The Ultimate Guide To Understanding Startup Funding Stages вђ Aaron Vick

The Ultimate Guide To Understanding Startup Funding Stages Aaron Vick Stage 4: mezzanine financing & bridge loans. the next of the startup funding stages mezzanine financing and bridge loans. this stage, aka “the growth phase”, comes when your startup is really beginning to grow in size. it may be time to start trying to scale the business to a big extent and the startup should have a superior product or. Former ceo turned degen. focused on web2 to web3 strategy. highly functional techie.

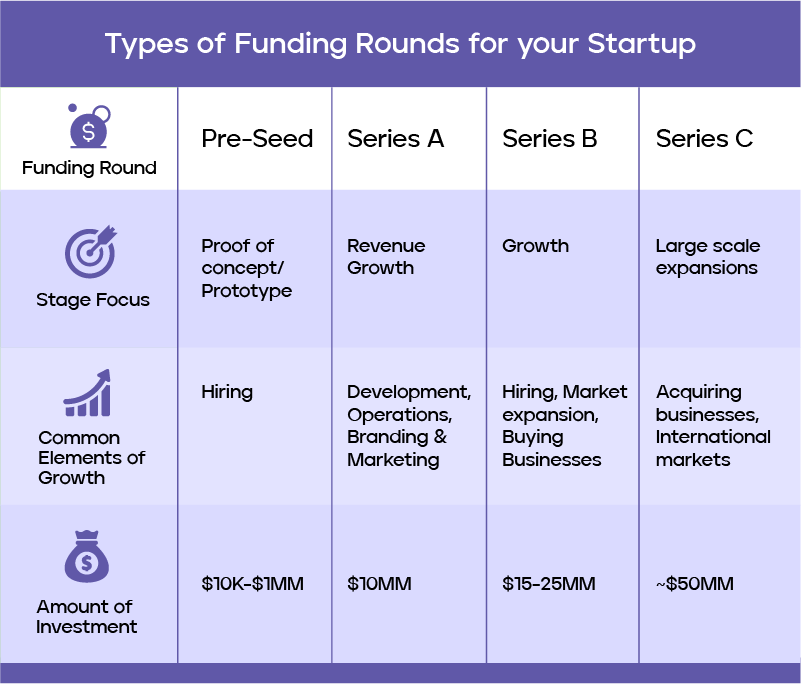

The Ultimate Guide To Understanding Startup Funding Stages Aaron Vick You know that startup funding is a vital part of ensuring your success. if you don’t understand the types of funding available and what rounds mean, you will miss out on a lot of opportunities. here’s a rundown of a startup’s various investment rounds explained, from what they are to what you canexpect in the process! the beginning: the. As the startup progresses beyond the ideation and seed stages, it enters the early stage financing phase. this phase involves attracting external investors who provide funding in exchange for equity (ownership) in the company. in the growth stage, startups have proven their concept and are ready to scale their operations. The most complete guide to startup funding stages in 2024. the journey of transforming a groundbreaking idea into a successful startup is an exhilarating and challenging endeavor. one of the critical aspects that entrepreneurs must navigate along this path is securing funding at various stages of their startup’s growth. Series a funding. moving beyond the seed stage, series a funding is where startups begin to scale operations. this stage is marked by the development of a robust business model and efforts to ramp up revenue streams. the average post money valuation for series a can be around $22 million but may vary widely based on several factors:.

What Are The Different Startup Funding Stages Marquee Equity The most complete guide to startup funding stages in 2024. the journey of transforming a groundbreaking idea into a successful startup is an exhilarating and challenging endeavor. one of the critical aspects that entrepreneurs must navigate along this path is securing funding at various stages of their startup’s growth. Series a funding. moving beyond the seed stage, series a funding is where startups begin to scale operations. this stage is marked by the development of a robust business model and efforts to ramp up revenue streams. the average post money valuation for series a can be around $22 million but may vary widely based on several factors:. The four main stages of venture capital funding are pre seed, seed, series a, and series b rounds. each stage offers a different form of investment to help businesses grow and reach their goals. ultimately, it is essential for startups to understand these rounds in order to secure the right funding for their venture. Equity: seed investors typically get between 15% 35% of equity. valuations: typical seed round valuations in 2024 land between $1m to $15m. runway: seed capital should last 12 24 months on average, depending on your burn rate. average seed funding amount: over the past decade, seed checks have increased significantly.

Comments are closed.