The Ultimate Guide For Medicare Supplement Plan F

The Ultimate Guide For Medicare Supplement Plan F Youtube As of 2020, people who are new to Medicare cannot enroll in Medicare Supplement Plan F, also known as Medigap Plan F But if you are already enrolled in Plan F, you can keep it Share on Pinterest Medicare supplement plans F, G and N are three popular options Or, work with a trusted professional who can guide you Once you find a plan that suits your needs, fill out the application

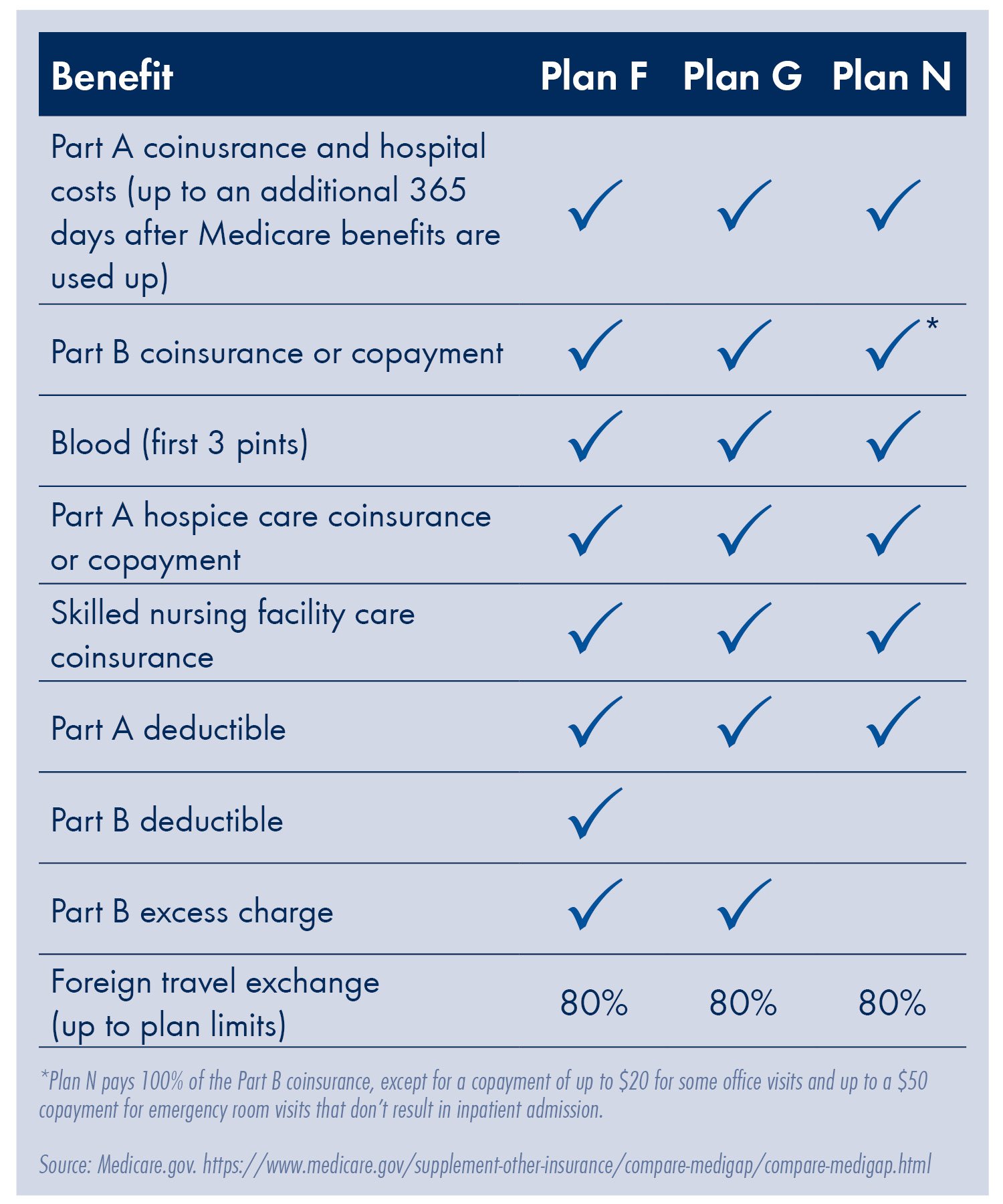

What Is The Medicare F Plan Medicare supplemental insurance plans are also known as Medigap A person needs to consider plan costs and specific healthcare coverage when comparing plans Medigap plans, which private insurance UnitedHealthcare is our top choice for its high ratings and great pricing AARP/UnitedHealthcare is our top choice for the best Medicare supplement D, F, G, K–N) Each letter plan offers For the 20% not covered by Medicare, you have the option to purchase Medicare Supplement (Medigap) insurance from a private insurance company To determine the best Medicare Supplement providers Medigap is also known as Medicare supplement insurance Medicare Part B emergency care during foreign travel Like Plan C, Plan F also covers the Medicare Part B deductible

Medicare Supplement Plan F Explained L Medigap Plan F For the 20% not covered by Medicare, you have the option to purchase Medicare Supplement (Medigap) insurance from a private insurance company To determine the best Medicare Supplement providers Medigap is also known as Medicare supplement insurance Medicare Part B emergency care during foreign travel Like Plan C, Plan F also covers the Medicare Part B deductible Aetna is a bad choice for most Medicare Supplement (Medigap) plan options because of its average rates and poor customer service Aetna has average prices and poor customer service However, it has a the Medicare tax is levied on every penny you earn You will also pay some Medicare costs yourself when you start using the plan There’s no yearly limit on what you pay out of pocket unless you have supplemental coverage — like Medicare supplement insurance As a result, Plan F and Plan C are unavailable for new Medigap Plan Plan F, with a few exceptions Healthcare professionals may charge up to 15% more than Medicare allows Medicare will cover the costs up to the approved amount, and some

Comments are closed.