Thinking Of Chapter 7 Bankruptcy Dont Do These 3 Things

Thinking Of Chapter 7 Bankruptcy Don T Do These 3 Things Youtube Most chapter 7 filers don’t own expensive items that are at risk. it’s incredibly rare for anyone to lose property in a chapter 7 case. still, it’s important to understand how exemptions work and whether you own any non exempt property. if you do, the bankruptcy trustee can sell it to repay creditors in your chapter 7 bankruptcy proceeding. Don't file for bankruptcy if you'll receive future payments. funds you don't have yet but expect to get in the future are part of your bankruptcy estate. if you are filing for chapter 7 bankruptcy, the chapter 7 trustee can take this money and use it to repay your unsecured creditors. examples include agreeing to accept a future bonus at work.

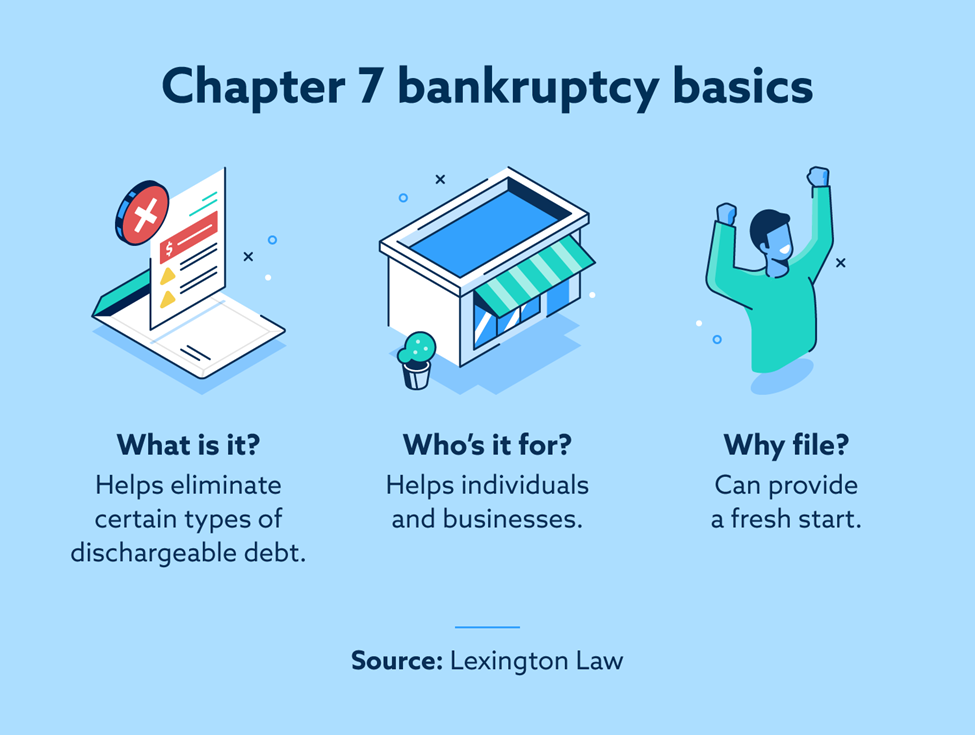

Thinking Of Chapter 7 Bankruptcy Don T Do These 3 Things Youtube For those people who refuse to be transparent about their financial situation, don’t file bankruptcy. second, if you have non exempt assets, and refuse to cooperate with the chapter 7 trustee in the administration of the estate, don’t file bankruptcy. Chapter 7 bankruptcy is a “second chance” to regain control of your finances by having most of your unsecured debt, including credit card debt, medical bills, and personal loans, legally discharged by a bankruptcy court. in virtually all cases, however, it does not discharge student loans, tax debt, alimony, or child support. Chapter 7 bankruptcy is a bankruptcy option for individual debtors. it allows you to wipe out most unsecured debt and retain some of your valuable possessions. chapter 13 bankruptcy allows personal debtors the chance to repay their debts over time. these repayment plans are three to five years. At its core, chapter 7 bankruptcy is a legal process that allows you to eliminate certain debts you can’t repay. to file, you fill out several bankruptcy forms. these forms tell the bankruptcy court what you earn, spend, own, and owe. you’ll also submit recent tax returns and pay stubs if you’re employed.

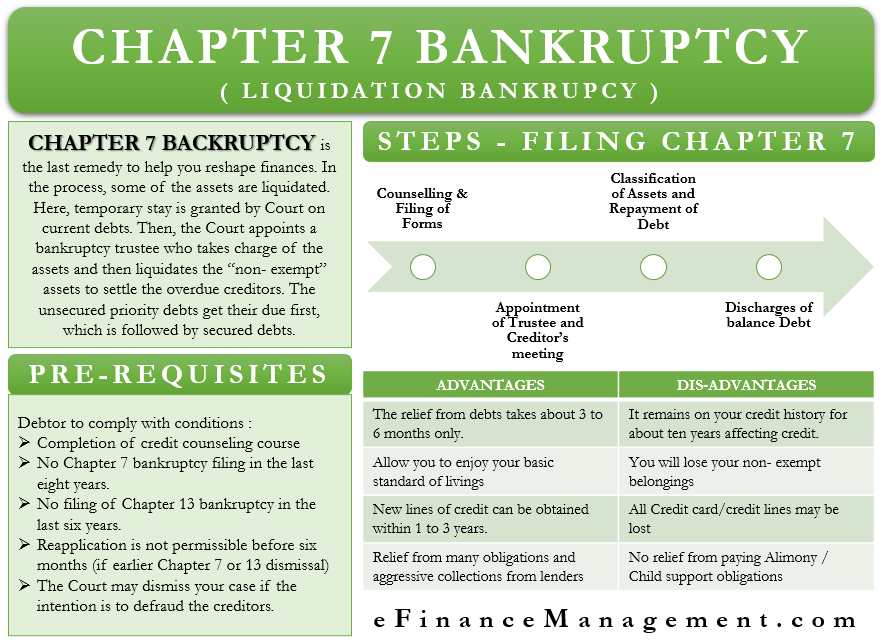

Chapter 7 Bankruptcy Conditions Steps Settlement Pros Cons Efm Chapter 7 bankruptcy is a bankruptcy option for individual debtors. it allows you to wipe out most unsecured debt and retain some of your valuable possessions. chapter 13 bankruptcy allows personal debtors the chance to repay their debts over time. these repayment plans are three to five years. At its core, chapter 7 bankruptcy is a legal process that allows you to eliminate certain debts you can’t repay. to file, you fill out several bankruptcy forms. these forms tell the bankruptcy court what you earn, spend, own, and owe. you’ll also submit recent tax returns and pay stubs if you’re employed. The average attorney fee for a chapter 7 bankruptcy is $1,250. it's $3,000 for a chapter 13 case. plus, you typically have to pay attorney fees up front, especially in chapter 7 cases. you'll also. The list of things to avoid before bankruptcy includes the following: file at the wrong time. use retirement funds unnecessarily. prepare bankruptcy paperwork carelessly or incorrectly. purchase luxury goods and services on credit or take cash advances. sell or transfer property for less than it's worth.

Chapter 7 Bankruptcy The Ultimate Guide Savingk The average attorney fee for a chapter 7 bankruptcy is $1,250. it's $3,000 for a chapter 13 case. plus, you typically have to pay attorney fees up front, especially in chapter 7 cases. you'll also. The list of things to avoid before bankruptcy includes the following: file at the wrong time. use retirement funds unnecessarily. prepare bankruptcy paperwork carelessly or incorrectly. purchase luxury goods and services on credit or take cash advances. sell or transfer property for less than it's worth.

What Is Chapter 7 Bankruptcy A Liquidation Guide Lexington Law

What Is Chapter 7 Bankruptcy Overview Filing Information

Comments are closed.