What Is 401k Ira Vs 401k Retirement Answers From Napkin Finance

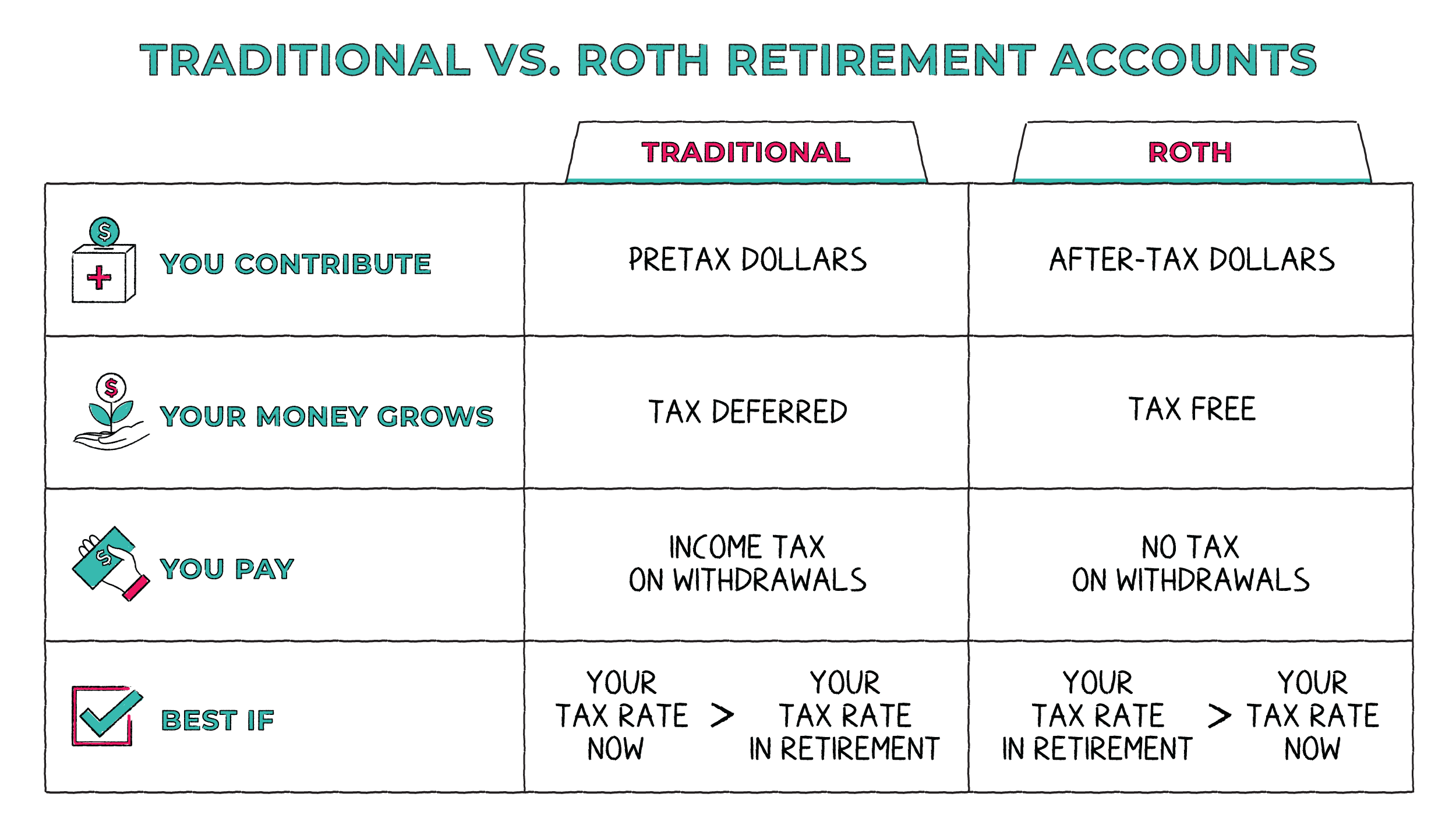

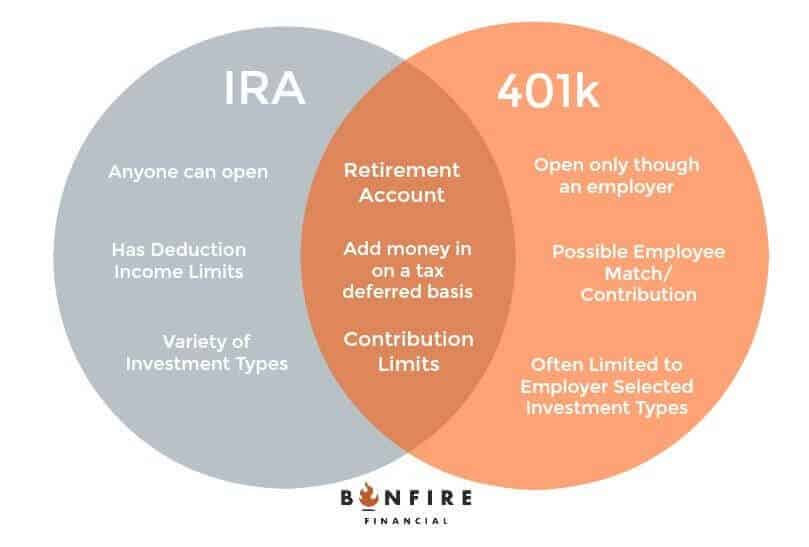

What Is 401k Ira Vs 401k Retirement Answers From Napkin Finance The average balance in a 401 (k) is just over $100,000, but it is possible to become a “401 (k) millionaire”—i.e., someone with a balance in the seven digits. iras and 401 (k)s are the two main types of retirement savings accounts. the main difference is that 401 (k)s must be sponsored by an employer, while you can set up an ira on your own. An ira is typically held by a brokerage or investment firm. in general, it offers more investment options than a 401 (k), but contribution limits are much lower. for tax year 2024, you can't.

What Is 401k Ira Vs 401k Retirement Answers From Napkin Finance The irs sets annual contribution limits for both 401 (k)s and iras. in 2024, the contribution limit for a 401 (k) is $23,000, and the contribution limit for an ira is $7,000. if you're 50 or older, you can make catch up contributions of $7,500 to your 401 (k) and $1,000 to your ira. the contribution limits for iras. A 401 (k) may provide an employer match but an ira does not. an ira generally has more investment choices than a 401 (k). an ira allows you to avoid the 10% early withdrawal penalty for certain. Contribution limits. one of the main differences between iras and 401 (k)s are contribution limits: 401 (k)s have vastly higher limits. for 2024, the 401 (k) contribution limit is $23,000 for those under 50 and $30,500 for those 50 or older, who are becoming eligible for catch up contributions. The 401 (k) is simply objectively better. the employer sponsored plan allows you to add much more to your retirement savings than an ira – $23,000 compared to $7,000 in 2024. plus, if you’re.

Differences Between An Ira And 401k A Simple Guide Contribution limits. one of the main differences between iras and 401 (k)s are contribution limits: 401 (k)s have vastly higher limits. for 2024, the 401 (k) contribution limit is $23,000 for those under 50 and $30,500 for those 50 or older, who are becoming eligible for catch up contributions. The 401 (k) is simply objectively better. the employer sponsored plan allows you to add much more to your retirement savings than an ira – $23,000 compared to $7,000 in 2024. plus, if you’re. A 401 (k) and ira are both great tax advantaged retirement savings options, and many people use both. a 401 (k) is a better option than an ira if you're looking for the convenience of automatic. The biggest difference between a 401 (k) and ira is flexibility. you can open an ira at most financial institutions, and the range of investments to choose from can be enormous. also, if you leave your job, you can roll over money from 401 (k)s and similar plans into iras. (some employers require that you take your money with you.).

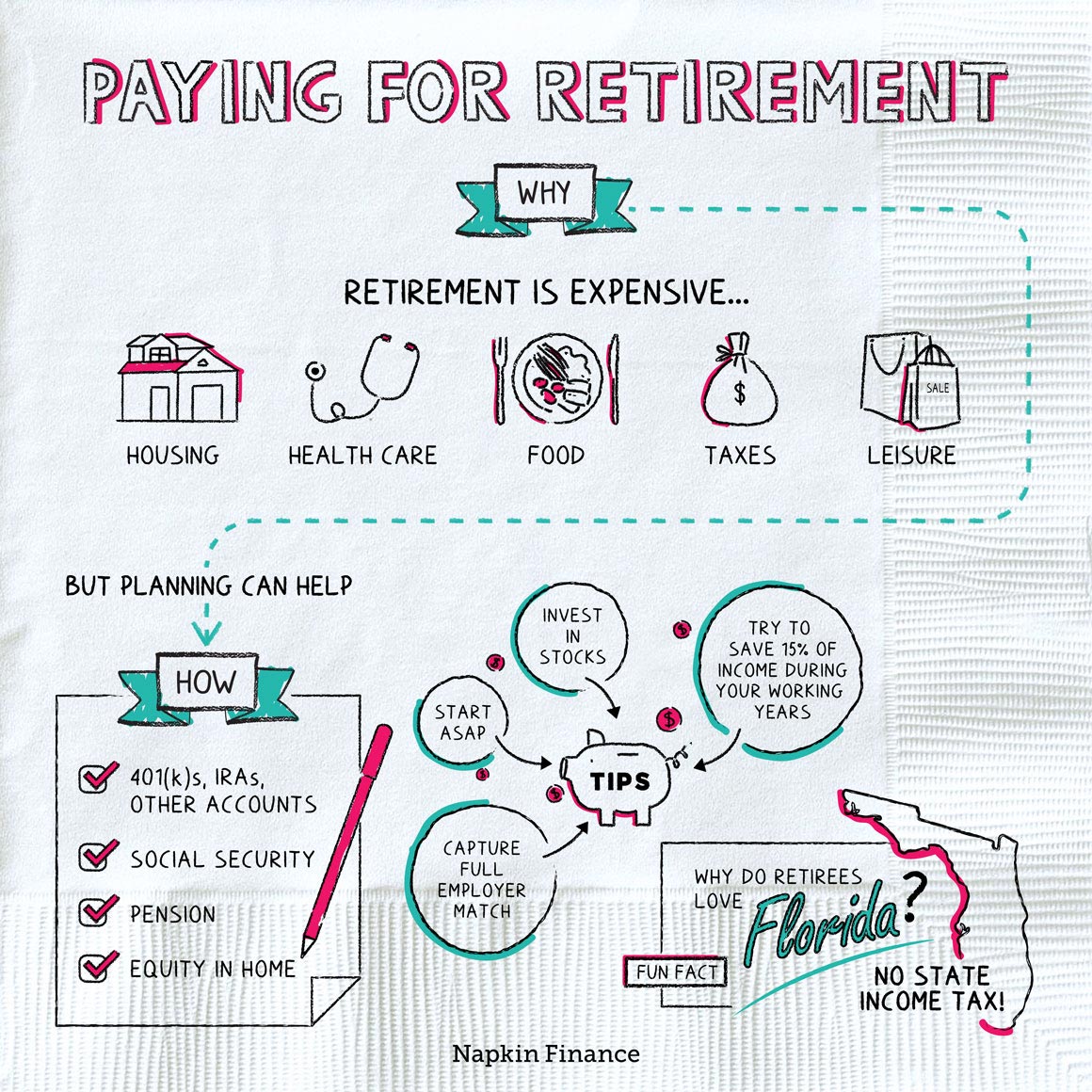

Paying For Retirement Napkin Finance A 401 (k) and ira are both great tax advantaged retirement savings options, and many people use both. a 401 (k) is a better option than an ira if you're looking for the convenience of automatic. The biggest difference between a 401 (k) and ira is flexibility. you can open an ira at most financial institutions, and the range of investments to choose from can be enormous. also, if you leave your job, you can roll over money from 401 (k)s and similar plans into iras. (some employers require that you take your money with you.).

Comments are closed.