What Is Diversification A Beginner S Guide Scoop

What Is Diversification A Beginner S Guide Scoop A guide for beginner investors. diversification is a commonly recommended strategy to manage risk in investing. it involves spreading your investments across numerous assets, or in other words, not putting all your eggs in one basket. it’s important because if one of your investments dips, your other holdings may prop up the rest of your. A guide for beginner investors diversification is a commonly recommended strategy to manage risk in investing. let's take a look at how to diversify and some classic examples.

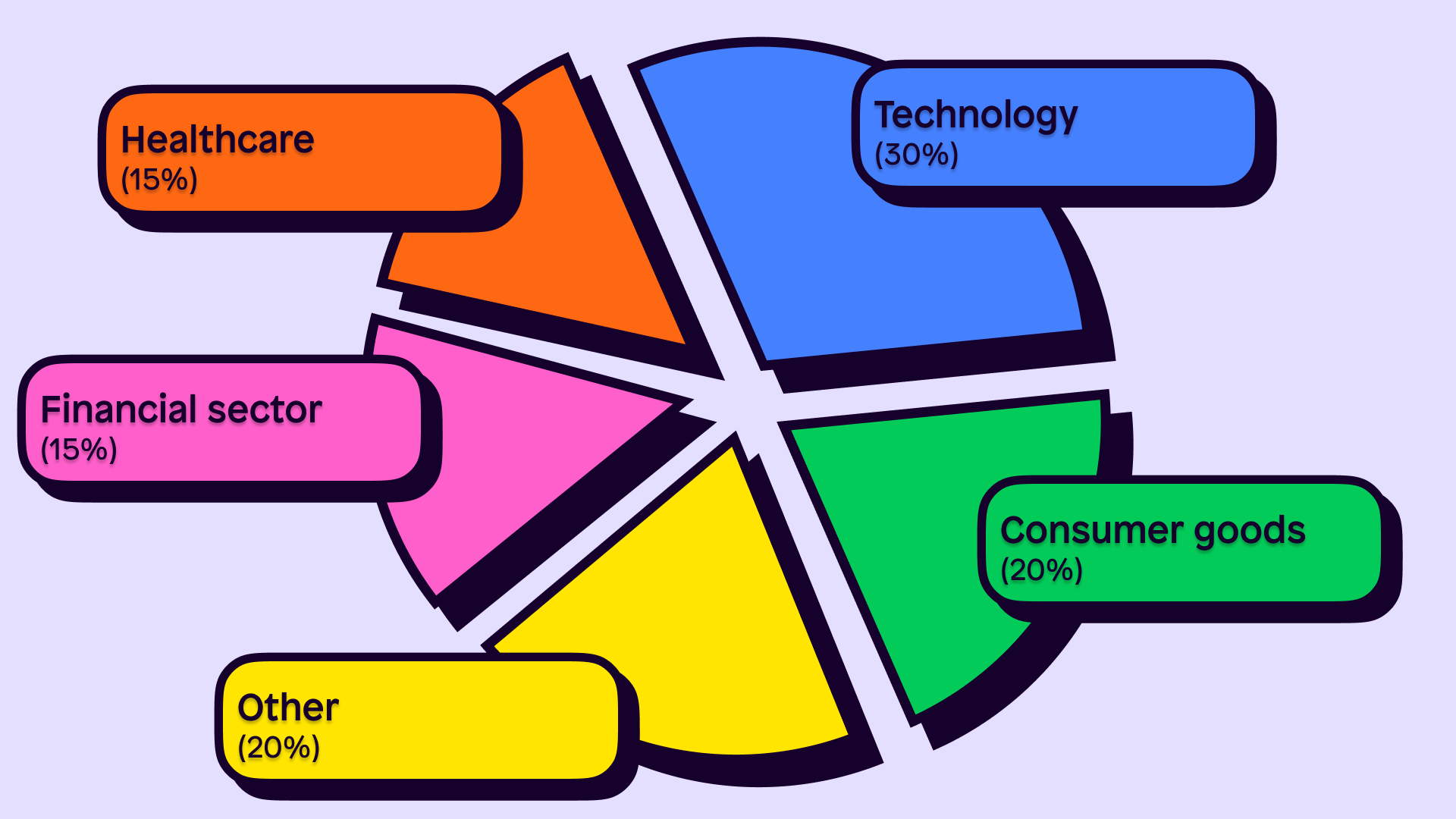

What Is Diversification A Beginner S Guide Scoop Diversification definition. diversification is a common investment strategy that entails buying different types of investments to reduce the risk of market volatility. it's part of what’s called. An investor’s guide to diversification. diversification is an investing strategy that helps reduce risk by allocating investments across various financial assets. here’s everything you need to know. in 1 minute. when you invest too heavily in a single asset, type of asset, or market, your portfolio is more exposed to the risks that come. 4 types of diversification strategies. there are a few different ways to diversify your portfolio: 1. asset diversification. the first way to diversify is by investing in multiple kinds of assets. A successful diversification strategy hinges on the investments in your portfolio having limited correlation. this inevitably requires abiding by the following approaches: invest across asset.

What Is Diversification A Definitive Guide For Kids Teens 4 types of diversification strategies. there are a few different ways to diversify your portfolio: 1. asset diversification. the first way to diversify is by investing in multiple kinds of assets. A successful diversification strategy hinges on the investments in your portfolio having limited correlation. this inevitably requires abiding by the following approaches: invest across asset. Big ideas. diversification in investing is a principle used by all successful investors aimed at reducing risk and increasing longevity in your portfolio. there are many ways and forms of diversification. proper diversification depends on the industry, risk tolerance, and correlation between securities. Investing is an ongoing process that requires regular attention and adjustment. here are 3 steps you can take to keep your investments working for you: 1. create a tailored investment plan. if you haven't already done so, define your goals and time frame, and take stock of your capacity and tolerance for risk. 2.

Why Is Diversification Important In Investing A Beginner S Guide Big ideas. diversification in investing is a principle used by all successful investors aimed at reducing risk and increasing longevity in your portfolio. there are many ways and forms of diversification. proper diversification depends on the industry, risk tolerance, and correlation between securities. Investing is an ongoing process that requires regular attention and adjustment. here are 3 steps you can take to keep your investments working for you: 1. create a tailored investment plan. if you haven't already done so, define your goals and time frame, and take stock of your capacity and tolerance for risk. 2.

Comments are closed.