Vital Life Insurance Statistics And Trends To Know In 2023

Vital Life Insurance Statistics And Trends To Know In 2023 Only 3% of americans correctly guessed the cost of a 10 year, $500,000 term life insurance policy for a healthy, 40 year old buyer. the largest percentage of respondents (28.4%) thought the cost. Gender differences in life insurance. according to limra, 46% of women have life insurance in 2024, compared to 57% of men. this data represents the largest disparity in coverage between men and women in the study’s 14 year history. 45% of women report needing life insurance or more life insurance coverage in 2024.

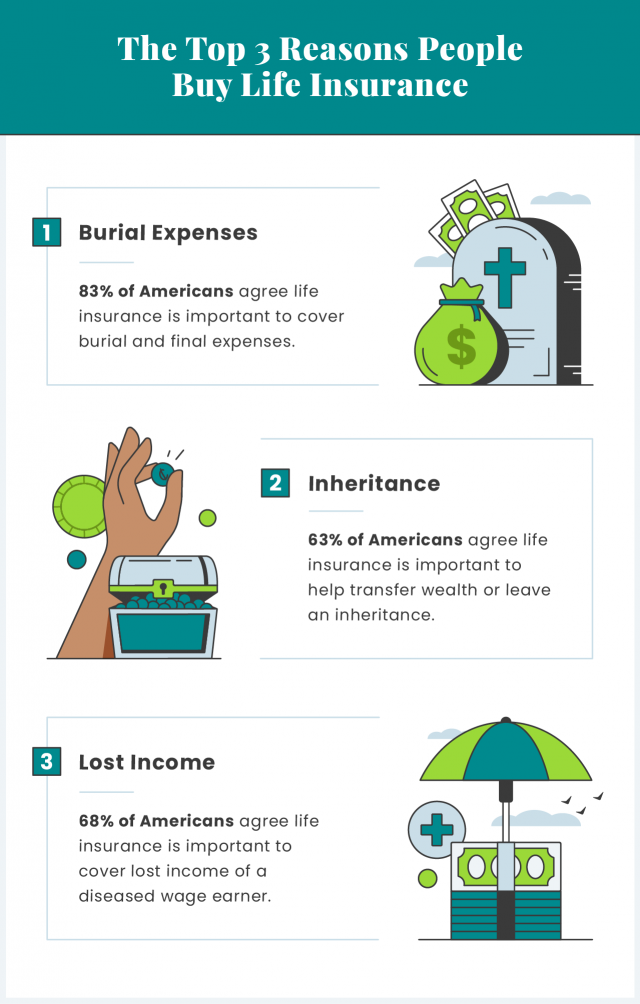

Vital Life Insurance Statistics And Trends To Know In 2023 The first is technology. insurance and life insurance are information businesses. over the years, there has been a lot of investment in technology. we have seen it spend grow from 2 percent of gross premium to 3 percent. we are on the cusp of a new era for life insurance to harness the power of data, analytics, and digital customer engagement. 56% of individuals with a household income of less than $50,000 don’t have (48%) or don’t have enough (8%) life insurance coverage, representing the largest need gap across income brackets. 39. In january 2023, 52% of consumers reported owning life insurance (e.g., individual, employer sponsored, etc.), which is up from 50% in 2022 but down from 63% in 2011. overall, there are more than 100 million uninsured and underinsured americans who say they need (or need more) life insurance coverage. thirty eight percent of americans say their. Top reasons for buying life insurance in the u.s. according to 2023 statistics from trade research organization limra and the non profit organization life happens, these are the most common reasons americans said they bought life insurance: 82% burial final expenses. 68% wealth transfer. 60% income replacement.

Vital Life Insurance Statistics And Trends To Know In 2023 In january 2023, 52% of consumers reported owning life insurance (e.g., individual, employer sponsored, etc.), which is up from 50% in 2022 but down from 63% in 2011. overall, there are more than 100 million uninsured and underinsured americans who say they need (or need more) life insurance coverage. thirty eight percent of americans say their. Top reasons for buying life insurance in the u.s. according to 2023 statistics from trade research organization limra and the non profit organization life happens, these are the most common reasons americans said they bought life insurance: 82% burial final expenses. 68% wealth transfer. 60% income replacement. Life insurance reinvention will continue in 2023 as the industry aims to ensure ongoing relevancy. pushed by current geopolitical and financial challenges, life insurers remain hyper focused on system modernization, digital transformation, and innovation to boost customer centricity. moreover, worldwide risk awareness sparked by the pandemic. Data from limra and life happens reveals younger americans have the greatest need and desire to buy life insurance . windsor, conn. and washington, d.c., april 24, 2023—while two thirds of americans report their lives have largely returned to normal following the covid 19 pandemic, the 2023 insurance barometer study shows a record high proportion of consumers (39%) who say they intend to.

Vital Life Insurance Statistics And Trends To Know In 2023 Life insurance reinvention will continue in 2023 as the industry aims to ensure ongoing relevancy. pushed by current geopolitical and financial challenges, life insurers remain hyper focused on system modernization, digital transformation, and innovation to boost customer centricity. moreover, worldwide risk awareness sparked by the pandemic. Data from limra and life happens reveals younger americans have the greatest need and desire to buy life insurance . windsor, conn. and washington, d.c., april 24, 2023—while two thirds of americans report their lives have largely returned to normal following the covid 19 pandemic, the 2023 insurance barometer study shows a record high proportion of consumers (39%) who say they intend to.

Vital Life Insurance Statistics And Trends To Know In 2023

Comments are closed.