What Is Diversification And What Are The Main Reasons To Diversify When

What Is Diversification And What Are The Main Reasons To Diversify When Diversification is the process of spreading investments across different asset classes, industries, and geographic regions to reduce the overall risk of an investment portfolio. the idea is that. Diversification is an investing strategy used to manage risk. rather than concentrate money in a single company, industry, sector or asset class, investors diversify their investments across a.

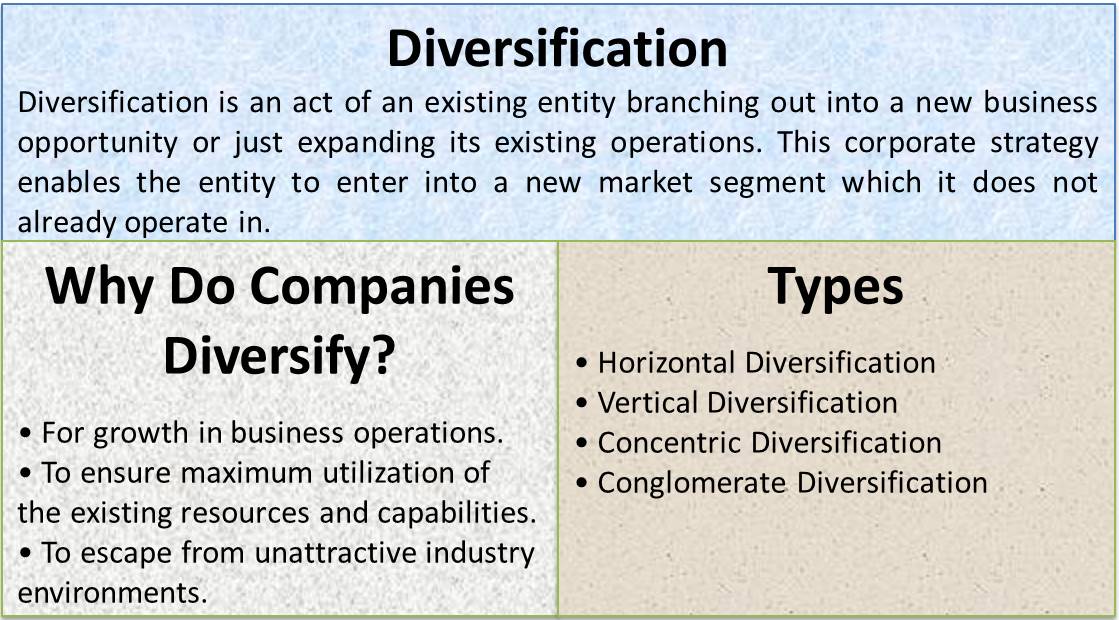

Diversification Strategy Examples Advantages Approaches Careercliff Diversification is a risk management strategy that creates a mix of various investments within a portfolio. a diversified portfolio contains a mix of distinct asset types and investment vehicles. The reasons for diversification may also relate to the advantages of this strategy. overall, the 7 primary reasons for diversification include the following. 1. enter new markets. one of the most crucial reasons to diversify includes entering new markets. by doing so, companies can explore areas with untapped potential. Benefits of investment diversification. the benefits of investment diversification include reduced risk and increased returns. by diversifying their portfolio, investors can reduce the risk of losing their entire investment if one asset or market performs poorly. diversification can also increase returns by exposing investors to different. Diversification is a strategy for growth through branching out into a new market segment, allowing your business to expand its presence and occupy a totally new space. this is achieved through expanding (or diversifying) your product or service offering to target new customers and grow profits. there isn’t just one type of diversification.

What Is Diversification Advantages Disadvantages Types Benefits of investment diversification. the benefits of investment diversification include reduced risk and increased returns. by diversifying their portfolio, investors can reduce the risk of losing their entire investment if one asset or market performs poorly. diversification can also increase returns by exposing investors to different. Diversification is a strategy for growth through branching out into a new market segment, allowing your business to expand its presence and occupy a totally new space. this is achieved through expanding (or diversifying) your product or service offering to target new customers and grow profits. there isn’t just one type of diversification. It is one way to balance risk and reward in your investment portfolio by diversifying your assets. diversification is the practice of spreading your investments around so that your exposure to any one type of asset is limited. this practice is designed to help reduce the volatility of your portfolio over time. The goal of diversification strategies in finance is to achieve a well balanced portfolio that aligns with your investment goals and risk tolerance. these strategies involve spreading investments across a range of assets, geographies, industries, and investment styles to reduce the impact of poor performing investments on the overall portfolio.

Comments are closed.