What Is Bull Flag Pattern How To Identify Points To Enter Trade Dttwв ў

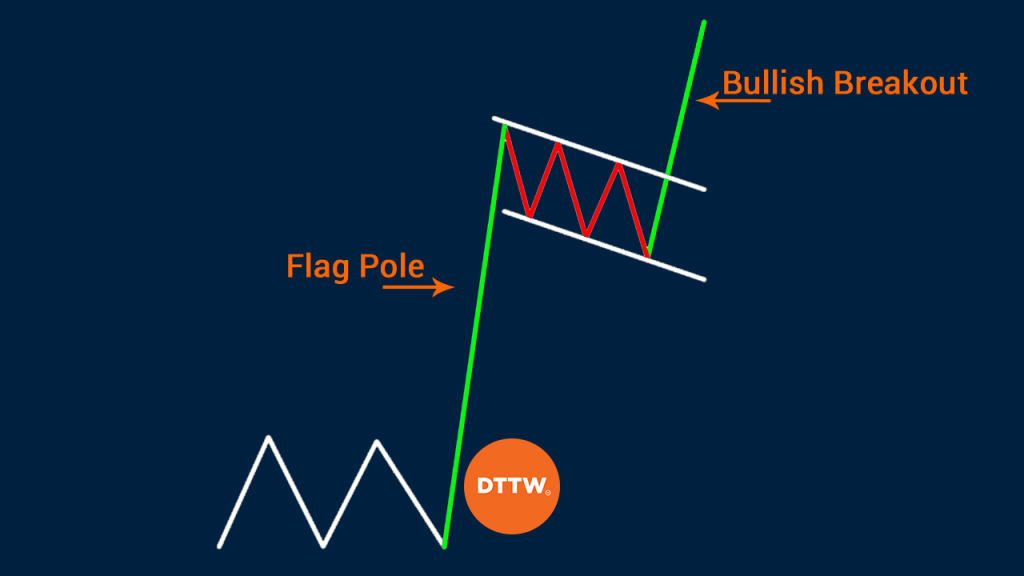

What Is Bull Flag Pattern How To Identify Points To Enter Trade Dttw邃 Follow the steps below, and you can quickly integrate the bull flag into your financial markets trading: identify an evolving uptrend in an fx pair. use a trend line and draw the vertical flag pole. use a channel, parallel lines, or separate horizontal lines to draw the flag. place a buy order immediately above the flag’s upper line. The 3 key features. as you can see, the bull flag pattern has three key features. first, it is formed after the price of an asset jumps. this is the flag pole of this flag. second, it has a consolidation phase, as bulls and bears battle it out. in most cases, this usually happens during a period of low volume.

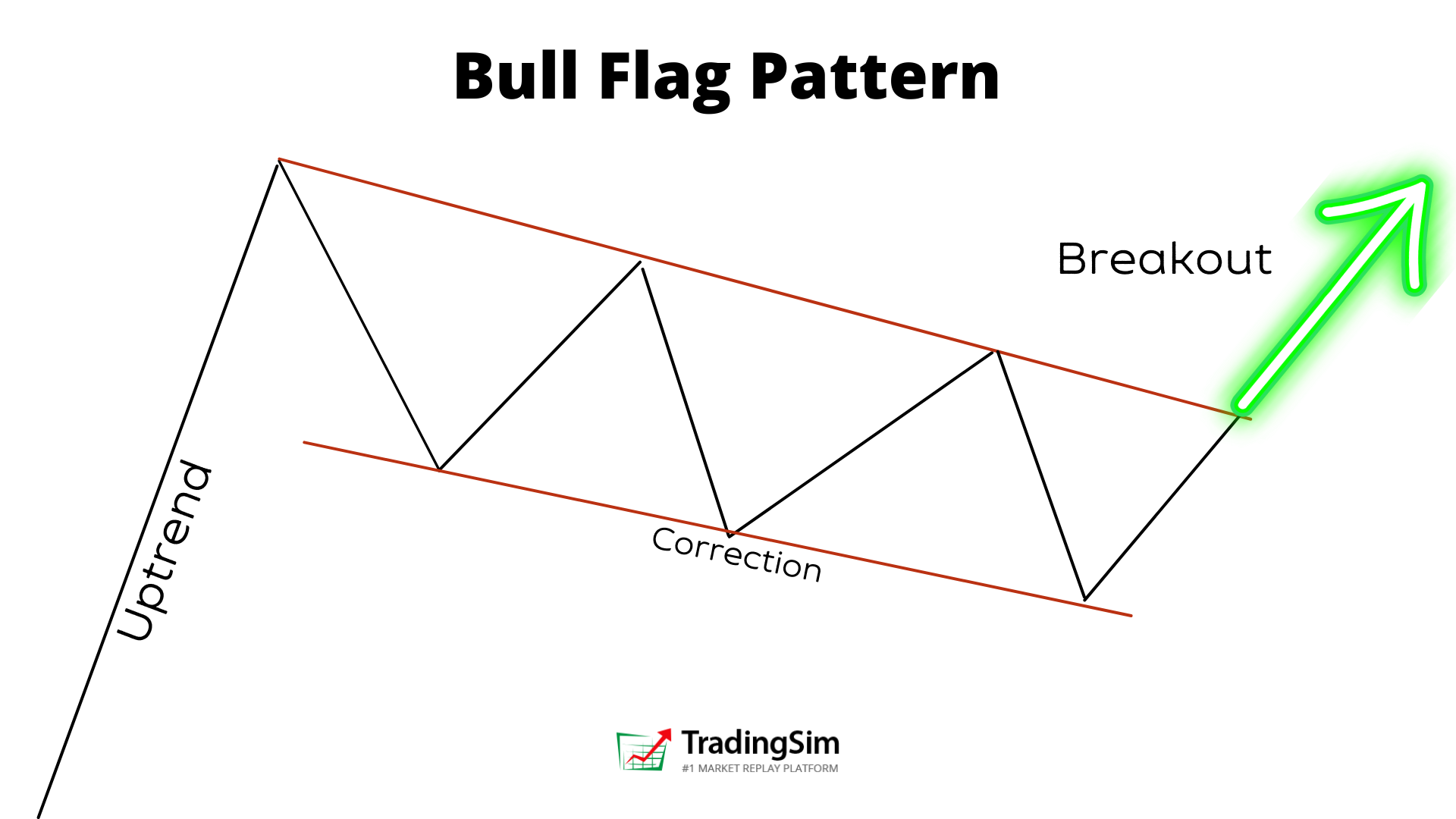

What Is A Bull Flag Pattern Bullish How To Trade With It Bybit Learn A bull flag pattern resembles a flag flying on a pole. the flag forms the top part of the pattern, while the pole forms the bottom part. the pattern is considered to be bullish, as it typically forms during an uptrend. however, some traders believe that the pattern is not reliable, as it can occasionally form during a downtrend. 1. bull flag pattern entry. the best place to enter a trade in the bull flag pattern is at the flag’s upper trendline breakout. additionally, significant trading volume is imperative. this indicates the resumption of the upward trend after the brief consolidation phase. 2. bull flag pattern profit target. Trading bull flag strategies involves identifying the completion of the flag formation and preparing for a potential breakout. the key is to wait for the price action to break above the resistance level of the flag, signaling a continuation of the initial uptrend. this breakout point is often accompanied by increased volume, serving as a. Identify the bull flag pattern: to identify a bullish flag pattern in a chart, traders should look for a sharp price increase followed by a consolidation period where the price moves sideways in a narrow range, forming a rectangular shape on the chart. the consolidation period should have lower trading volume, indicating a decrease in market.

Bull Flag Chart Patterns The Complete Guide For Traders Trading bull flag strategies involves identifying the completion of the flag formation and preparing for a potential breakout. the key is to wait for the price action to break above the resistance level of the flag, signaling a continuation of the initial uptrend. this breakout point is often accompanied by increased volume, serving as a. Identify the bull flag pattern: to identify a bullish flag pattern in a chart, traders should look for a sharp price increase followed by a consolidation period where the price moves sideways in a narrow range, forming a rectangular shape on the chart. the consolidation period should have lower trading volume, indicating a decrease in market. Step 1: recognize the trend. determine the overall trend of the asset you’re researching before looking for the bull flag chart pattern. the pattern should appear during an uptrend when prices are often rising. it is irrelevant if the purchase is in a downtrend or heading sideways. Let's start with how to identify a bull flag pattern. this pattern forms in a time of consolidation, which makes this a continuation pattern. this means that when the price breaks out of the pattern, it's likely to continue in the same direction it was heading before. the pattern begins when a stock's price rises from a low point to a high point.

Bull Flag Pattern What Is It How To Use It Step 1: recognize the trend. determine the overall trend of the asset you’re researching before looking for the bull flag chart pattern. the pattern should appear during an uptrend when prices are often rising. it is irrelevant if the purchase is in a downtrend or heading sideways. Let's start with how to identify a bull flag pattern. this pattern forms in a time of consolidation, which makes this a continuation pattern. this means that when the price breaks out of the pattern, it's likely to continue in the same direction it was heading before. the pattern begins when a stock's price rises from a low point to a high point.

Bull Flag Chart Pattern Trading Strategies Warrior Trading

Bull Flag Trading Pattern Explained Tradingsim

Comments are closed.