Usaa Consumer Loan Calculator

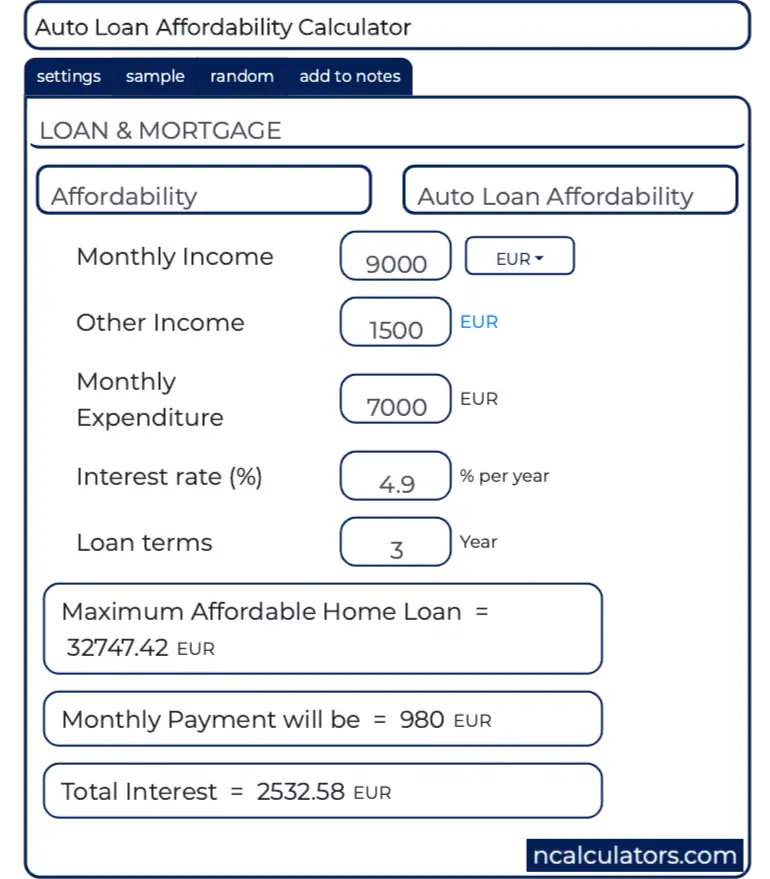

Buying A Car At The End Of The Year Here S What You Need To Know Loan term ( to 84 months) . . apply discount. sign up for an automatic payment plan 0.25% rate discount. notes: this calculator is a self help tool used to quickly estimate the loan amount or monthly payment that fits your budget. this information is provided for illustrative purposes only. this is not an application for credit. Retirement income calculator. ira required minimum distribution calculator. roth ira conversion calculator. immediate annuity calculator. deferred annuity calculator. explore the calculators, planners, and tools usaa has to help guide you in your decision making.

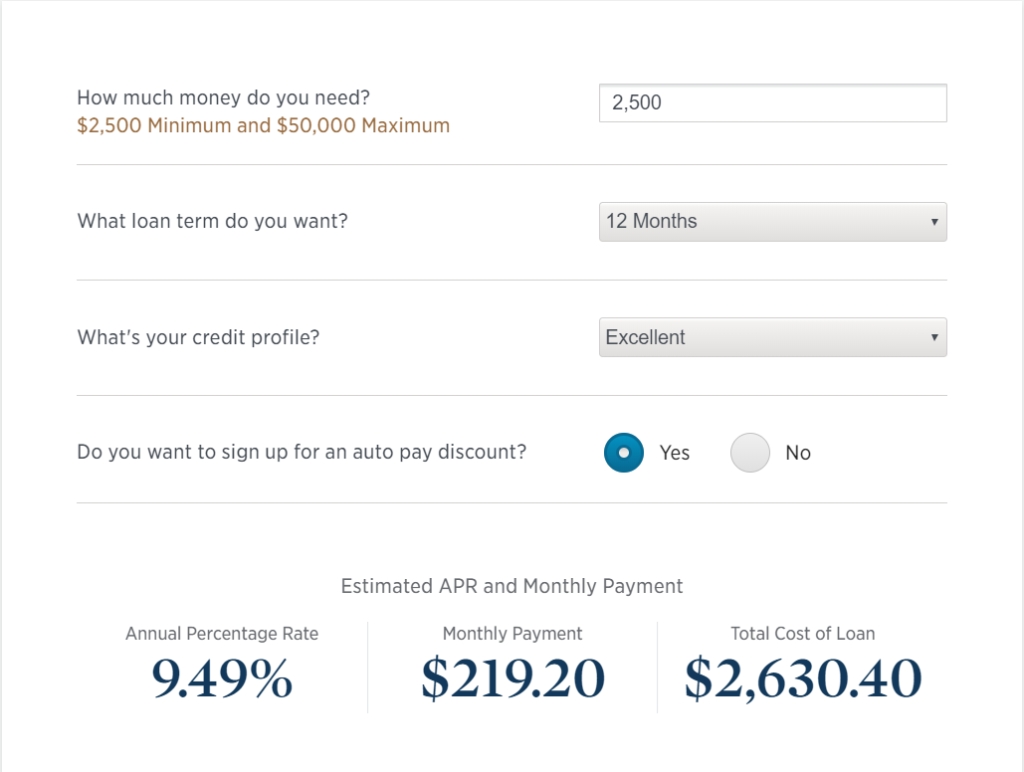

Awasome Car Loan Payment Calculator Usaa Ideas Step 1: apply online. tell us how much you want to borrow, plus details about your income, housing and employer. there's no fee to apply. step 2. step 2: set up your loan. once you're approved, choose your term and save time by signing documents online or in the mobile app. step 3. We offer multiple loan types to meet your needs: dealer purchase — buy a new, used or older car from a dealership. you can get approved for an auto loan before you pick out a car. private party — buy a vehicle from another person. lease buyout — buy a vehicle currently being leased. to apply, call 800 531 0342. Typically, personal loans have a fixed annual percentage rate, or apr. factors that can affect apr include the amount of the loan and the length of the loan term. usaa federal saving bank offers unsecured personal loans. you can get an estimate of your apr and monthly payment by using our personal loan calculator. it can also show you an. Before you start, gather the information, and documents you may need. different lenders have different requirements for the application. common examples include: employment status (if self employed: bank statements, 1099 forms, income tax returns) proof of income (pay stubs, w 2 forms) bank statements.

Usaa Auto Loan Payoff Address 2023 Phone Number Regular Overnight Typically, personal loans have a fixed annual percentage rate, or apr. factors that can affect apr include the amount of the loan and the length of the loan term. usaa federal saving bank offers unsecured personal loans. you can get an estimate of your apr and monthly payment by using our personal loan calculator. it can also show you an. Before you start, gather the information, and documents you may need. different lenders have different requirements for the application. common examples include: employment status (if self employed: bank statements, 1099 forms, income tax returns) proof of income (pay stubs, w 2 forms) bank statements. 28% or less of gross income. consumer debt to income ratio. 20% or less of monthly take home pay. so, for example, if a person's total monthly debt payment is $1,700 and their monthly gross income is $4,855, that's a 35% total debt to income ratio. if that person's monthly housing cost is $1,200, that's a 25% housing ratio. Consumer loans. there are two basic kinds of consumer loans: secured or unsecured. secured loans. a secured loan means that the borrower has put up some asset as a form of collateral before being granted a loan. the lender is issued a lien, which is a right to possession of property belonging to another person until a debt is paid.

Home Equity Loan Calculator Usaa At Christine Cargile Blog 28% or less of gross income. consumer debt to income ratio. 20% or less of monthly take home pay. so, for example, if a person's total monthly debt payment is $1,700 and their monthly gross income is $4,855, that's a 35% total debt to income ratio. if that person's monthly housing cost is $1,200, that's a 25% housing ratio. Consumer loans. there are two basic kinds of consumer loans: secured or unsecured. secured loans. a secured loan means that the borrower has put up some asset as a form of collateral before being granted a loan. the lender is issued a lien, which is a right to possession of property belonging to another person until a debt is paid.

25 Usaa Boat Loan Calculator Julianajmunisa

Comments are closed.