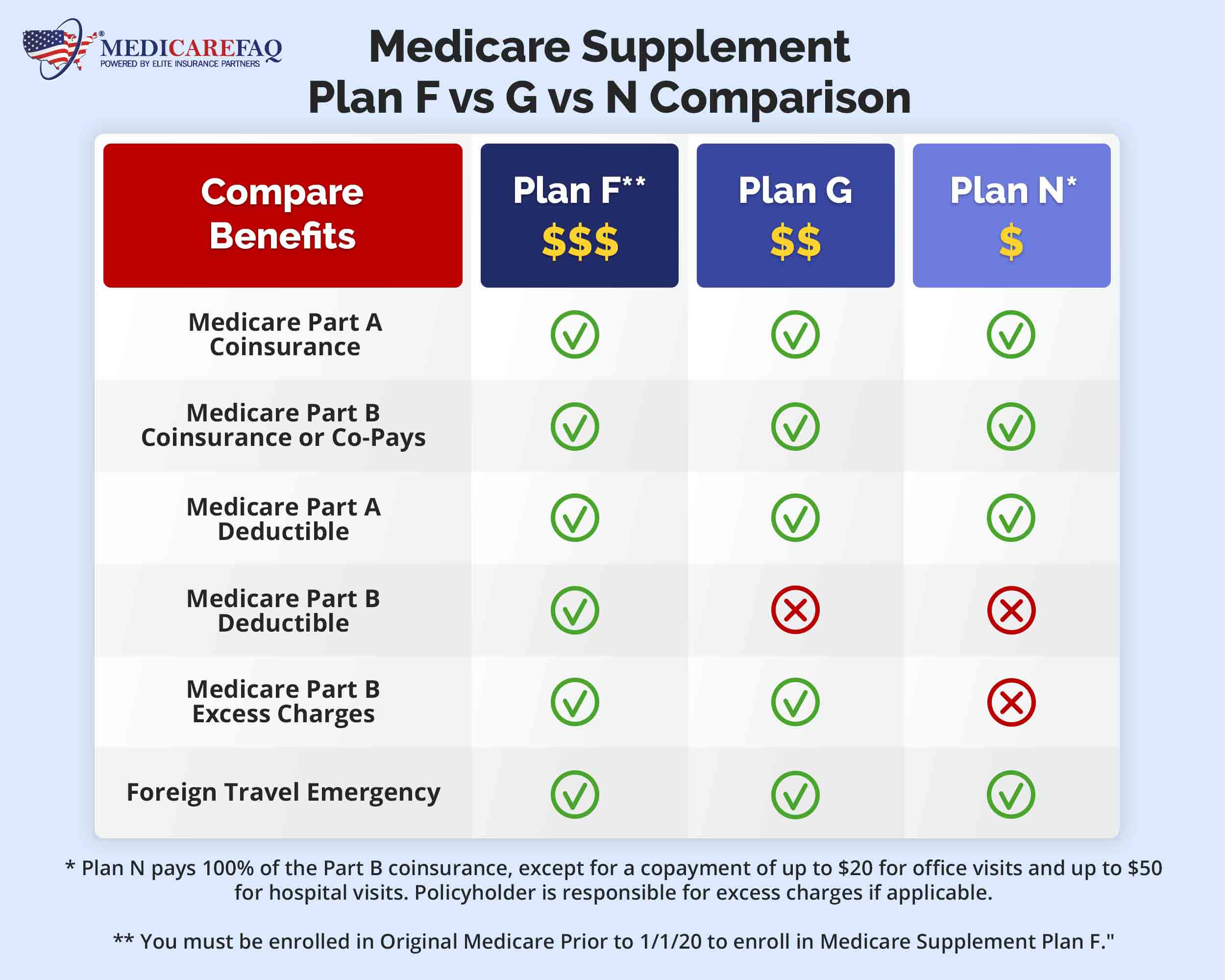

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N

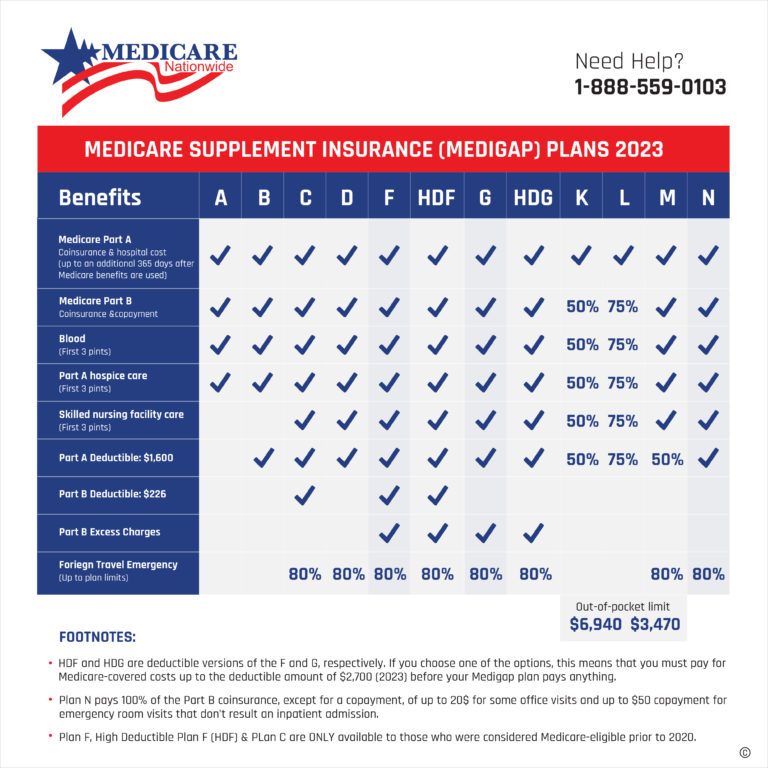

Medicare Supplement Medigap Plan F Vs Plan G Vs Plan N Medicare plan f vs. g vs. n: deductibles. the other major difference to consider when comparing plans f, g and n is that plan f covers the annual part b deductible of $240, but plans g and n don. 1 plans f and g offer high deductible plans that each have an annual deductible of $2,800 in 2024. once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. the high deductible plan f is not available to new beneficiaries who became eligible for medicare on or after january 1, 2020.

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N The biggest difference between medigap plan g and medigap plan n is that plan n has copays for certain medical office and emergency department visits, whereas plan g doesn’t. if you wouldn’t. Medicare supplement plan f is the most comprehensive plan. plan f covers one more benefit than plan g, which is the part b deductible. plan g and plan n premiums are lower to reflect that. 7. plan g will typically have higher premiums than plan n because it includes more coverage. Medigap plan f is no longer available for adults who turned 65 on or after jan. 1, 2020. however, you may still be able to enroll in plan f if it’s available in your state and zip code and you. Medicare supplement plan g works similarly to plan f. the main difference between the two plans is how plan g interacts with the part b deductible. with plan f, the medicare supplement plan pays for the part b deductible. under plan g, you are responsible for the part b deductible only. otherwise, all part a deductibles, copays, and coinsurance.

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide Medigap plan f is no longer available for adults who turned 65 on or after jan. 1, 2020. however, you may still be able to enroll in plan f if it’s available in your state and zip code and you. Medicare supplement plan g works similarly to plan f. the main difference between the two plans is how plan g interacts with the part b deductible. with plan f, the medicare supplement plan pays for the part b deductible. under plan g, you are responsible for the part b deductible only. otherwise, all part a deductibles, copays, and coinsurance. Medigap plan g and plan n are the two most popular medicare supplement insurance plans available for new medicare members. plan n covers a little less than plan g, but it generally has lower premiums. The high deductible plan f is not available to new beneficiaries who became eligible for medicare on or after january 1, 2020. plan k has an out of pocket yearly limit of $7,060 in 2024. after you pay the out of pocket yearly limit and yearly part b deductible, it pays 100% of covered services for the rest of the calendar year.

Comments are closed.