What Is A Consumer Use Tax

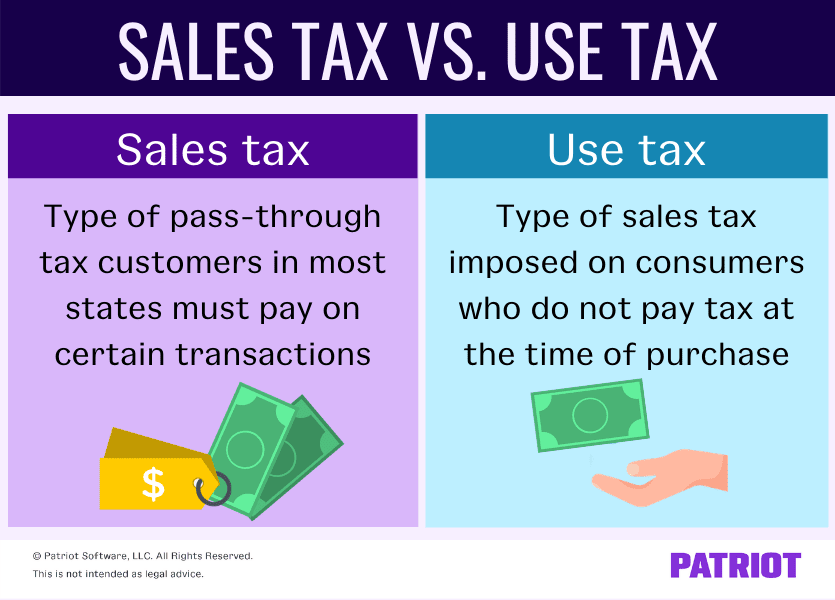

What Is Consumer Use Tax Taxjar Consumers are responsible for calculating and remitting the use tax to the government. the purpose of the use tax is to protect in state retailers against competition from out of state sellers. The differences. sales tax and use tax are both types of taxes that are imposed on the sale of goods and services. the main difference between the two is that sales tax is a tax on the sale of tangible personal property, while use tax is a tax on the use of that property within a state.

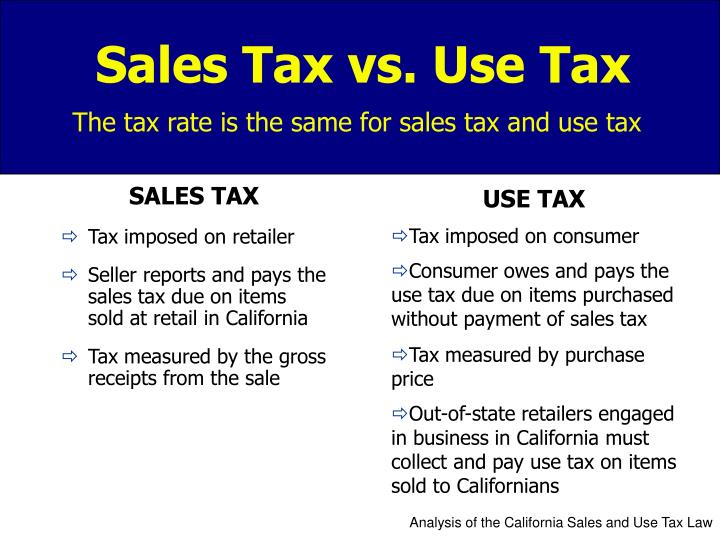

Sales Tax Vs Use Tax How They Work Who Pays More Consumer use tax is imposed on every item that is subject to sales tax if the item had been purchased locally. if shoes are taxable if purchased locally, then shoes are subject to use tax if purchased online or through a catalog. in addition, many states impose tax on transportation charges (like shipping), so the consumer use tax would also. Buyers self assess consumer use tax — it doesn’t appear on an invoice. businesses must also self assess consumer use tax when they use inventory or other items purchased tax free for resale or another purpose (e.g., incorporation into an end product). for example: if a grocery store pulls paper towels off the shelf to clean up a spill, it. Sales tax definition. sales tax is a transaction tax, calculated as a percentage of the sales price of taxable goods and certain taxable services. sales tax is usually imposed on the purchaser (consumer). however, some sales taxes are imposed on the seller, sometimes called a “transaction privilege tax”. however, in either case, the tax is. Sales tax (or retail sales tax) is a transaction tax imposed by states and thousands of local jurisdictions on a sale — the transfer of a product or service from a seller to a consumer. but someone needs to collect the tax, and it would be costly and awkward to station a tax collector in every shop to collect sales tax from each individual.

Ppt Sales Tax Vs Use Tax Powerpoint Presentation Id 1295294 Sales tax definition. sales tax is a transaction tax, calculated as a percentage of the sales price of taxable goods and certain taxable services. sales tax is usually imposed on the purchaser (consumer). however, some sales taxes are imposed on the seller, sometimes called a “transaction privilege tax”. however, in either case, the tax is. Sales tax (or retail sales tax) is a transaction tax imposed by states and thousands of local jurisdictions on a sale — the transfer of a product or service from a seller to a consumer. but someone needs to collect the tax, and it would be costly and awkward to station a tax collector in every shop to collect sales tax from each individual. Consumer use tax is a significant component of taxation that often goes unnoticed by many consumers and businesses alike. unlike sales tax, which is collected at the point of sale within one’s home state, consumer use tax comes into play when purchases are made from vendors located outside of the home state, where sales or use tax wasn’t collected. A use tax is a required contribution on goods and services that was not collected as sales tax at the time of purchase. if your local tax and fee administration charges sales tax as a percentage of a purchase price, that tax is owed regardless of whether a seller collects it. this means that if you buy a product from an out of state seller that.

Comments are closed.