What Is Compound Interest Definition How It Works Examples

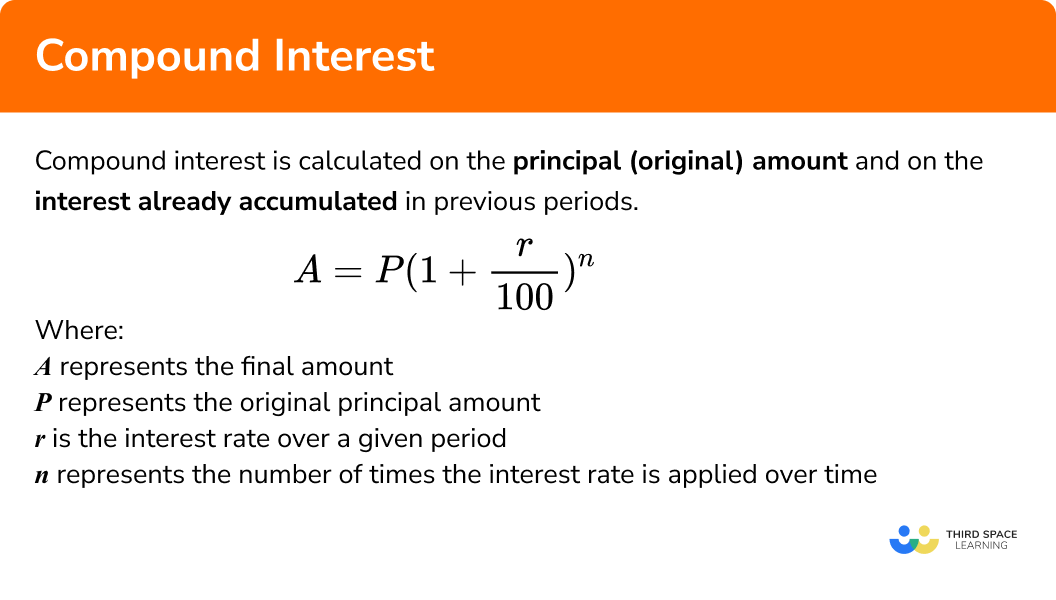

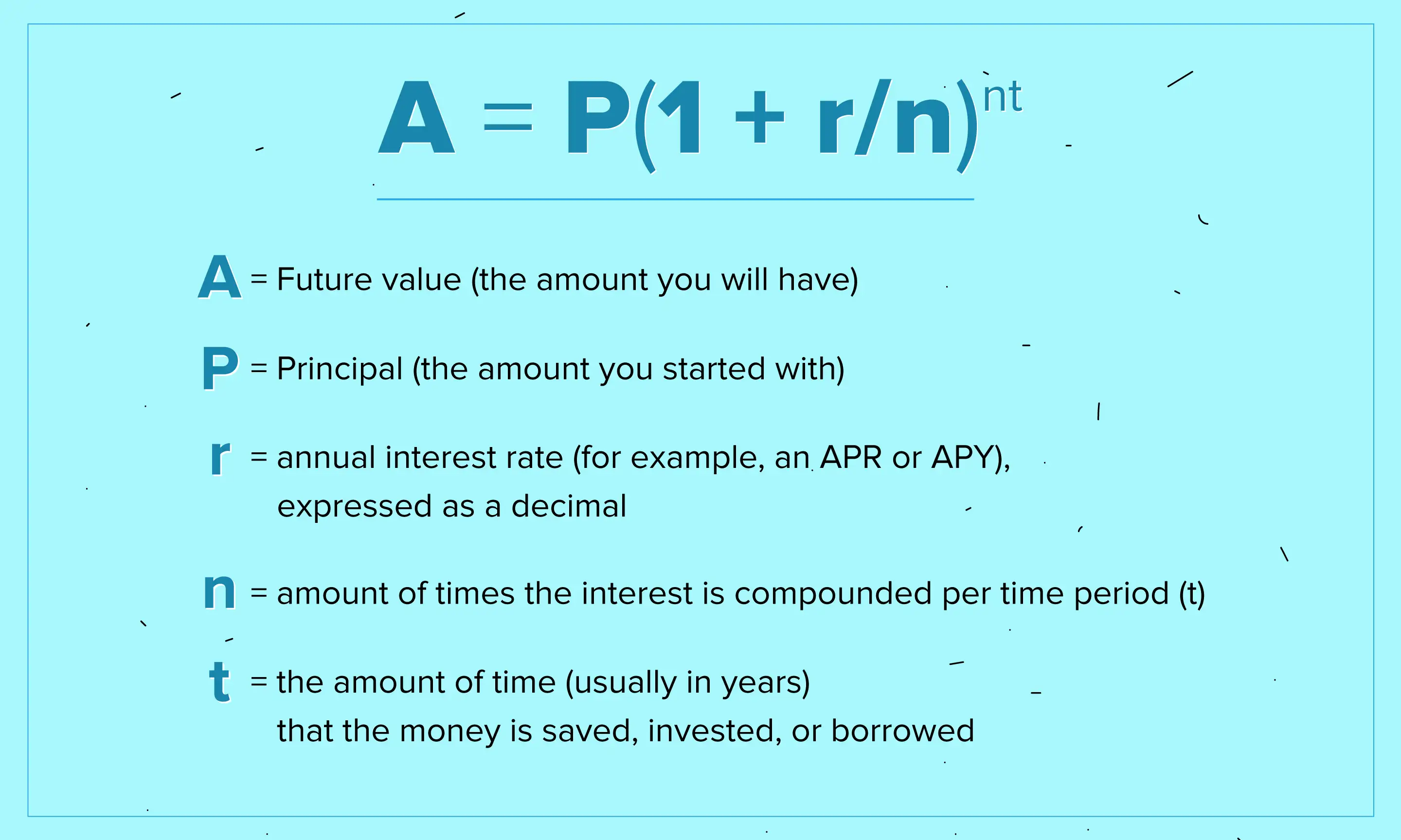

Compound Interest Gcse Maths Steps Examples Worksheet In cell b7, the calculation is “=b6*1.05”. finally, the calculated value in cell b7—$1,276.28—is the balance in your savings account after five years. to find the compound interest value. Compound interest allows reinvestment of earnings, increasing the principal and potential returns. long term compounding dramatically boosts investment growth, e.g., $10,000 grows to $174,494 in.

What Is Compound Interest Money Compound interest works on both assets and liabilities. while compounding boosts the value of an asset more rapidly, it can also increase the amount of money owed on a loan, as interest. Compound interest is the interest paid on the original principal and on the accumulated past interest. when you borrow money from a bank, you pay interest. interest is really a fee charged for borrowing the money, it is a percentage charged on the principal amount for a period of a year usually. Compound interest is when the interest you earn on a balance in a savings or investing account is reinvested, earning you more interest. as a wise man once said, “money makes money. and the. Compound interest savings account example. here’s a chart that shows how a $5,000 balance could grow over a period of three years. this assumes you make $100 monthly contributions and earn a 4% apy.

/compound-interest-d0fbc3665a274591bc2cb29e769b3015.gif)

What Is Compound Interest Compound interest is when the interest you earn on a balance in a savings or investing account is reinvested, earning you more interest. as a wise man once said, “money makes money. and the. Compound interest savings account example. here’s a chart that shows how a $5,000 balance could grow over a period of three years. this assumes you make $100 monthly contributions and earn a 4% apy. Compound interest is defined as interest earned on principal plus interest that was earned previously. compound interest is important to understand if you: for example, when you deposit money into a high yield savings account and leave it there, that money will collect a certain amount of interest each month. Let’s run through a few examples to better understand the power of compound interest for savers. how the rule of 72 works. the rule of 72 is an easy compound interest calculation to quickly determine how long it will take to double your money based on the interest rate. simply divide 72 by the interest rate to determine the outcome. at a 2%.

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Definition Compound interest is defined as interest earned on principal plus interest that was earned previously. compound interest is important to understand if you: for example, when you deposit money into a high yield savings account and leave it there, that money will collect a certain amount of interest each month. Let’s run through a few examples to better understand the power of compound interest for savers. how the rule of 72 works. the rule of 72 is an easy compound interest calculation to quickly determine how long it will take to double your money based on the interest rate. simply divide 72 by the interest rate to determine the outcome. at a 2%.

What Is Compound Interest And How Does It Work For Your Savings Ally

Compound Interest Formula And Examples Mathbootcamps

Comments are closed.