The Best Medigap Plan Medicare Supplement G 2021 Review

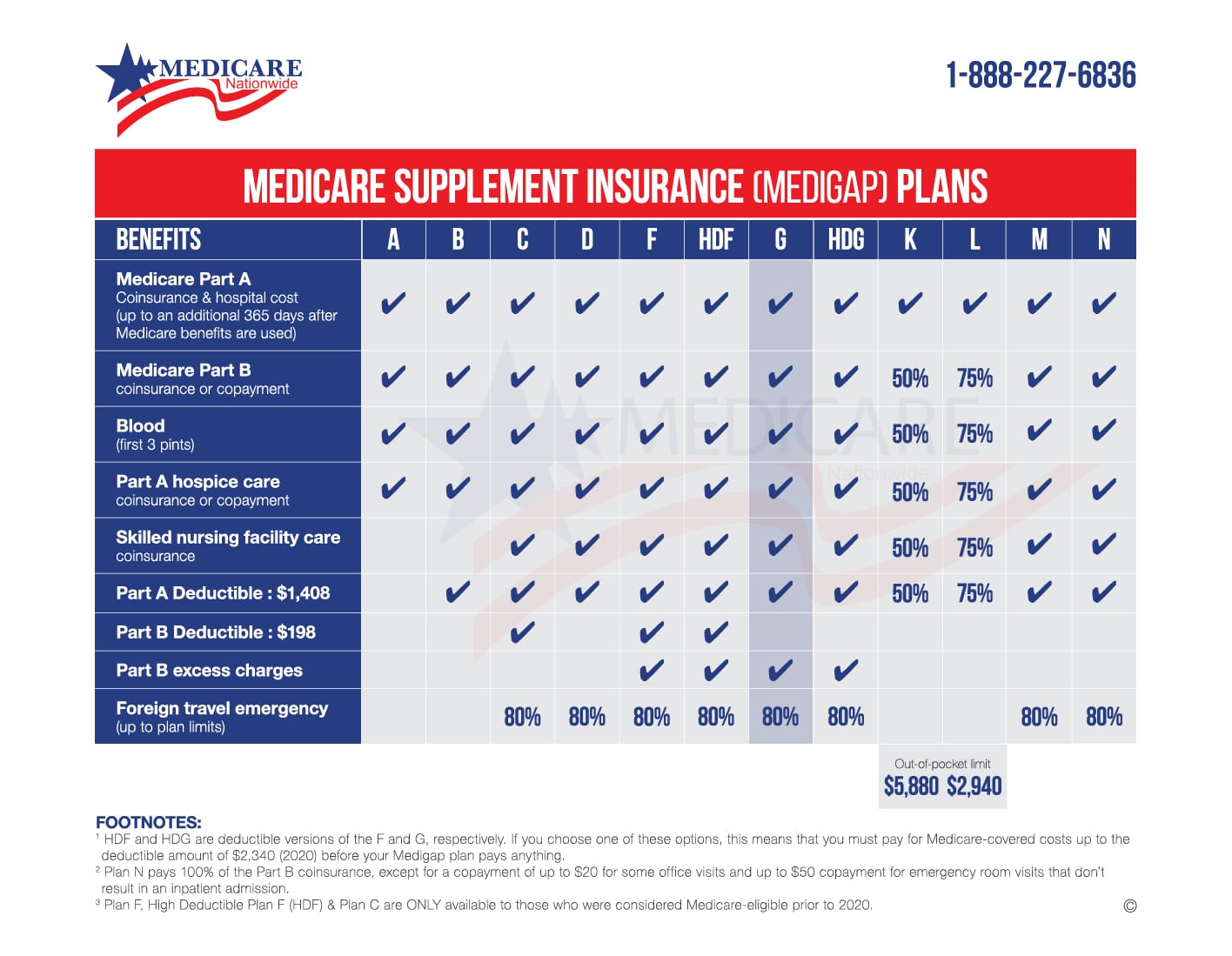

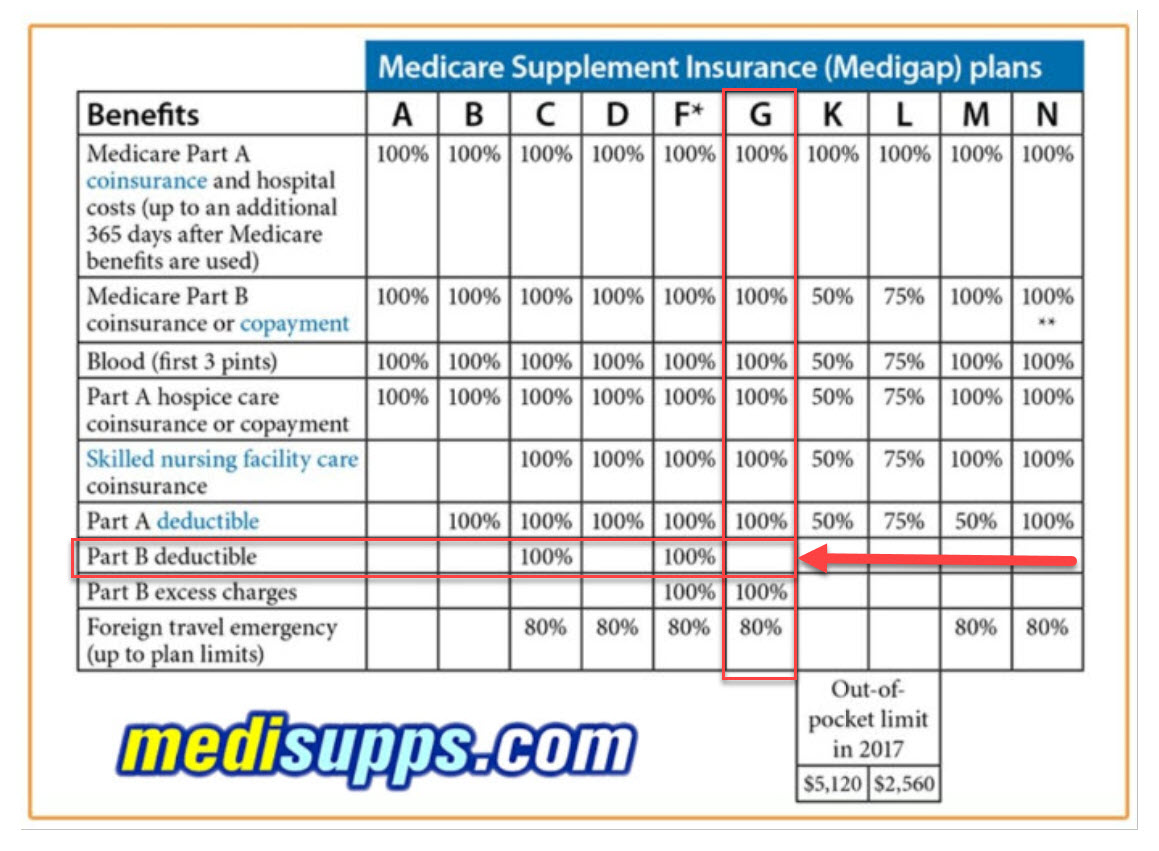

Medigap Plans Chart The Best Medicare Supplement Plans For 2021 Best for high deductible medigap plan g: mutual of omaha medicare supplement insurance. honorable mention: blue cross blue shield medicare supplement insurance. if you have additional questions. Best medicare supplement plans and providers of 2024. best nationwide coverage: bluecross blueshield. best additional plan benefits: humana. best membership perks: aarp by unitedhealthcare. best.

What Is A Medicare Medigap Plan Medicaretalk Net The best time to buy your medicare supplement plan g policy is during the six month medigap open enrollment period. this period happens only once. it starts once you’re 65 and enrolled in. Plan g: best for most people. $184 mo. plan f: best coverage. $111 mo. plan n: best cheap coverage. plan g is the best medicare supplement policy for most people because it pays for nearly all of the health care costs not covered by medicare. however, plan g is also one of the more expensive plans, with an average price of $148 per month for 2024. Medigap plan f is offered by private companies and provides the most comprehensive coverage of the medigap plans. it covers 100% of: part a coinsurance and hospital costs. part b copays and. Cons. the downside of high deductible plan g can, of course, be your upfront cost before you receive help with out of pocket expenses. assuming you have this high deductible medigap plan and receive a medicare part b covered service, you’ll be responsible for the part b deductible, which is $240 in 2024. then medicare will pay 80% of covered.

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Medigap plan f is offered by private companies and provides the most comprehensive coverage of the medigap plans. it covers 100% of: part a coinsurance and hospital costs. part b copays and. Cons. the downside of high deductible plan g can, of course, be your upfront cost before you receive help with out of pocket expenses. assuming you have this high deductible medigap plan and receive a medicare part b covered service, you’ll be responsible for the part b deductible, which is $240 in 2024. then medicare will pay 80% of covered. The average medicare supplement plan g premium was $135 per month in 2023. this was one of the lowest average monthly premiums of any standardized medigap plan. 2. as previously mentioned, the only benefit area that is not covered by plan g is the medicare part b deductible. however, the part b deductible is only $240 per year in 2024. The best time to enroll in a medicare supplement plan is during medigap open enrollment. this period begins the first month you are enrolled in medicare part b and are 65 or older. it lasts six.

Medicare Supplement Plans Comparison Chart 2021 What S New The average medicare supplement plan g premium was $135 per month in 2023. this was one of the lowest average monthly premiums of any standardized medigap plan. 2. as previously mentioned, the only benefit area that is not covered by plan g is the medicare part b deductible. however, the part b deductible is only $240 per year in 2024. The best time to enroll in a medicare supplement plan is during medigap open enrollment. this period begins the first month you are enrolled in medicare part b and are 65 or older. it lasts six.

Comments are closed.