What Is Hedge Fund Guide To Fees Structure Strategies With

What Is Hedge Fund Guide To Fees Structure Strategies With A hedge fund constitutes a diversified portfolio sourced from various institutional investors. central to its management strategy is the pursuit of elevated returns, albeit accompanied by an augmented risk profile. the fund employs a diverse array of risk management and hedging techniques to counterbalance this risk. The fees associated with hedge funds vary, but a common structure is a 2% annual management fee and a 20% performance fee that comes into effect if the fund surpasses a certain threshold of.

What Is Hedge Fund Guide To Fees Structure Strategies With Two and twenty: explanation of the hedge fund fee structure. by. the multiple strategies of hedge funds. by. neil o'hara. updated aug 31, 2023. redemption: definition in finance and business. by. A long short hedge fund strategy is an extension of pairs trading, hedge funds employ the 2% management fee and 20% performance fee structure. in 2022, the average expense ratio across all. What is the typical hedge fund fee structure? the fee structure for hedge funds is often called two and twenty. investors are charged a 2% management fee, regardless of the performance of the hedge fund. then, they are charged a 20% performance fee only if the fund exceeds the hurdle rate. If the fund charges the standard "two and twenty", the total annual fees made by the fund at the end of each year can be calculated as follows . year 1: fund aum at beginning of year 1 = $1,000m.

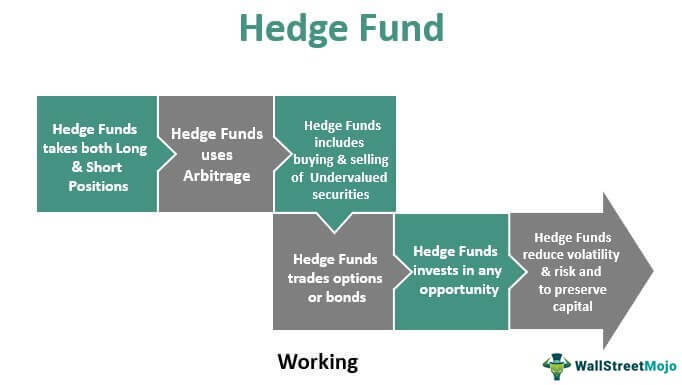

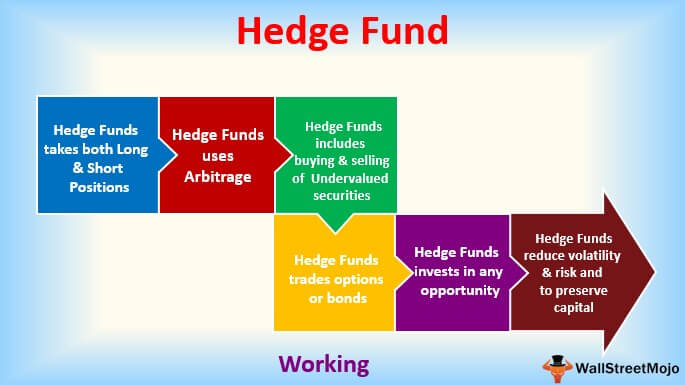

What Is A Hedge Fund Types Examples Strategies And Risks What is the typical hedge fund fee structure? the fee structure for hedge funds is often called two and twenty. investors are charged a 2% management fee, regardless of the performance of the hedge fund. then, they are charged a 20% performance fee only if the fund exceeds the hurdle rate. If the fund charges the standard "two and twenty", the total annual fees made by the fund at the end of each year can be calculated as follows . year 1: fund aum at beginning of year 1 = $1,000m. The main types of hedge funds include long short equity, event driven, global macro, relative value, and multi strategy. each type employs a unique investment approach, targeting opportunities in equity markets, corporate events, macroeconomic trends, price discrepancies, or a combination of strategies. Hedge funds use a variety of strategies to generate returns. learn about how they work. which is a common entity structure of modern hedge funds. fees: hedge fund fees are commonly 1 2% of.

Hedge Fund Strategy Long Short Market Neutral Arbitrage The main types of hedge funds include long short equity, event driven, global macro, relative value, and multi strategy. each type employs a unique investment approach, targeting opportunities in equity markets, corporate events, macroeconomic trends, price discrepancies, or a combination of strategies. Hedge funds use a variety of strategies to generate returns. learn about how they work. which is a common entity structure of modern hedge funds. fees: hedge fund fees are commonly 1 2% of.

Comments are closed.