These Are The Steps To Manage Your Money Personal Finance Basics

The Basics Of Personal Finance Ramsey Keep new credit card charges limited to what you can pay off, in full, each month. hint: create and follow a budget. pay off existing credit card balances. longer term goals: start saving at least. Do you have any idea about personal finance? if not, do you know where to start? do you go on spending sprees that break your budget? do you even have a budg.

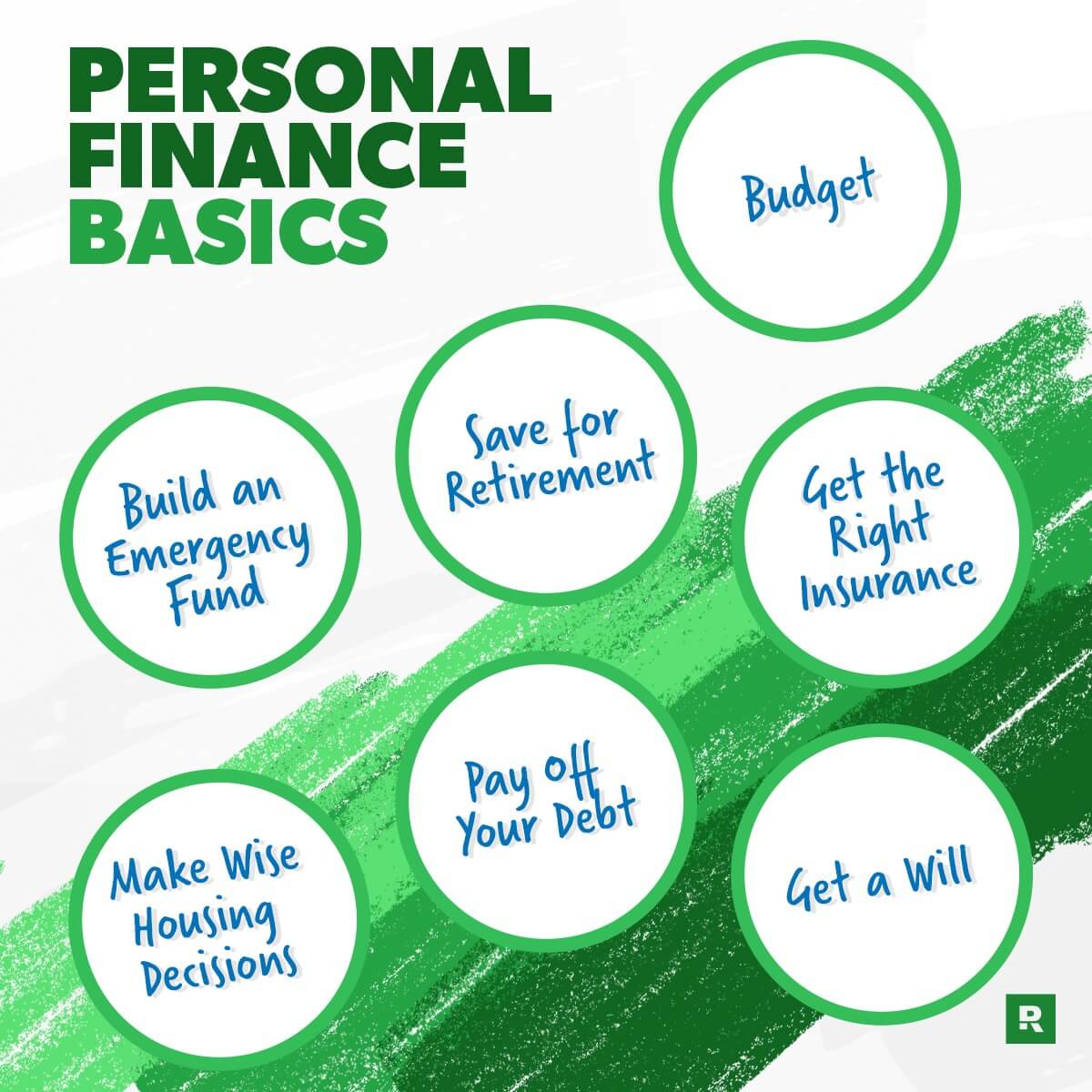

These Are The Steps To Manage Your Money Personal Finance Basics Personal finance is important because it deals with four very critical stages of managing your lifestyle security: 1) making money. 2) saving money. 3) building wealth. 4) protecting assets. these. 7. pay your taxes. 8. build wealth, not your credit score. 1. do a monthly budget. the first basic of personal finance is to create and stick to a monthly budget. budgeting is simply making a plan for your money. it’s the foundational habit you build all other money habits on. These 10 personal finance basics can put you on the path to taking control of your cash and achieving your money goals. key points. • personal finance basics include budgeting, saving, investing, managing debt, and understanding credit. • budgeting involves tracking income and expenses, setting financial goals, and making informed spending. See full bio. step 1. figure out your after tax income step 2. choose a budgeting system step 3. track your progress step 4. automate your savings step 5. practice budget management.

How To Manage Personal Finances And Save Money These 10 personal finance basics can put you on the path to taking control of your cash and achieving your money goals. key points. • personal finance basics include budgeting, saving, investing, managing debt, and understanding credit. • budgeting involves tracking income and expenses, setting financial goals, and making informed spending. See full bio. step 1. figure out your after tax income step 2. choose a budgeting system step 3. track your progress step 4. automate your savings step 5. practice budget management. It is important to put your credit cards away and not use them until you get your finances in order. you’ll be paying a lot more money in interest by carrying a credit card balance. don’t move onto step 2 of the beginner’s guide to personal finance until you have saved up and put away $1,000 extra dollars. Here are seven steps to take to manage your money properly: understand your current financial situation. set personal priorities and finance goals. create and stick to a budget. establish an.

Personal Finance Basics The Beginner S Guide To Wise Money Management It is important to put your credit cards away and not use them until you get your finances in order. you’ll be paying a lot more money in interest by carrying a credit card balance. don’t move onto step 2 of the beginner’s guide to personal finance until you have saved up and put away $1,000 extra dollars. Here are seven steps to take to manage your money properly: understand your current financial situation. set personal priorities and finance goals. create and stick to a budget. establish an.

Comments are closed.