Venture Capital Vs Angel Investor Notes Learning

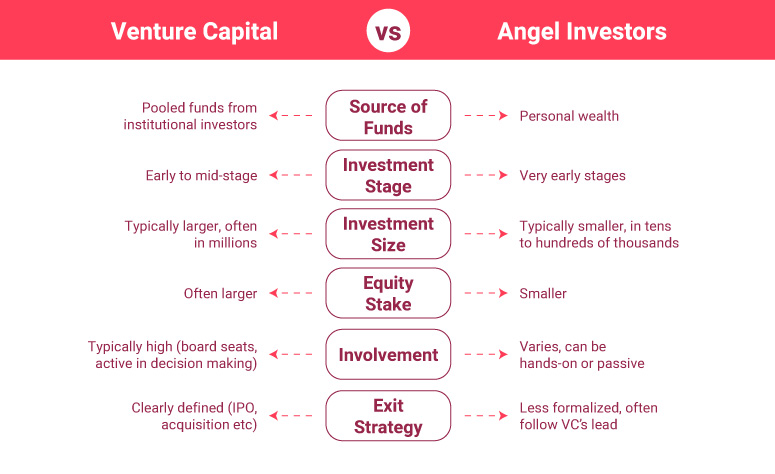

Venture Capital Vs Angel Investor Notes Learning Apart from startup details, angel investors can invest based on personal interest or expertise. investmentamount: venture capital invests large amounts of capital. they may have multiple rounds of fundings. angel investors invest as per their capital availability. generally, angel investors invest in smaller sums. decision making process. Angel investors: angel investors have a more flexible and faster decision making process, often based on personal discretion and can quickly decide to invest. 5. control and influence. venture capital: vcs exert significant control, often taking board seats and influencing the company's strategic direction.

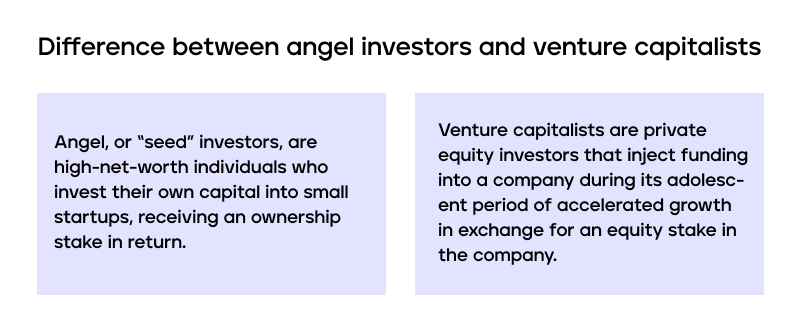

Angel Investor Vs Venture Capital 5 Most Awesome Differences To Learn Venture capitalists ask for more company equity than angel investors. angel investors fund younger, less established businesses than venture capitalists. venture capitalists look for a bigger return on investment than angel investors. angel investors spend more time working with and mentoring business owners than venture capitalists do. Venture capitalists and angel investors differ in their investment criteria and preferences: investment size: vcs typically invest larger amounts of capital compared to angel investors. while angel investments can range from tens of thousands to a few million dollars, venture capital investments often start at several million dollars and can go. Whether an angel investment or venture capital funding is right for you hinges on multiple factors. choosing the right type of investor for your startup is like choosing a partner for a road trip; you need alignment in destination, pace, and style. Angel investors and venture capital (vc) firms both play critical roles in the early stages of a startup company's life cycle, but there are key differences between the two: : angel investors typically use their personal funds to invest in startups, while venture capitalists manage pooled money from several institutional, pension funds and.

Angel Investors Vs Venture Capitalists Truic Whether an angel investment or venture capital funding is right for you hinges on multiple factors. choosing the right type of investor for your startup is like choosing a partner for a road trip; you need alignment in destination, pace, and style. Angel investors and venture capital (vc) firms both play critical roles in the early stages of a startup company's life cycle, but there are key differences between the two: : angel investors typically use their personal funds to invest in startups, while venture capitalists manage pooled money from several institutional, pension funds and. Angel investors are wealthy individuals (or groups of wealthy individuals) who invest their own money into companies. venture capitalists (vcs) are employees of venture capital firms that invest other people’s money (which they hold in a fund) into companies. now let’s take a closer at the two, before diving into the specific differences. One major difference between angel investors vs. venture capitalists is the type of projects they’re looking to invest in. venture capitalists want businesses with very large market caps from whom they predict an immense return—often 10x or more. (this is obviously a bit different from angel investors, who are looking to make a return, but.

The Key Differences Between Venture Capital And Angel Investors Angel investors are wealthy individuals (or groups of wealthy individuals) who invest their own money into companies. venture capitalists (vcs) are employees of venture capital firms that invest other people’s money (which they hold in a fund) into companies. now let’s take a closer at the two, before diving into the specific differences. One major difference between angel investors vs. venture capitalists is the type of projects they’re looking to invest in. venture capitalists want businesses with very large market caps from whom they predict an immense return—often 10x or more. (this is obviously a bit different from angel investors, who are looking to make a return, but.

Venture Capitalist Vs Angel Investor Who Should You Pitch To

Angel Investors Vs Venture Capitalists Equitynet

Comments are closed.