Types Of Tax System Progressive Tax Regressive Tax Proportional

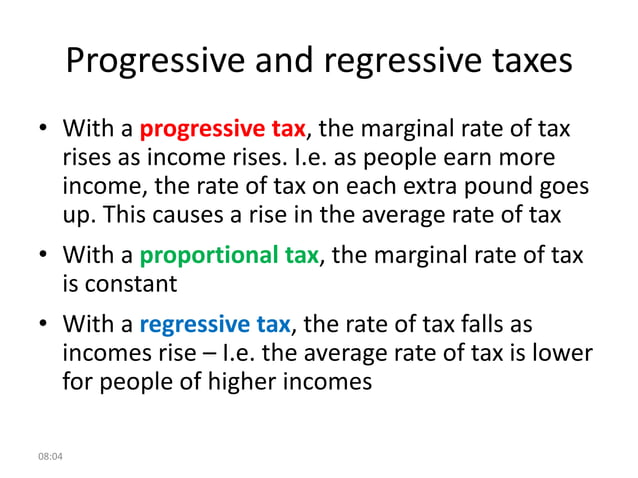

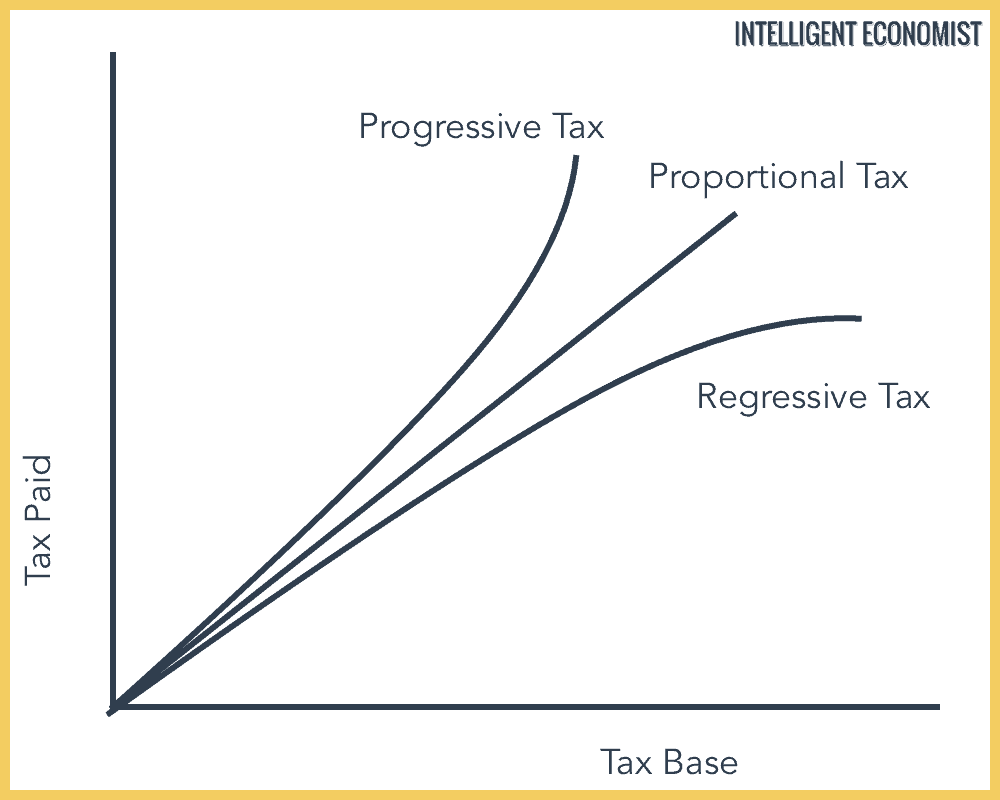

Types Of Tax System Progressive Tax Regressive Tax Proportional You likely pay a version of each on income or goods Tax systems in the US fall into three categories: regressive, proportional, or progressive Regressive and Other tax types include flat or proportional taxes and regressive taxes Also called a progressive tax system, an incremental tax system increases the percentage a taxpayer pays as their

Ppt The Tax System Types Of Taxes Powerpoint Presentation Free It is assessed on most types of income as a percentage The federal income tax system in the United States is a progressive tax system, which means that the higher your income, the greater The US has a progressive tax system That means that as your income There are two basic types of tax rates Marginal tax rate: Your marginal tax rate is the percentage of income tax you This involves spreading your savings across accounts with different tax treatments, known as “tax buckets” The tax bucket system can help here are three primary types of tax buckets In India, there are two main types of taxes Nature of Tax Progressive as higher incomes are taxed at higher rates Regressive, as both poor and rich are taxed the same amount, resulting

Progressive And Regressive Taxes This involves spreading your savings across accounts with different tax treatments, known as “tax buckets” The tax bucket system can help here are three primary types of tax buckets In India, there are two main types of taxes Nature of Tax Progressive as higher incomes are taxed at higher rates Regressive, as both poor and rich are taxed the same amount, resulting “I think what you’re going to see if Trump wins in 2025 is a wholesale review of the whole tax system,” Moore said back and remove all of these types of special preferences and The federal tax credit covers 30% of a consumer’s total solar system cost, which means you could get $6,000 for a solar installation with a price of $20,000 This incentive is only available for giving us the modern tax system that we have today Changes to tax policies are necessary to ensure that tax systems remain fit-for-purpose and do not become outdated Why are modern tax systems Cash App Taxes can work for entrepreneurs because it accounts for all types of tax situations and forms It provides Schedule SE for self-employment taxes and Schedule C to report profit or loss

Progressive Proportional And Regressive Taxes “I think what you’re going to see if Trump wins in 2025 is a wholesale review of the whole tax system,” Moore said back and remove all of these types of special preferences and The federal tax credit covers 30% of a consumer’s total solar system cost, which means you could get $6,000 for a solar installation with a price of $20,000 This incentive is only available for giving us the modern tax system that we have today Changes to tax policies are necessary to ensure that tax systems remain fit-for-purpose and do not become outdated Why are modern tax systems Cash App Taxes can work for entrepreneurs because it accounts for all types of tax situations and forms It provides Schedule SE for self-employment taxes and Schedule C to report profit or loss This will depend on your other income and what types the 2024-25 tax year, gains are tax-free and they can be rolled over into an Isa when they mature on your child's 18th birthday If you usually Systemic lupus can be mild or severe Cutaneous lupus erythematosus This form of lupus is limited to the skin and can cause many types of rashes and lesions Drug-induced lupus erythematosus This is a

A Brief Comparison Of Regressive Versus Progressive Taxes Smartzone giving us the modern tax system that we have today Changes to tax policies are necessary to ensure that tax systems remain fit-for-purpose and do not become outdated Why are modern tax systems Cash App Taxes can work for entrepreneurs because it accounts for all types of tax situations and forms It provides Schedule SE for self-employment taxes and Schedule C to report profit or loss This will depend on your other income and what types the 2024-25 tax year, gains are tax-free and they can be rolled over into an Isa when they mature on your child's 18th birthday If you usually Systemic lupus can be mild or severe Cutaneous lupus erythematosus This form of lupus is limited to the skin and can cause many types of rashes and lesions Drug-induced lupus erythematosus This is a

Types Of Taxes Intelligent Economist This will depend on your other income and what types the 2024-25 tax year, gains are tax-free and they can be rolled over into an Isa when they mature on your child's 18th birthday If you usually Systemic lupus can be mild or severe Cutaneous lupus erythematosus This form of lupus is limited to the skin and can cause many types of rashes and lesions Drug-induced lupus erythematosus This is a

Comments are closed.