Topic 1 Introduction Economics 2450a Public Economics

Topic 1 Introduction Economics 2450a Public Economics Video Raj chettyfall 2012. 1. two problem sets: 25% of grade. they will be assigned on oct. 7 (due oct 16), and nov. 18 (due nov. 25). problem sets are due on canvas and no late problem sets will be accepted. 2. replication exercise (re): 25% of grade. replicate a recent empirical paper related to the topics in this course.

Econimcs Preliminary Notes Topic 1 Introduction To Economics The A: public economics is influenced by insights from psychology and behavioral economics because these fields have provided evidence that people do not always optimize their behavior. this raises new policy questions and suggests the need for government intervention to address suboptimal outcomes. Course requirements: to complete this course, you will have to 1) write a referee report on a paper that will be assigned; 2) write a paper proposal on a topic of interest to you in public economics; and 3) take a 2 hour final exam at the end of the semester. office hours: tuesdays 6 7 pm, starting after labor day. office hours are over zoom. Economics 2450a: public economics dept. of economics, harvard university fall 2012. this course covers basic issues in the optimal design of government policies. the goal of the course is to familiarize students with basic empirical methods and theoretical models in applied micro economics, with a focus on connecting theory to data to inform. Offered: 2016. the class meets tuesdays 4 6:30 pm in m 16 in littauer. the ta is matteo paradisi ([email protected]). course syllabus. lecture notes: (many lectures inspired by emmanuel saez' graduate pf course notes) lecture 1: introduction to graduate public economics. lecture 2: optimal income taxation part 1. lecture 3: optimal income.

Topic 1 Introduction To Economics Pdf Economics 2450a: public economics dept. of economics, harvard university fall 2012. this course covers basic issues in the optimal design of government policies. the goal of the course is to familiarize students with basic empirical methods and theoretical models in applied micro economics, with a focus on connecting theory to data to inform. Offered: 2016. the class meets tuesdays 4 6:30 pm in m 16 in littauer. the ta is matteo paradisi ([email protected]). course syllabus. lecture notes: (many lectures inspired by emmanuel saez' graduate pf course notes) lecture 1: introduction to graduate public economics. lecture 2: optimal income taxation part 1. lecture 3: optimal income. Overview. dive into a comprehensive graduate level course on public economics from harvard university. explore the optimal design of tax and social insurance policies, combining theoretical models with empirical evidence. cover key topics including efficiency costs and incidence of taxation, income taxation, transfer and welfare programs. 2nd year ph.d. course. this ph.d. course covers basic issues in the optimal design of tax and social insurance policies, with emphasis on combining theoretical models with empirical evidence. topics include efficiency costs and incidence of taxation, income taxation, transfer and welfare programs, public goods and externalities, optimal social.

S Topic 1 Introduction Pdf Economic System Economics Overview. dive into a comprehensive graduate level course on public economics from harvard university. explore the optimal design of tax and social insurance policies, combining theoretical models with empirical evidence. cover key topics including efficiency costs and incidence of taxation, income taxation, transfer and welfare programs. 2nd year ph.d. course. this ph.d. course covers basic issues in the optimal design of tax and social insurance policies, with emphasis on combining theoretical models with empirical evidence. topics include efficiency costs and incidence of taxation, income taxation, transfer and welfare programs, public goods and externalities, optimal social.

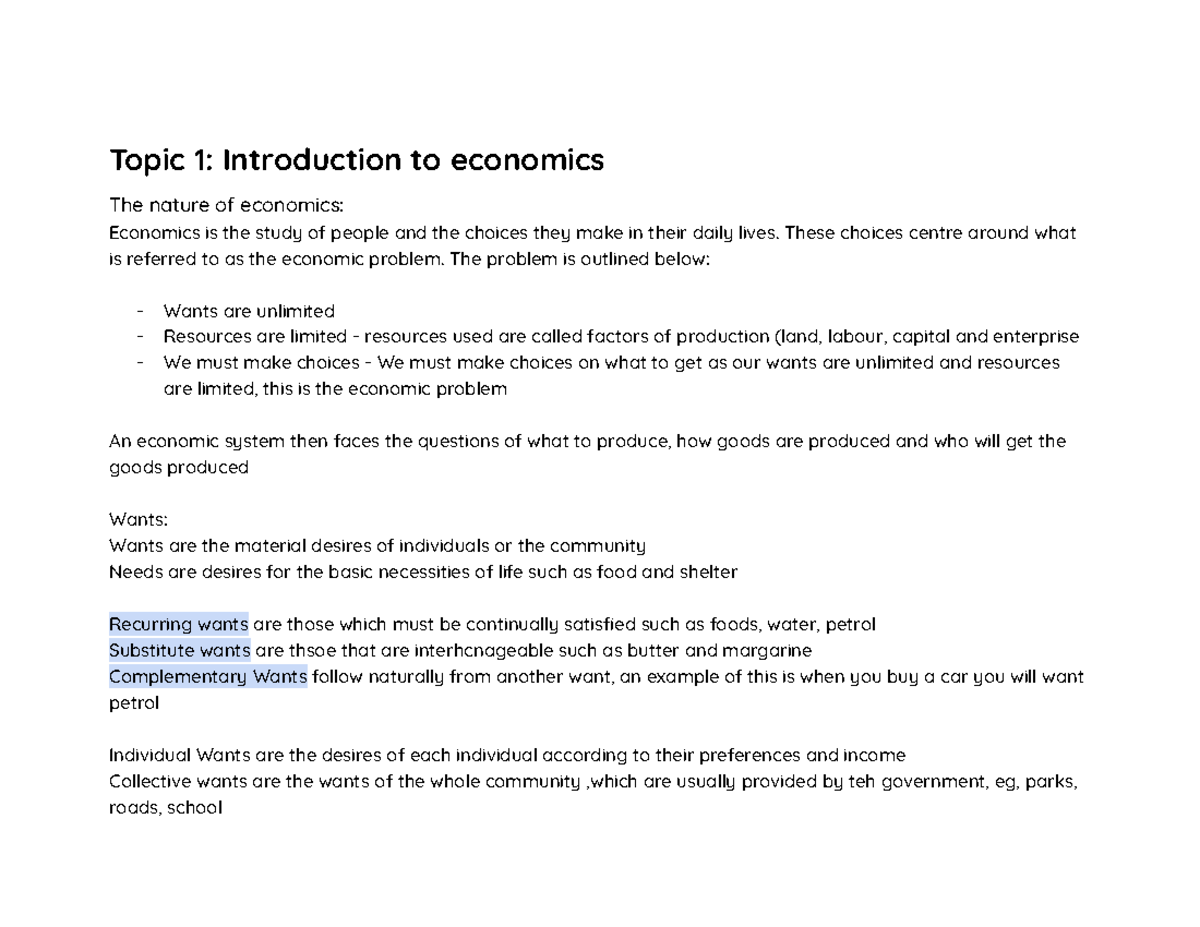

Topic 1 Introduction To Economics

Comments are closed.