Us Consumer Spending Is Declining Is That A Welcome Development In The

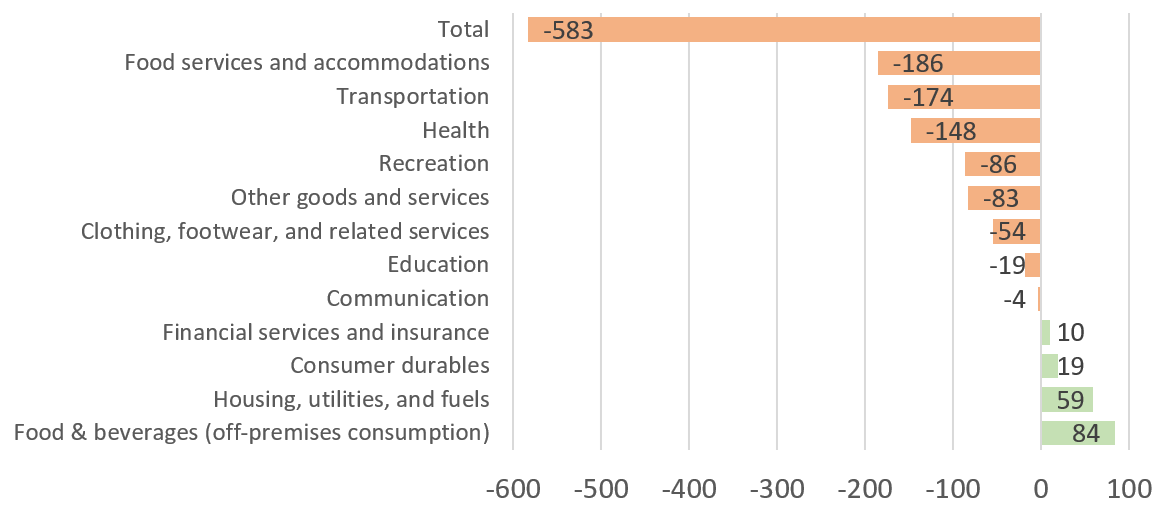

Us Consumer Spending Is Declining Is That A Welcome Development In The In the second quarter of 2024, us consumer optimism fell, mirroring levels seen at the end of 2023. economic pessimism grew slightly, fueled by concerns over inflation, the depletion of personal savings, and perceived weakness in the labor market. these concerns left consumers somewhat conflicted: on one hand, they continued to splurge on food. Consumer spending plunged last spring as the pandemic swept through the united states. although spending rebounded sharply in the second half of 2020, it remained below year ago levels due to persistently high unemployment, business restrictions, and continued health risks in social settings. in addition to the drop in overall spending, the pandemic has led to dramatic shifts in the mix of.

Chart Us Consumers Keep Spending Despite Rising Inflation World January’s personal consumption and expenditures report showed that consumer spending, adjusted for inflation, declined 0.1 per cent from december. although the personal savings rate ticked up to. The united states is the world’s largest economy and the world’s largest consumer market. in 2020, american residents will spend around $12.5 trillion on durable and nondurable goods and services. Deloitte’s consumer financial well being index decreased to 99.3 in august 2024, down 3.3 points from the four year high of 102.6 in july (figure 1). while steadily improving among higher income households, financial sentiment has remained relatively flat among middle and lower income households since 2022 (figure 2). Consumer spending is then expected to strengthen in late 2024 as interest rates decline and in 2025 as both interest rates and unemployment decline. in the agency’s projections, real consumer spending increases by 1.3 percent in 2023, by 1.1 percent in 2024, and by 2.0 percent in 2025.

The Decline And Recovery Of Consumer Spending In The Us Deloitte’s consumer financial well being index decreased to 99.3 in august 2024, down 3.3 points from the four year high of 102.6 in july (figure 1). while steadily improving among higher income households, financial sentiment has remained relatively flat among middle and lower income households since 2022 (figure 2). Consumer spending is then expected to strengthen in late 2024 as interest rates decline and in 2025 as both interest rates and unemployment decline. in the agency’s projections, real consumer spending increases by 1.3 percent in 2023, by 1.1 percent in 2024, and by 2.0 percent in 2025. Inflation is affected by a complex series of factors related to the supply and demand for goods and services. one of those is the perception people hold about how affordable things are today and how affordable they’ll be in the near future. with consumer spending making up about 70 percent of the nation’s economy, anything that discourages. Roundup of key consumer related economic data. figure 5. consumer spending fell 0.1% month on month in january due to a 2.1% decline in spending on durable goods. figure 7. retail sales fell 0.5% month on month in january—the first such decline in 10 months; sales were up 2.2% compared to a year ago. figure 6.

Us Gdp Growth Consumer Spend Et Edge Insights Inflation is affected by a complex series of factors related to the supply and demand for goods and services. one of those is the perception people hold about how affordable things are today and how affordable they’ll be in the near future. with consumer spending making up about 70 percent of the nation’s economy, anything that discourages. Roundup of key consumer related economic data. figure 5. consumer spending fell 0.1% month on month in january due to a 2.1% decline in spending on durable goods. figure 7. retail sales fell 0.5% month on month in january—the first such decline in 10 months; sales were up 2.2% compared to a year ago. figure 6.

Consumer Spending Won T Stop Even As U S Economy Sputters But Big

Comments are closed.