The Four Phases Of Your Financial Life

The Four Phases Of Your Financial Life Stage four: distribution of wealth (retirement) the fourth and final stage of your financial life cycle is retirement. your working days are over, and you've officially entered your golden years. with your income from work likely at $0, you're now living off your retirement accounts (assuming you're of age to take distributions) and either. At its core, life cycle financial planning serves as a personalized compass. it helps you navigate the nuanced financial requirements that characterize the different stages of life. life cycle.

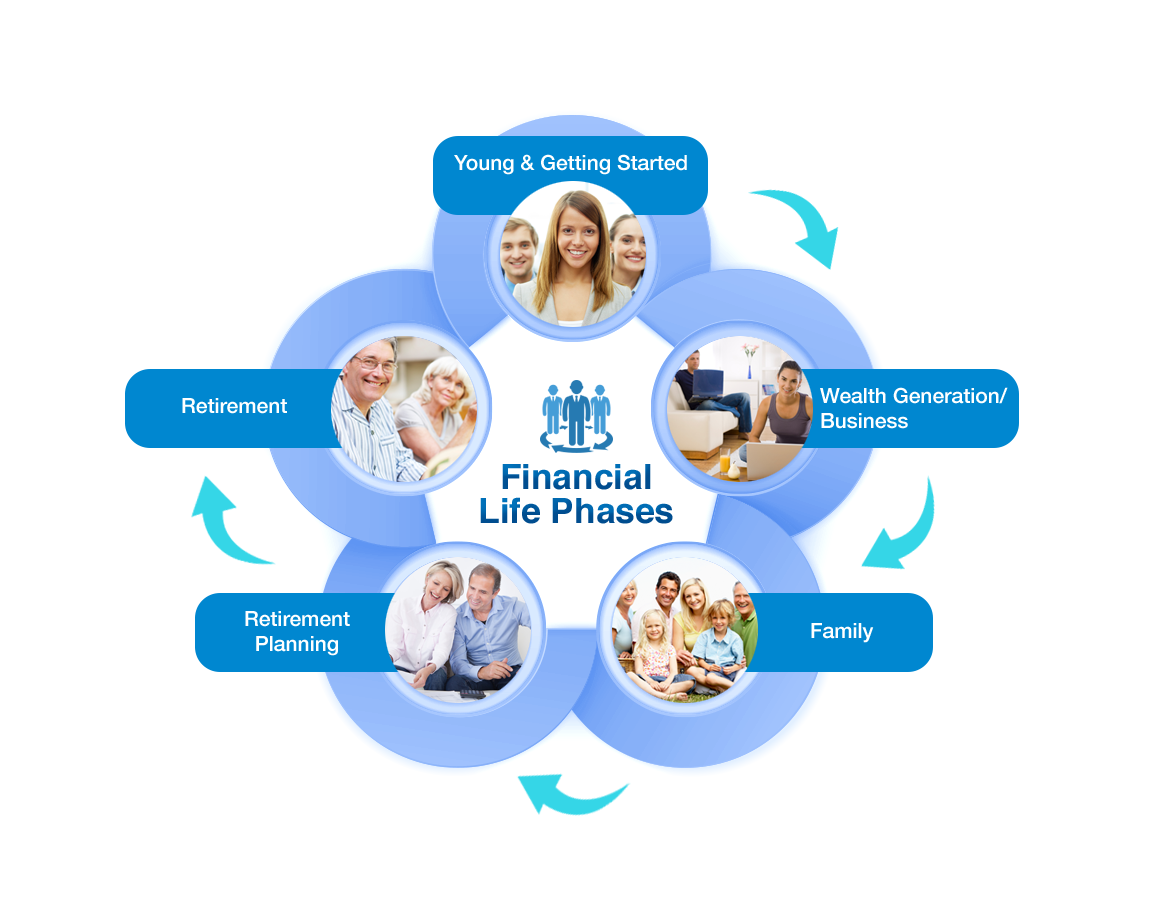

Financial Life Phases Wealthlife By having a better understanding of each phase, you’ll be able to know what to expect and plan throughout your retirement. we’ll break things down into four phases: accumulation. transition. distribution. legacy. keep in mind, you might have to revisit pieces of each phase as you plan for other phases. Stage four: retirement. the golden years have arrived – but so has the time when you’ll no longer have the reassurance of an employer provided income. instead, you’ll be paying yourself from the finite nest egg you’ve accumulated over the earlier stages of your financial life cycle. the critical consideration during this time will be. There are stages, four stages. your aim is to complete the tasks and markers within one classification, and then move on to the next. this will allow you to focus on the right things. this will allow you to progress consistently. and not to get all dramatic up in here, but progressing through these four stages will change your financial life. Retirement is often a succession of phases with different spending priorities and budgeting needs. a four phase model for retirement consists of pre retirement (age 50 to 62 or so), the early.

The Four Phases Of Your Financial Life There are stages, four stages. your aim is to complete the tasks and markers within one classification, and then move on to the next. this will allow you to focus on the right things. this will allow you to progress consistently. and not to get all dramatic up in here, but progressing through these four stages will change your financial life. Retirement is often a succession of phases with different spending priorities and budgeting needs. a four phase model for retirement consists of pre retirement (age 50 to 62 or so), the early. The 5 stages of the personal financial life cycle are: 1) early career and accumulation, 2) family formation and protection, 3) mid career and growth, 4) pre retirement and preservation, and 5) retirement and distribution. these stages represent different financial goals and challenges individuals may face throughout their lives. Life is inherently risky, and there is no magic answer to how much risk you should take on, as that is personal. what matters is that as you face the next chapter in your life, you reevaluate the.

Pdf The Four Stages Of Your Financial Life There Are Four Stages Of The 5 stages of the personal financial life cycle are: 1) early career and accumulation, 2) family formation and protection, 3) mid career and growth, 4) pre retirement and preservation, and 5) retirement and distribution. these stages represent different financial goals and challenges individuals may face throughout their lives. Life is inherently risky, and there is no magic answer to how much risk you should take on, as that is personal. what matters is that as you face the next chapter in your life, you reevaluate the.

The Stages Of Financial Life Essential Wealth

The Four Phases Of Your Financial Life

Comments are closed.