What Is A Consumer Finance Company Account Benefits Pros Cons The

What Is A Consumer Finance Company Account Benefits Pros Cons The Definition of a consumer finance company account. a consumer finance company account is a specialized financial account provided by consumer finance companies to meet the unique financial needs of individuals. unlike traditional bank accounts, which generally offer a range of services such as checking, savings, and loans, a consumer finance. Consumer credit in finance is extended by lenders to enable consumers to make purchases immediately and pay off the balance over time with interest. it is broadly divided into two classifications.

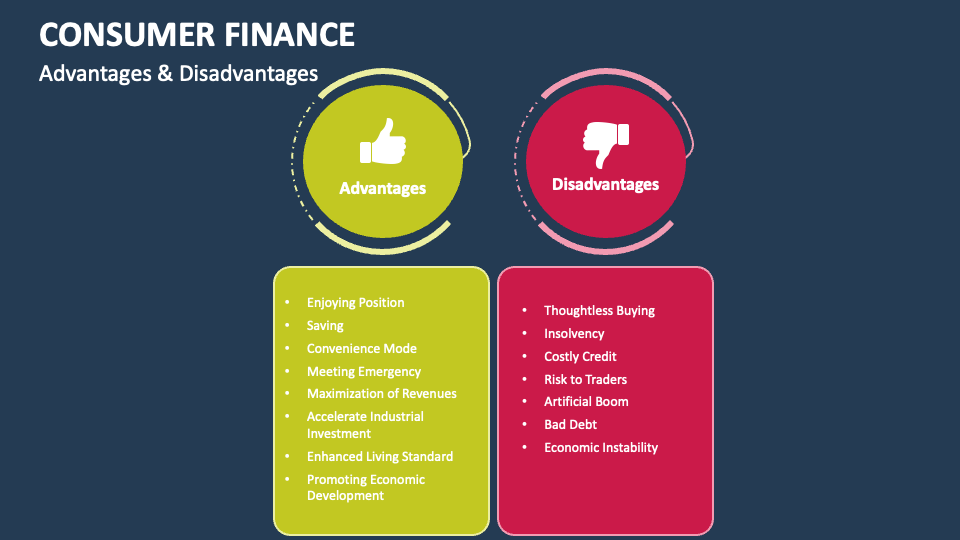

What Is A Consumer Finance Company Account Benefits Pros Cons The Consumer finance accounts are a type of financing that comes with a specific intention to create an affordable payment. it is a layaway style account that allows people to purchase something that they wouldn’t normally get because of the cost. today’s lending products allow for credit to ensure immediate delivery. The cfpb also provides data and research on various consumer finance topics, such as mortgage delinquency rates, consumer financial well being, debt collection practices and other aspects of how. The bottom line. consumer credit provides access to more spending power, which enables you to do things like take out a home loan or make purchases with a credit card. responsible use of consumer credit can open doors to new opportunities, but borrowing also has the potential to result in unmanageable levels of debt. Consumer finance is defined as “the business of providing credit and other financial services to consumers.”. it includes a variety of financial products, such as credit cards, personal loans, mortgages, auto loans, and more. these products are designed to help consumers access the funds they need to make purchases or investments.

Consumer Finance Powerpoint Presentation Slides Ppt Template The bottom line. consumer credit provides access to more spending power, which enables you to do things like take out a home loan or make purchases with a credit card. responsible use of consumer credit can open doors to new opportunities, but borrowing also has the potential to result in unmanageable levels of debt. Consumer finance is defined as “the business of providing credit and other financial services to consumers.”. it includes a variety of financial products, such as credit cards, personal loans, mortgages, auto loans, and more. these products are designed to help consumers access the funds they need to make purchases or investments. Regardless of the pros and cons, consumer debt in the united states is on the rise due to the ease of obtaining financing matched with the high level of interest rates. as of may 2024, consumer. Chapter 13 bankruptcy puts you on a three to five year court approved payment plan, which may have lower interest rates or smaller payments compared to your current debt. bankruptcy pros. it may.

Comments are closed.