Venture Capital Vs Angel Investors Which Is Right For You

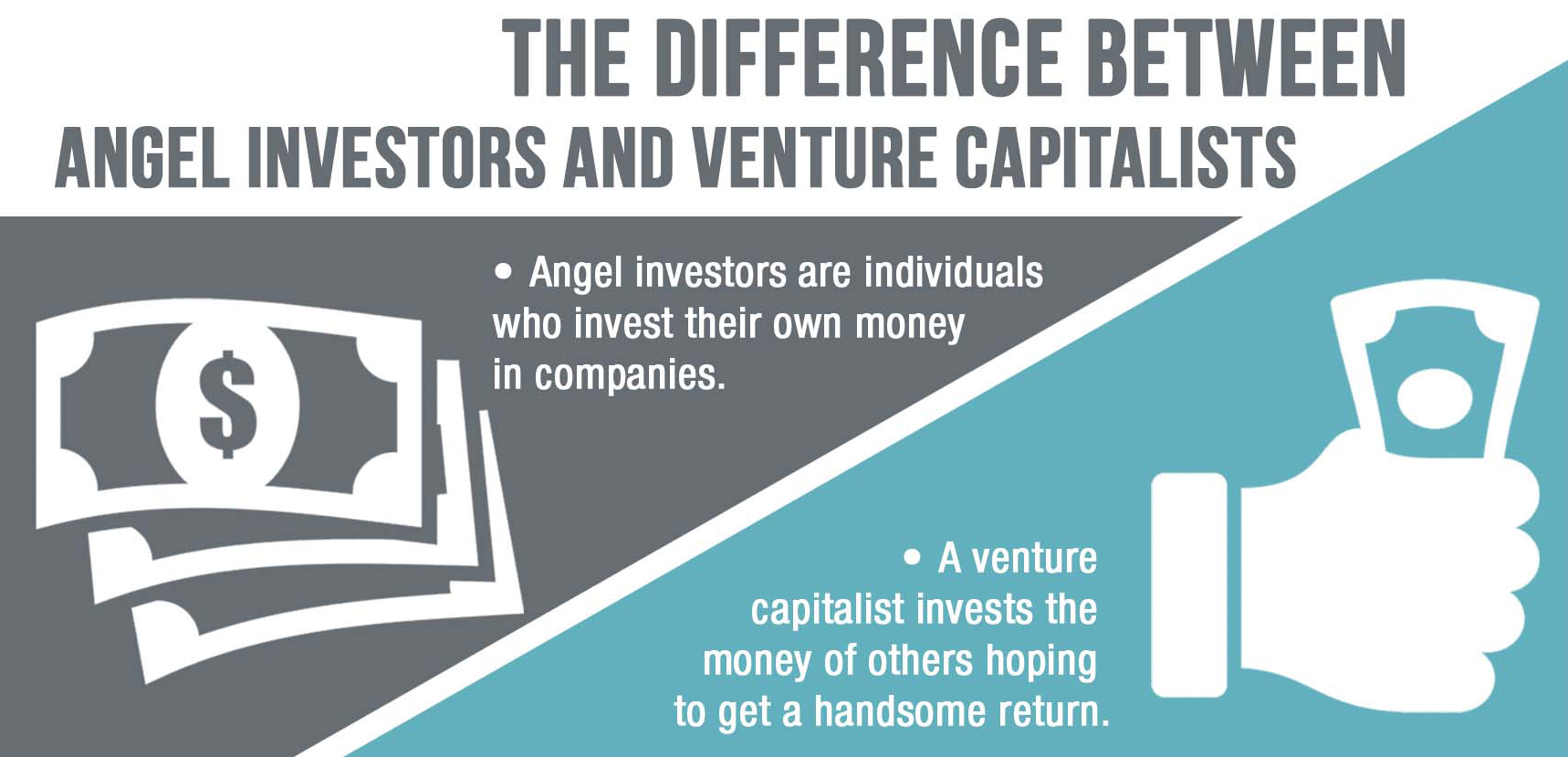

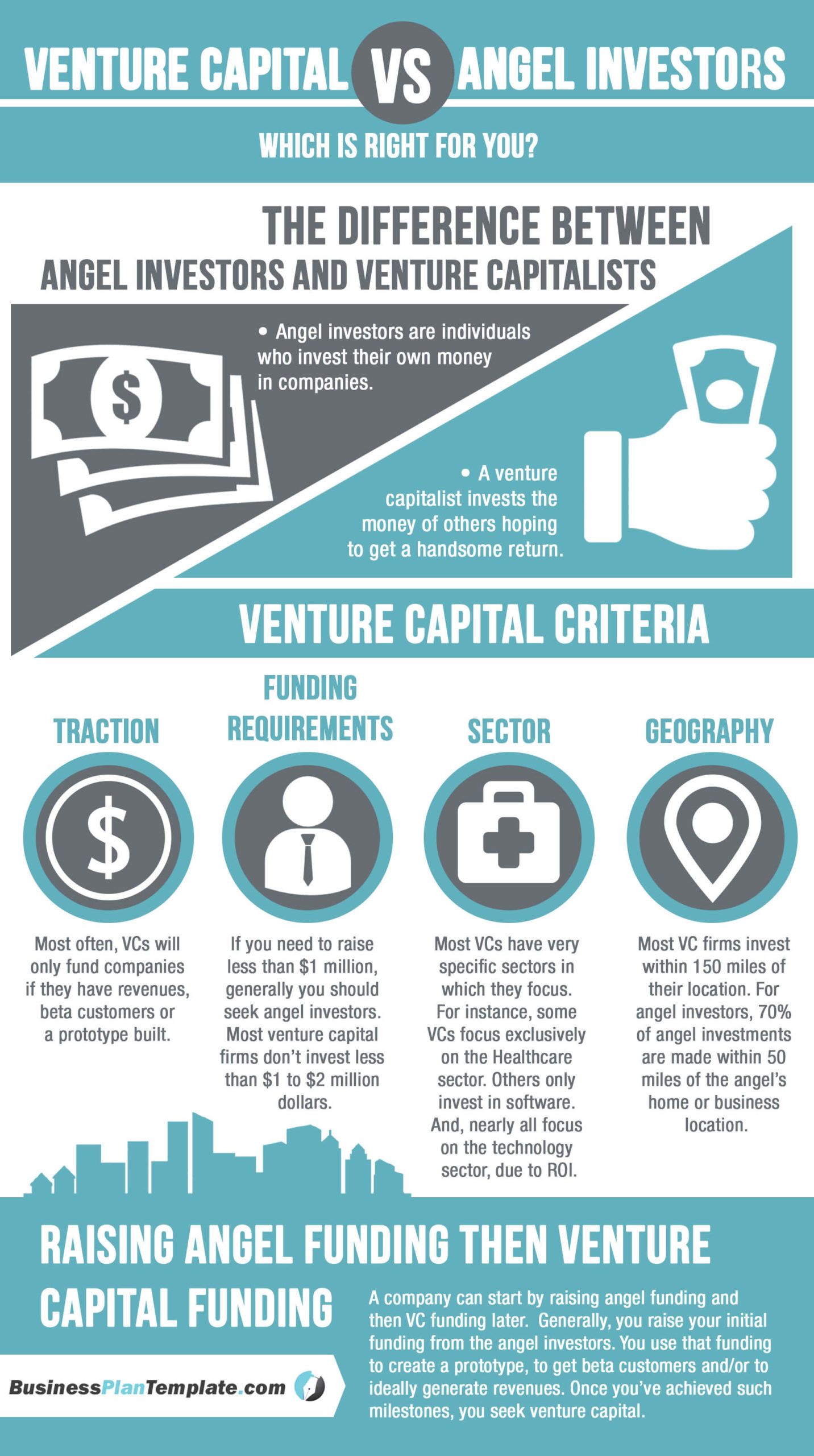

Venture Capital Vs Angel Investors Which Is Right For You Businesses can find this funding in a few places, such as by filing for a bank loan or finding a venture capitalist or angel investor. venture capitalists and angel investors provide funding to. Venture capitalists ask for more company equity than angel investors. angel investors fund younger, less established businesses than venture capitalists. venture capitalists look for a bigger return on investment than angel investors. angel investors spend more time working with and mentoring business owners than venture capitalists do.

Venture Capital Vs Angel Investors Which Is Right For You 2. investment amount. one of the most notable differences between angel investors and venture capitalists is the amount of money they typically invest. angel investors usually provide smaller sums, often ranging from $25,000 to $100,000 per deal, though in some cases, they may invest up to $500,000. The main differences between angel investors vs. venture capitalists are who is doing the investing, stages at which they invest, and the amounts typically invested. angel investors are usually private, high net worth individuals or groups of people who write relatively small checks in companies’ early stages. Venture capital firms make an average return of 57% per year before the company is sold. however, vc investments are very volatile, so this figure has a standard deviation of about 100% (compared to 10% for most s&p 500 stocks). meanwhile, angel investors see anywhere between 20 40% rate of return each year. Angel investors: angel investors have a more flexible and faster decision making process, often based on personal discretion and can quickly decide to invest. 5. control and influence. venture capital: vcs exert significant control, often taking board seats and influencing the company's strategic direction.

Angel Investors Vs Venture Capitalists Equitynet Venture capital firms make an average return of 57% per year before the company is sold. however, vc investments are very volatile, so this figure has a standard deviation of about 100% (compared to 10% for most s&p 500 stocks). meanwhile, angel investors see anywhere between 20 40% rate of return each year. Angel investors: angel investors have a more flexible and faster decision making process, often based on personal discretion and can quickly decide to invest. 5. control and influence. venture capital: vcs exert significant control, often taking board seats and influencing the company's strategic direction. Angel investors: invest smaller amounts, typically ranging from $10,000 to $5 million per startup. for example, sarah, an angel investor, invests $250,000 in a promising food delivery startup led by a passionate team with a strong vision. venture capital: invest larger sums, typically starting from $1 million and ranging upwards based on the. Angel investors are typically a better fit for the earliest stages, while venture capitalists come in at later stages where the focus shifts to scaling the business. identify support and capital needs. consider the type and amount of support and capital your startup requires.

Venture Capital Vs Angel Investors Which Is Right For You Angel investors: invest smaller amounts, typically ranging from $10,000 to $5 million per startup. for example, sarah, an angel investor, invests $250,000 in a promising food delivery startup led by a passionate team with a strong vision. venture capital: invest larger sums, typically starting from $1 million and ranging upwards based on the. Angel investors are typically a better fit for the earliest stages, while venture capitalists come in at later stages where the focus shifts to scaling the business. identify support and capital needs. consider the type and amount of support and capital your startup requires.

Comments are closed.