The Macd Indicator For Beginners Become An Expert Immediately Youtube

The Macd Indicator For Beginners Become An Expert Immediately Youtube Ttc forex university eap training program (they are the same program) thetradingchannel 500offfree full forex beginner course ttcfor. The moving average convergence divergence or also known as the macd, is one of the most simplest and popular indicator used by traders.using mostly original.

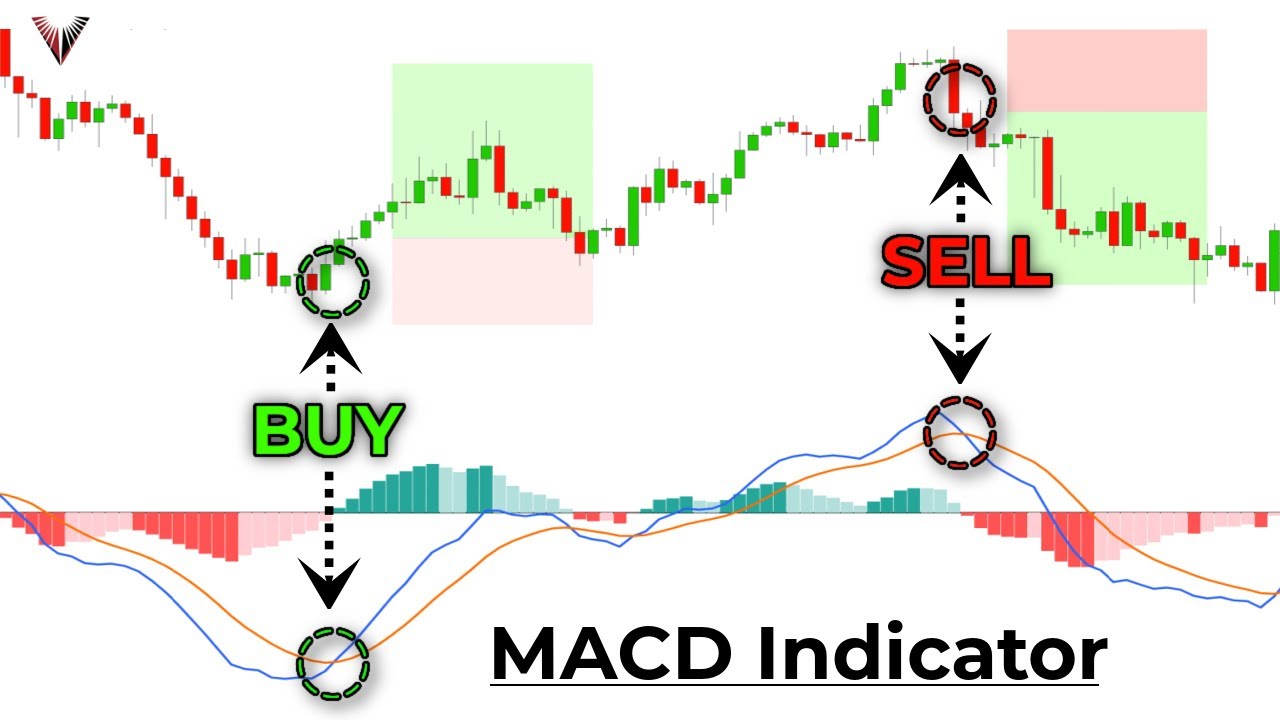

The Macd Indicator For Beginners Become An Expert Immediately Youtube In this video i explain to you how the macd works both as an indicator or as a strategy in lugandaopen account link hfm ?refid=348857whatsap. In this tutorial, we will cover 5 trading strategies using the indicator and how you can implement these methodologies within your own trading system. beyond the strategies, we will explore if the macd stock indicator is appropriate for day trading and how well the macd stock indicator stacks up against moving averages. The macd, short for moving average convergence divergence, is a commonly used technical indicator that consists of the macd line and a signal line. traders use this indicator to look at the crossovers and divergences of the two lines to generate buy and sell signals and act on them wherever applicable. the indicator was developed by gerald. Macd is a trend following momentum indicator that shows the relationship between two moving averages of a security’s price. the calculation involves subtracting the 26 period exponential moving average (ema) from the 12 period ema, resulting in what is known as the macd line. macd line: the difference between the 12 day and 26 day emas.

Mastering The Macd Indicator In Your Trading Strategy Youtube The macd, short for moving average convergence divergence, is a commonly used technical indicator that consists of the macd line and a signal line. traders use this indicator to look at the crossovers and divergences of the two lines to generate buy and sell signals and act on them wherever applicable. the indicator was developed by gerald. Macd is a trend following momentum indicator that shows the relationship between two moving averages of a security’s price. the calculation involves subtracting the 26 period exponential moving average (ema) from the 12 period ema, resulting in what is known as the macd line. macd line: the difference between the 12 day and 26 day emas. The macd indicator explained for beginners: your essential guide to understanding the macd (moving average convergence divergence), macd formula, practical examples, macd divergences, and macd crossovers. dive deep into how this tool can signal market trends and momentum for informed investment deci. The macd indicator is a separate graph that usually appears under the price chart for your chosen market. it lines up with the chart so that the data from the macd corresponds with the price action for the same timeframe. calculating the macd involves using the exponential moving averages (emas). emas are weighted averages that favour the most.

The Macd Indicator For Beginners Become An Expert Immediately Luganda The macd indicator explained for beginners: your essential guide to understanding the macd (moving average convergence divergence), macd formula, practical examples, macd divergences, and macd crossovers. dive deep into how this tool can signal market trends and momentum for informed investment deci. The macd indicator is a separate graph that usually appears under the price chart for your chosen market. it lines up with the chart so that the data from the macd corresponds with the price action for the same timeframe. calculating the macd involves using the exponential moving averages (emas). emas are weighted averages that favour the most.

Macd Indicator For Beginners Youtube

Comments are closed.