Things To Avoid After Applying For A Mortgage The Compass Group

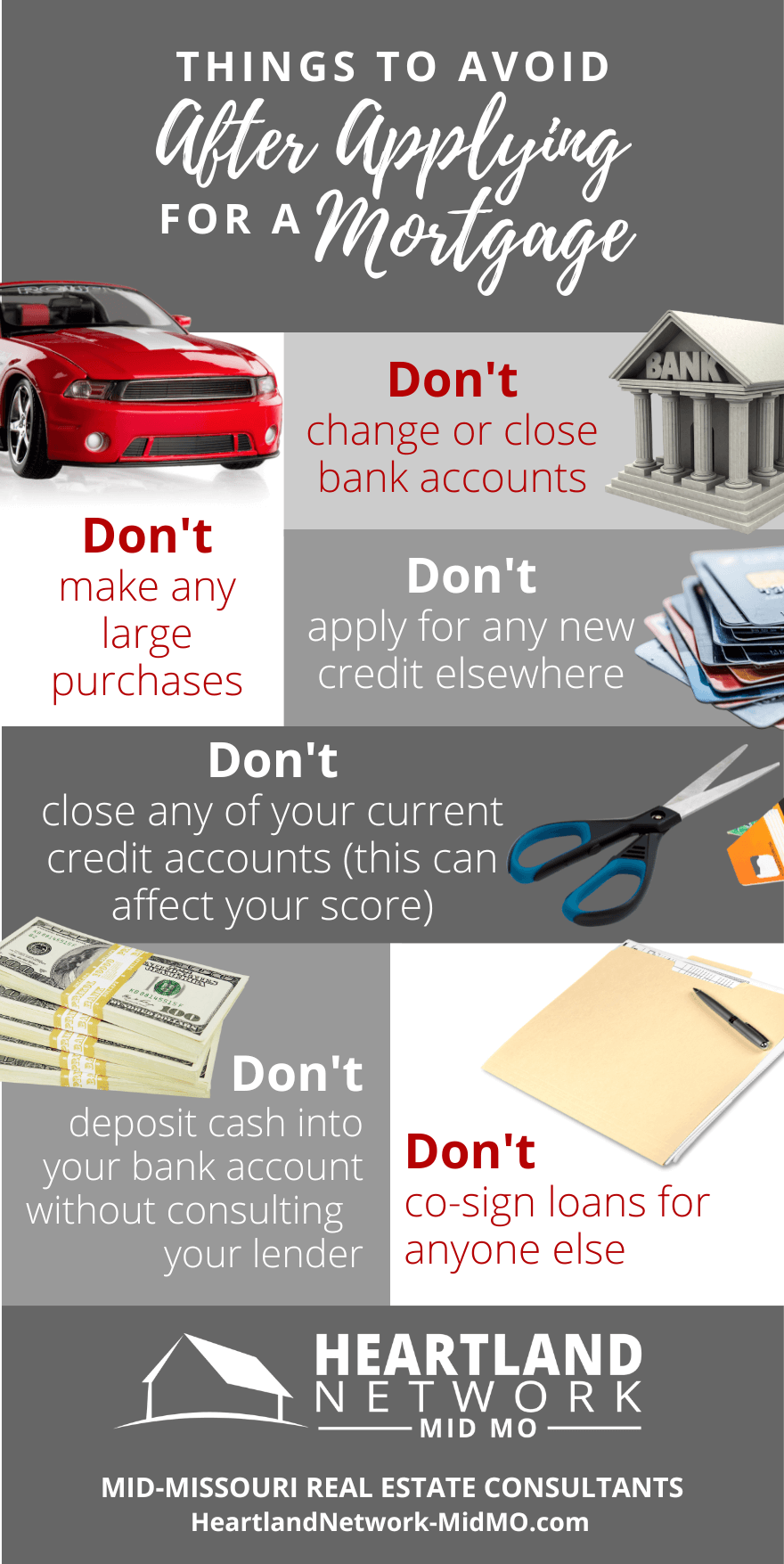

Things To Avoid After Applying For A Mortgage The Compass Group Below is a list of things you shouldn’t do after applying for a mortgage. they’re all important to know – or simply just good reminders – for the process. 1. don’t deposit cash into your bank accounts before speaking with your bank or lender. lenders need to source your money, and cash is not easily traceable. Some of the top things to avoid after applying for a mortgage include: 1. don’t deposit large sums of cash into your bank account. lenders need to source your money, and cash is often difficult to trace. before making any large deposits, it’s wise to ask your loan officer how to properly document that money. 2.

Things To Avoid Do After Applying For A Mortgage Infographic 7. don’t think you make the rules. the mortgage application process isn’t easy. it comes with (seemingly) never ending amounts of paperwork and can feel like you’re working a second job. but homebuyers must follow directions exactly to make sure the process isn’t delayed. Learn about common mistakes to avoid after applying for a mortgage, including handling cash deposits, making large purchases, cosigning loans, and managing bank accounts. understand the impact of credit score changes and the importance of open communication with your lender. make informed financial decisions for a successful home purchase journey. Any large purchases can be red flags for lenders. people with new debt have higher debt to income ratios (how much debt you have compared to your monthly income). since higher ratios make for riskier loans, borrowers may no longer qualify for their mortgage. resist the temptation to make any large purchases, even for furniture or appliances. Common mistakes after applying for a mortgage. if you’re getting ready to buy a home, it’s exciting to jump a few steps ahead and think about moving in and making it your own. but before you get too far down the emotional path, there are some key things to keep in mind after you apply for your mortgage and before you close.

Things You Shouldn T Do After Applying For A Mortgage Infographic Any large purchases can be red flags for lenders. people with new debt have higher debt to income ratios (how much debt you have compared to your monthly income). since higher ratios make for riskier loans, borrowers may no longer qualify for their mortgage. resist the temptation to make any large purchases, even for furniture or appliances. Common mistakes after applying for a mortgage. if you’re getting ready to buy a home, it’s exciting to jump a few steps ahead and think about moving in and making it your own. but before you get too far down the emotional path, there are some key things to keep in mind after you apply for your mortgage and before you close. 3. don’t assume you need 20% down. many first time buyers assume they need a 20 percent down payment to buy a house. but while having 20 percent down comes with perks — like avoiding private. If you’re ready to shop for a new home, a mortgage preapproval letter shows sellers that you’re a serious buyer who can secure financing from a lender. it also gives you a clear idea of how.

Things To Avoid After Applying For A Mortgage Infographic 3. don’t assume you need 20% down. many first time buyers assume they need a 20 percent down payment to buy a house. but while having 20 percent down comes with perks — like avoiding private. If you’re ready to shop for a new home, a mortgage preapproval letter shows sellers that you’re a serious buyer who can secure financing from a lender. it also gives you a clear idea of how.

Things To Avoid Do After Applying For A Mortgage Infographic

Comments are closed.