The Easing Cycle Begins Will The Fed Spark A Gold Rally Or Fuel Economic Concern Will Rhind

The Key Difference Between Now And The 2 Previous Starts Of The Fed S Jeremy szafron, anchor at kitco news, interviews will rhind, founder and ceo of graniteshares. they discuss the federal reserve's anticipated interest rate c. Gold prices rose over 1% on thursday as the u.s. federal reserve launched its monetary easing cycle with a half percentage point move, boosting bullion to an all time high and just a few cents shy.

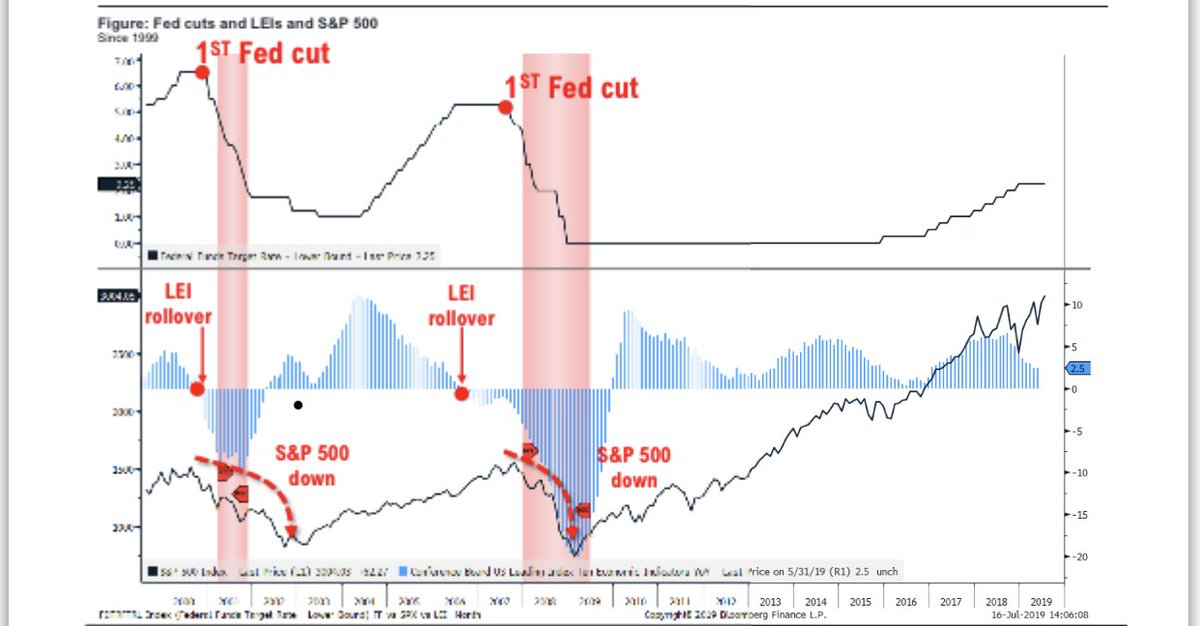

The Key Difference Between Now And The 2 Previous Starts Of The Fed S Kitco news (@kitconews). 'the easing cycle begins': will the fed spark a gold rally or fuel economic concern? jeremy szafron interviews will rhind, founder and ceo of graniteshares. they discuss the federal reserve's anticipated interest rate cuts and the potential ripple effects across gold markets and the broader economy. watch the full interview with jeremyszafron and will rhind: https. Sept 19 (reuters) gold prices rose over 1% on thursday as the u.s. federal reserve launched its monetary easing cycle with a half percentage point move, boosting bullion to an all time high and just a few cents shy of the key $2,600 ceiling in the previous session. spot gold rose 1.2% to $2,590.47 per ounce by 2:02 p.m. et (1802 gmt). Looking ahead, with the federal reserve just embarking on a new easing cycle, analysts have said that the precious metal has the potential to move higher next week and through the rest of the year. december gold futures last traded at $2,644.70 an ounce, up more than 1% on the day. The 2019 2020 easing cycle. at the end of june 2019, one month before the fed lowered rates, markets priced 75 bps of rate cuts by december that year. indeed, the fed cut rates from 2.375% to 1.625%, nearly in line with market expectations at the beginning of the rate cut cycle. the market priced 25 bps of further easing in 2020.

Gold Weekly Ready To Bounce Again As The Fed Begins Its Easing Cycle Looking ahead, with the federal reserve just embarking on a new easing cycle, analysts have said that the precious metal has the potential to move higher next week and through the rest of the year. december gold futures last traded at $2,644.70 an ounce, up more than 1% on the day. The 2019 2020 easing cycle. at the end of june 2019, one month before the fed lowered rates, markets priced 75 bps of rate cuts by december that year. indeed, the fed cut rates from 2.375% to 1.625%, nearly in line with market expectations at the beginning of the rate cut cycle. the market priced 25 bps of further easing in 2020. "the primary drivers of the gold price move are financial investment demand, particularly with etf buying improving and overall improved sentiment as the expectations of fed easing cycle to begin. She said the imf expects core u.s. personal consumption expenditures index (pce) inflation ending 2024 at 2.5% and returning to the fed's 2% target by mid 2025, and recent data show less upside.

Comments are closed.