The Draw Period On A Heloc Refers To

Heloc Do S And Don Ts A Step By Step Guide To Home Equity Lines Of The draw period is the initial phase of a home equity line of credit (heloc), during which you can withdraw funds, up to your credit limit. the draw period typically lasts up to 10 years. during. The heloc draw period will vary in length based on the terms of each individual heloc. generally, a draw period is between five and 15 years, with 10 being the most common. the repayment period is.

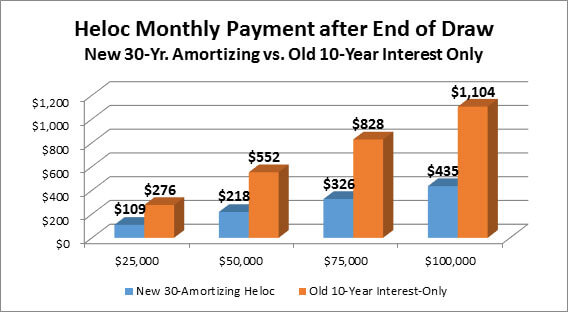

Heloc Draw Period Payment Calculator Draw It Out A heloc’s draw period refers to the period of time during which a borrower can withdrawal funds from the line of credit. draw periods vary in length depending on each one’s terms, but typically range between 5 and 15 years. ten years is the most common draw period length. during the draw period, you’ll be able to take out any amount of. Heloc terms typically include a 5 to 10 year draw period and a 10 to 20 year repayment period, with varying interest rates. heloc terms affect costs through variable interest rates and potential balloon payments during repayment. reduce heloc payments by paying down principal during the draw period or refinancing to secure a lower interest rate. Your lender will set the length of time for your heloc draw period, which is usually somewhere between five and 10 years. during this draw period, you can withdraw the amount of money you need. A heloc "draw period" is the amount of time you have to tap into that available credit. as you pay down your mortgage, you build equity—the difference between the amount of money you owe on your mortgage and your home's current value. if you owe $300,000 on your mortgage and your home's value is assessed at $600,000, for instance, you have.

Heloc Draw Period Vs Repayment Period Your lender will set the length of time for your heloc draw period, which is usually somewhere between five and 10 years. during this draw period, you can withdraw the amount of money you need. A heloc "draw period" is the amount of time you have to tap into that available credit. as you pay down your mortgage, you build equity—the difference between the amount of money you owe on your mortgage and your home's current value. if you owe $300,000 on your mortgage and your home's value is assessed at $600,000, for instance, you have. A: the repayment period takes place once the draw period ends, which is typically 10 years after you start using the heloc.you’ll no longer be able to borrow from your credit line, and you’ll start paying back the amount that you borrowed on top of the interest payments that were already taking place during the draw period on the amount borrowed. A draw period is the amount of time you're entitled to draw funds from a home equity line of credit (heloc). you’ll only have to pay interest on the amount you borrow during the draw period. the repayment period will come into effect when the draw period is over, and you’ll be required to repay your entire balance.

Heloc End Of Draw Period Guidance Alter Playground A: the repayment period takes place once the draw period ends, which is typically 10 years after you start using the heloc.you’ll no longer be able to borrow from your credit line, and you’ll start paying back the amount that you borrowed on top of the interest payments that were already taking place during the draw period on the amount borrowed. A draw period is the amount of time you're entitled to draw funds from a home equity line of credit (heloc). you’ll only have to pay interest on the amount you borrow during the draw period. the repayment period will come into effect when the draw period is over, and you’ll be required to repay your entire balance.

Heloc Draw Period Payment Calculator Draw It Out

Comments are closed.