The Fcra Promotes The Following Aspects Of Consumer Reporting

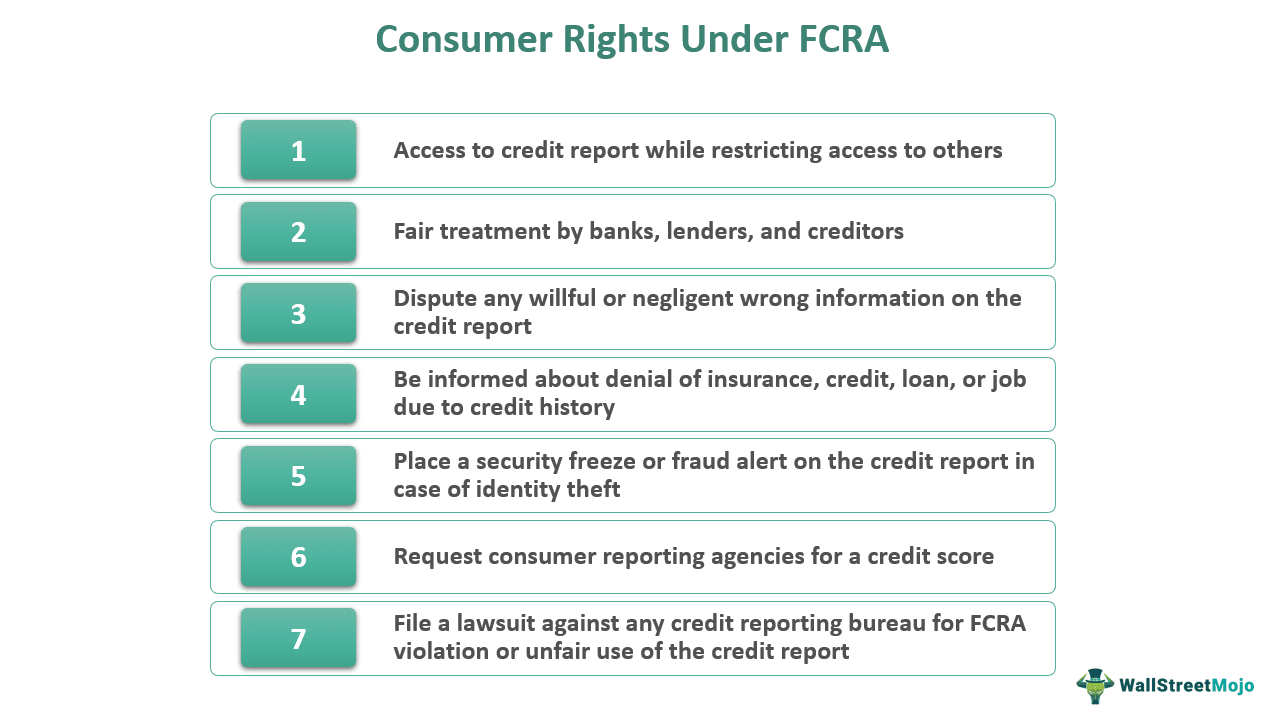

Know Your Rights Under The Fair Credit Reporting Act Credit Recovery The fair credit reporting act (fcra) is a federal law that requires: lenders, employers, insurance companies, and anyone using a consumer report to exercise fairness, confidentiality, and accuracy in preparing, submitting, using, and disclosing credit information. this law regulates the reporting and use of consumer credit information and seeks. Study with quizlet and memorize flashcards containing terms like the was passed in 1970 to protect an individual's privacy rights and to ensure accurate and fair credit reporting., fcra's primary intent is to protect consumers from the willful and or negligent inclusion of ., the fair credit reporting act is enforced by the and more.

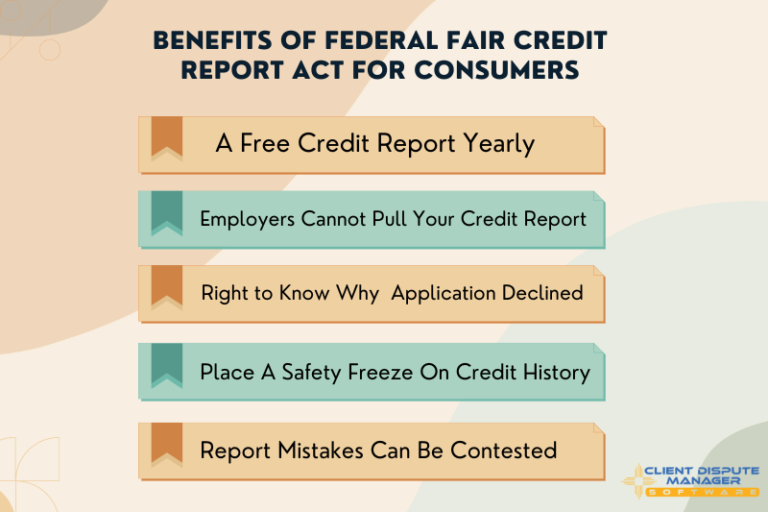

The Guide To Understanding The Fair Credit Reporting Act Fcra A summary of your rights under the fair credit reporting act. the fair credit reporting act (fcra) is a federal law that helps to ensure the accuracy, fairness and privacy of the information in consumer credit bureau files. the law regulates the way credit reporting agencies can collect, access, use and share the data they collect in your. The fair credit reporting act (fcra) is a federal law that regulates the collection of consumers' credit information and access to their credit reports. it was passed in 1970 to address the. The federal fair credit reporting act (fcra) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies. there are many types of consumer reporting agencies, including credit bureaus and specialty agencies (such as agencies that sell information about check writing histories, medical records, and. Fcra may2023 508.pdf (652.93 kb) the act (title vi of the consumer credit protection act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. information in a consumer report cannot be provided to anyone who does not have a purpose specified in the act.

Fair Credit Reporting Act Fcra Definition Purpose The federal fair credit reporting act (fcra) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies. there are many types of consumer reporting agencies, including credit bureaus and specialty agencies (such as agencies that sell information about check writing histories, medical records, and. Fcra may2023 508.pdf (652.93 kb) the act (title vi of the consumer credit protection act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. information in a consumer report cannot be provided to anyone who does not have a purpose specified in the act. A summary of your rights under the fair credit reporting act. the federal fair credit reporting act (fcra) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies. there are many types of consumer reporting agencies, including credit bureaus and specialty agencies (such as agencies that sell. The fair credit reporting act governs how credit bureaus can collect and share consumer information. under the fcra, consumers can dispute inaccurate or outdated information on their credit.

Comments are closed.