Types Of Retirement Accounts Explained 401k Rollover Ira

What Is 401k Ira Vs 401k Retirement Answers From Napkin Finance Most pre retirement payments you receive from a retirement plan or ira can be “rolled over” by depositing the payment in another retirement plan or ira within 60 days. you can also have your financial institution or plan directly transfer the payment to another plan or ira. the rollover chart pdf summarizes allowable rollover transactions. You can also contribute a lot more annually to a 401 (k) than you can to an ira. in tax year 2024, the most you can contribute to an ira as someone who is under 50 is $7,000. if you're age 50 or.

The Complete 401k Rollover Guide Retire Ira rollovers can occur from a retirement account, such as a 401(k) into an ira or as an ira to ira transfer. you can also rollover employer retirement variable annuity contracts such as 457 or. An indirect rollover is when a bank or institution makes a check out to the account holder. the owner is then responsible for depositing 100% of the funds into a new qualified account within 60 days to avoid penalties. 2. indirect rollovers are limited to one within a 12 month period. they also cannot be split among multiple accounts. A 401 (k) rollover is when you take money out of your 401 (k) and move those funds into another tax advantaged retirement account. many people roll their 401 (k) into an individual retirement. Rollover ira: how to do it in 3 steps. 1. choose an ira account type. if you have an existing ira, you can transfer your balance into that account if you want. if you don't have an ira, you can.

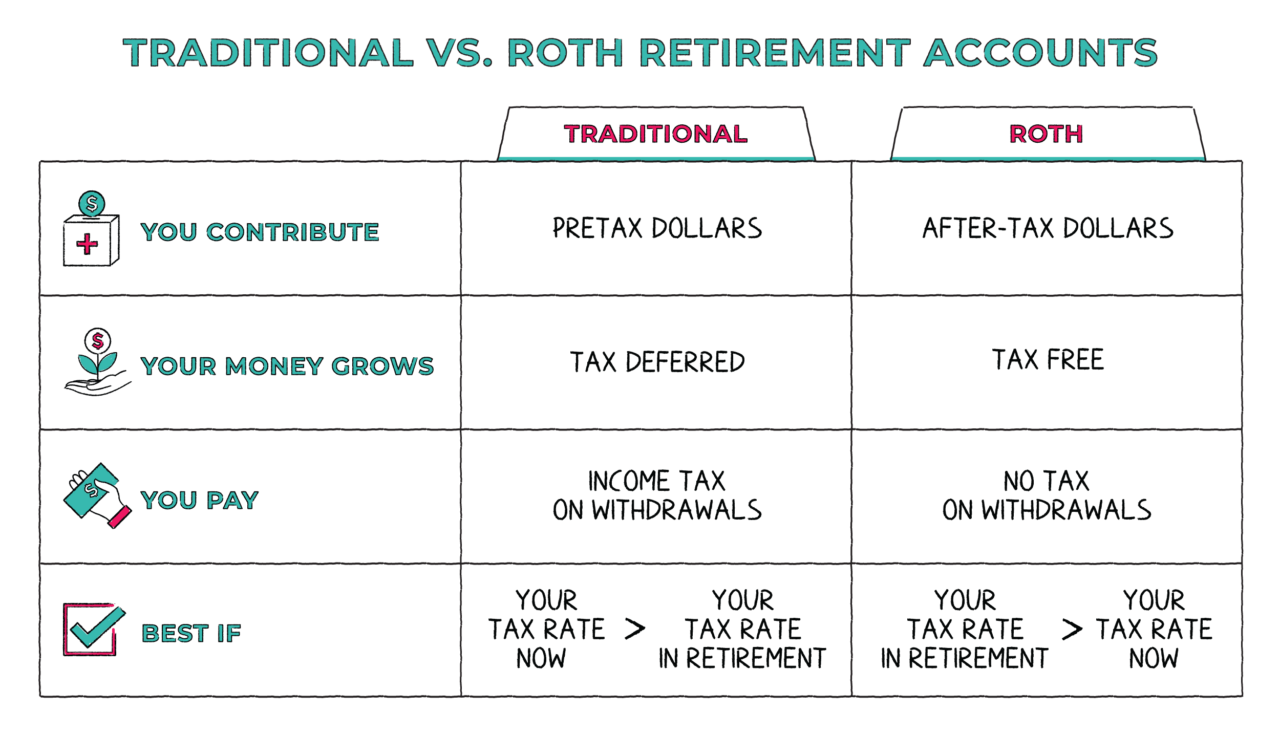

Types Of Retirement Accounts Explained 401k Rollover Ira A 401 (k) rollover is when you take money out of your 401 (k) and move those funds into another tax advantaged retirement account. many people roll their 401 (k) into an individual retirement. Rollover ira: how to do it in 3 steps. 1. choose an ira account type. if you have an existing ira, you can transfer your balance into that account if you want. if you don't have an ira, you can. An individual retirement account (ira) lets you contribute directly, without a workplace sponsor (as with 401 (k)s and 403 (b)s). in a traditional ira, you can make contributions up to the annual limit. but if you're within certain income limits (for 2024, $87,000 or less if single and $143,000 or less if married) you may be able to deduct all. The purpose of a rollover ira is to maintain the tax deferred status of those assets. rollover iras are commonly used to hold 401 (k), 403 (b), or profit sharing plan assets that are transferred.

The Beginner S Guide To Retirement 401 K Ira An individual retirement account (ira) lets you contribute directly, without a workplace sponsor (as with 401 (k)s and 403 (b)s). in a traditional ira, you can make contributions up to the annual limit. but if you're within certain income limits (for 2024, $87,000 or less if single and $143,000 or less if married) you may be able to deduct all. The purpose of a rollover ira is to maintain the tax deferred status of those assets. rollover iras are commonly used to hold 401 (k), 403 (b), or profit sharing plan assets that are transferred.

What Is 401k Ira Vs 401k Retirement Answers From Napkin Finance

Comments are closed.