The Statute Of Limitations For Credit Card Debt

Statute Of Limitations For Credit Card Debt Youtube The statute of limitations on debt collection is the amount of time a bill collector has to file a lawsuit against someone over debt. it protects debtors from being liable for their debts forever. The “statute of limitations” for credit card debt is a law limiting the amount of time lenders and collection agencies have to sue consumers for nonpayment. that time frame is set by each state and varies from just three years (in 13 states) to 10 years (two states) with the other 25 states somewhere in between.

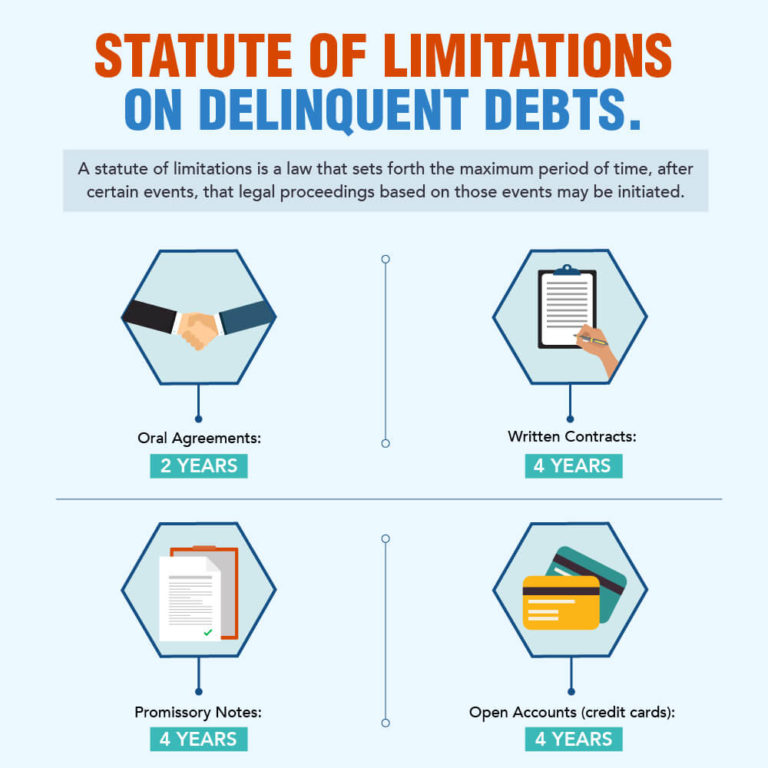

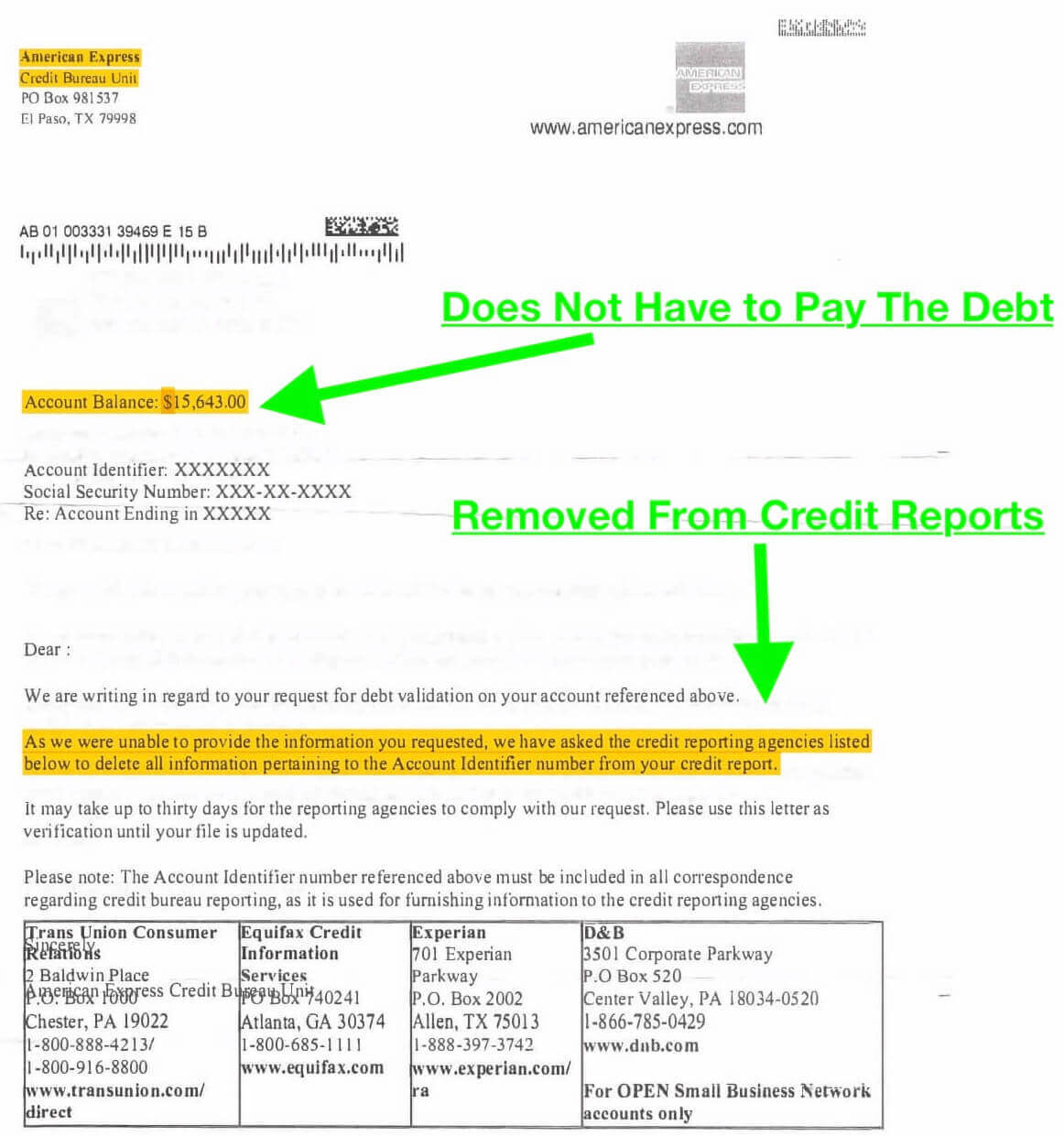

Statute Of Limitations On Debt Including Credit Card Debt In All 50 The statute of limitations on debt is a rule limiting how long a creditor can sue you for payment on a debt. all consumer debts, from credit card balances to medical bills, have limits on the. The statute of limitations is the period of time when a creditor or debt collector can file a lawsuit against you to recoup the money you owe. this debt may include credit cards, mortgages, auto. The federal trade commission notes that if you make a payment or agree to payment arrangements in certain states, the debt is revived. that means the statute of limitations is reset, allowing the collector to legally sue you for the remainder of the debt. even if you pay the entire debt off, it may not be removed from your credit report. 8 years. 1 3 105. state law. 1on april 12, 2011, the governor signed house bill 2412 into law. this bill amends section 12 548 of the state code and makes the statute of limitations for credit card debt six years. 2clicking on this link takes you to a third party website. click “i agree” to the terms.

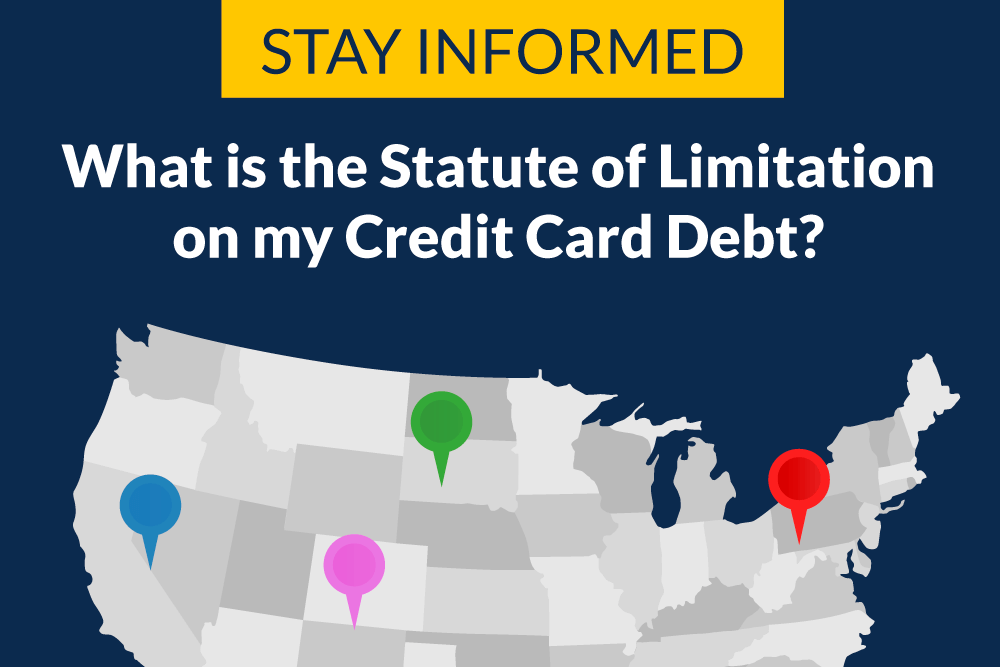

Statute Of Limitations On Debt Collection By State The federal trade commission notes that if you make a payment or agree to payment arrangements in certain states, the debt is revived. that means the statute of limitations is reset, allowing the collector to legally sue you for the remainder of the debt. even if you pay the entire debt off, it may not be removed from your credit report. 8 years. 1 3 105. state law. 1on april 12, 2011, the governor signed house bill 2412 into law. this bill amends section 12 548 of the state code and makes the statute of limitations for credit card debt six years. 2clicking on this link takes you to a third party website. click “i agree” to the terms. To pay off $40,000 in credit card debt within 36 months, you will need to pay $1,449 per month, assuming an apr of 18%. you would incur $12,154 in interest charges during that time, but you could avoid much of this extra cost and pay off your debt faster by using a 0% apr balance transfer credit card. Each state has its statute of limitations for collecting debt and most states allow creditors to pursue credit card debt for longer periods. that typically spans between three to 10 years, though.

Statute Of Limitations On Debt Including Credit Card Debt In All 50 To pay off $40,000 in credit card debt within 36 months, you will need to pay $1,449 per month, assuming an apr of 18%. you would incur $12,154 in interest charges during that time, but you could avoid much of this extra cost and pay off your debt faster by using a 0% apr balance transfer credit card. Each state has its statute of limitations for collecting debt and most states allow creditors to pursue credit card debt for longer periods. that typically spans between three to 10 years, though.

What Is The Statute Of Limitations Credit Card Debt Youtube

Arizona Finally Clarifies Statute Of Limitations On Credit Cards Az

Comments are closed.