The Stages Of Financial Life Essential Wealth

The Stages Of Financial Life Essential Wealth Managing wealth: ensuring you maximise your standard of living when you don’t want to work so hard. retaining wealth: retaining more of your hard earned money legally and ethically. preserving wealth: preserving the value of your estate for the benefit of your family. *hm revenue and customs practice and the law relating to taxation are. Stage 6: accumulated 10 years’ worth of annual expenses. stage 6 builds upon the work of stages 4 and 5. at stage 6, you would have accumulated a larger sum than in the previous stages. you will try to build up ten years of your annual expenses. suppose your annual expenses hover around $25,000 yr.

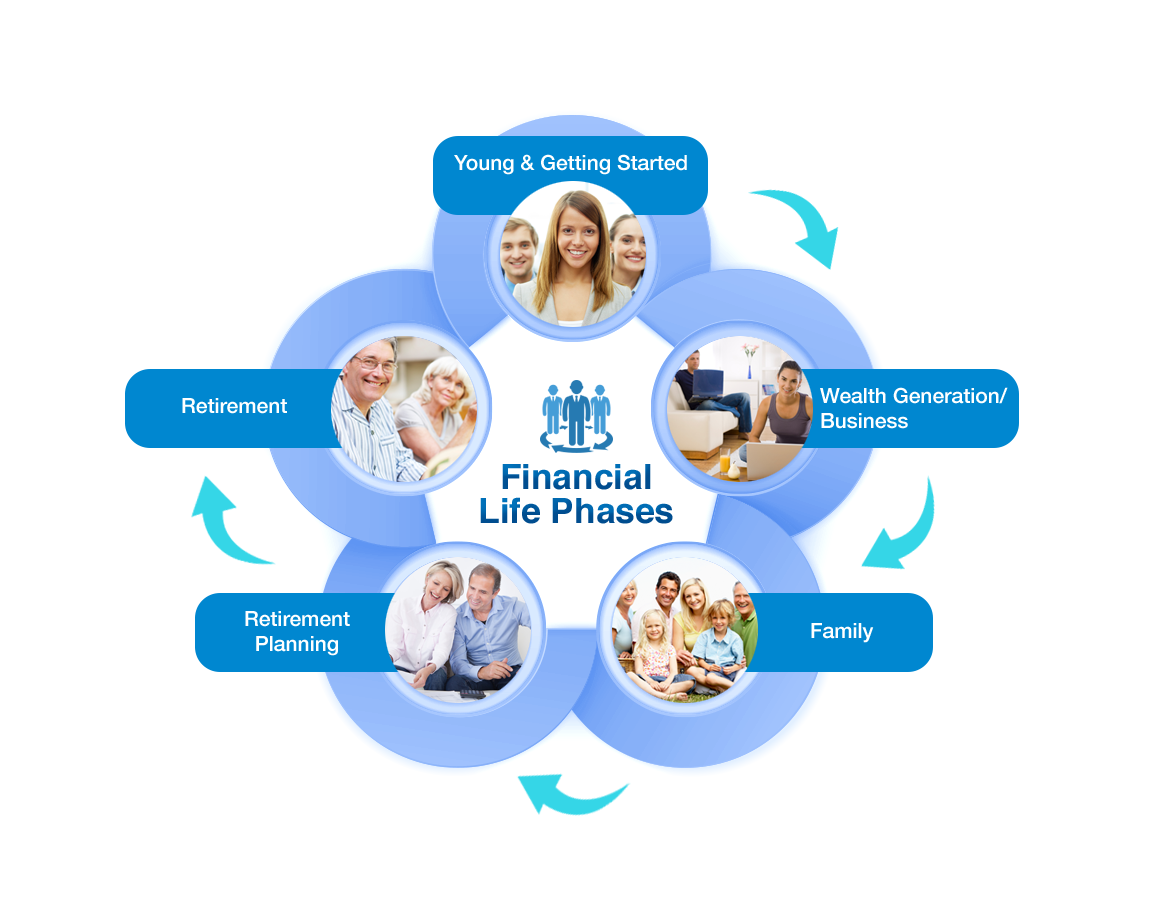

Financial Life Phases Wealthlife Table of contents. stage 1: entering the workforce – early career years. stage 2: family and career building years. stage 3: the pre retirement years. stage 4: early retirement years. stage 5: later retirement years. final thoughts. At its core, life cycle financial planning serves as a personalized compass. it helps you navigate the nuanced financial requirements that characterize the different stages of life. life cycle. Planning for each stage of the financial life cycle individually can lead to disjointed decision making and inefficient financial plans. a holistic approach, however, provides several key benefits: 1. offers alignment with both short and long term goals. aligning your personal financial planning with your short and long term goals forges a. Financial life planning is a holistic approach to managing personal finances that considers an individual's values, goals, and life stages. it aims to create a customized financial strategy that helps individuals achieve their short term and long term objectives while maintaining financial stability and well being.

5 Stages Of Financial Life Cycle Printable Templates Protal Planning for each stage of the financial life cycle individually can lead to disjointed decision making and inefficient financial plans. a holistic approach, however, provides several key benefits: 1. offers alignment with both short and long term goals. aligning your personal financial planning with your short and long term goals forges a. Financial life planning is a holistic approach to managing personal finances that considers an individual's values, goals, and life stages. it aims to create a customized financial strategy that helps individuals achieve their short term and long term objectives while maintaining financial stability and well being. November 1, 2024. while life is unpredictable, having a clear plan for saving and investing is essential, as building wealth usually requires consistent, intentional actions over time. to help navigate this process at different life stages, consumers can find a certified financial planner® professional on cfp board’s website, letsmakeaplan.org. The first level of wealth: the financial stability stage. level 1 wealth means you can pay your bills! 40% of americans struggle to pay for basic needs, so being able to comfortably cover expenses is a great first step. traps to avoid: at this stage, don’t fall into the trap of tunnel vision and only focusing on monthly payments.

Comments are closed.