What Is Islamic Banking

What Is Islamic Bankings Its Benefits Maybank Singapore Islamic banking is a form of finance that follows shariah law and avoids interest and speculation. learn how it works, its history, and an example of a bank that practices it. Islamic banking, islamic finance (arabic: مصرفية إسلامية masrifiyya 'islamia), or sharia compliant finance[1] is banking or financing activity that complies with sharia (islamic law) and its practical application through the development of islamic economics. some of the modes of islamic finance include mudarabah (profit sharing and.

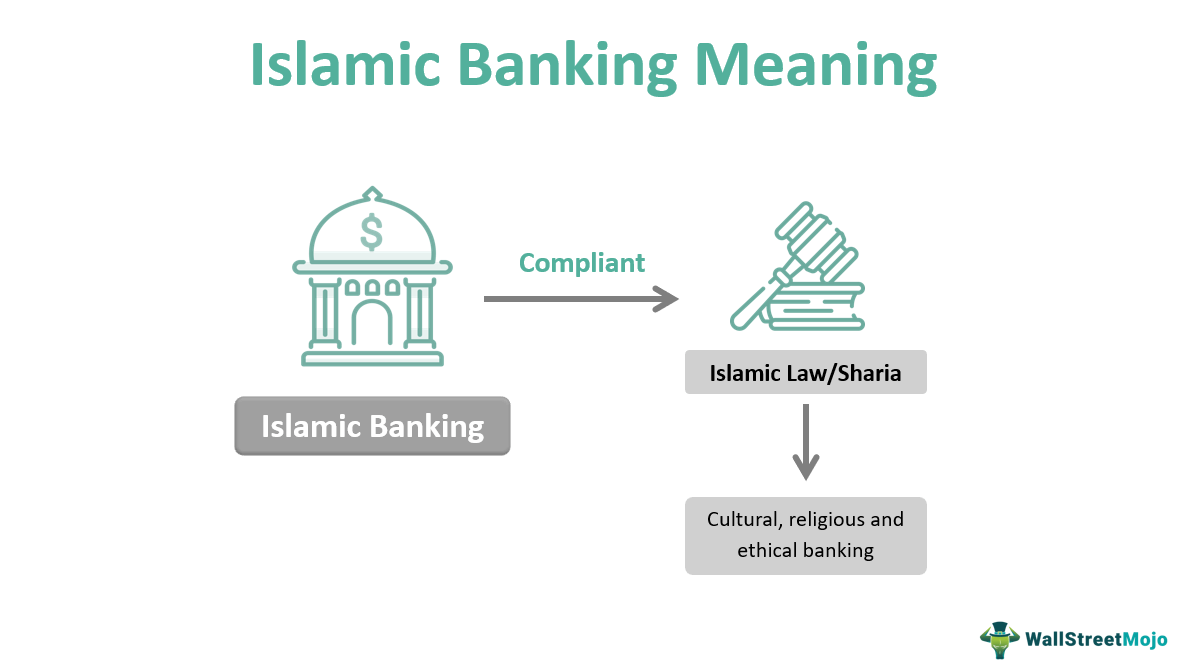

Islamic Banking What Is It Principles Types Examples Islamic banking or islamic finance is a form of sharia (islamic law) compliant finance. here, the banking and financial practices strictly adhere to islamic legal practices. it incorporates cultural and ethical components into finance. some practices like islamic banking loans, profit sharing, and investing significantly differ from. Islamic banking is a way of doing financial transactions and banking while respecting islamic law or sharia. it prohibits interest, speculation, and illicit activities, and focuses on risk sharing and social responsibility. learn more about the history, principles, and benefits of islamic finance in this web series. Learn the basics of islamic banking, a form of finance that adheres to shariah principles and avoids interest, riba, and gharar. discover the benefits, challenges, and examples of islamic transactions such as murabaha, mudaraba, and musharaka. As imtiaz a. pervez describes, the first modern islamic bank, mit ghamr savings bank, was established in egypt in 1963; other institutions across the muslim world soon followed. since then, islamic finance has grown into a global industry, encompassing insurance companies ( takaful ), banks , and investment funds , with assets predicted to.

What Is Islamic Banking And How Islamic Banks Work Learn the basics of islamic banking, a form of finance that adheres to shariah principles and avoids interest, riba, and gharar. discover the benefits, challenges, and examples of islamic transactions such as murabaha, mudaraba, and musharaka. As imtiaz a. pervez describes, the first modern islamic bank, mit ghamr savings bank, was established in egypt in 1963; other institutions across the muslim world soon followed. since then, islamic finance has grown into a global industry, encompassing insurance companies ( takaful ), banks , and investment funds , with assets predicted to. The term islamic finance is used to refer to financial activities conforming to islamic law (sharia). one of the main principles of the islamic finance system is the prohibition of the payment and the receipt of riba (interest) in a financial transaction. Islamic finance is a method of financing and banking operations that abides by sharia law. with the help of bank of london and middle east we outline the rules that all sharia compliant financial.

Islamic Banking Mansoor Danish The term islamic finance is used to refer to financial activities conforming to islamic law (sharia). one of the main principles of the islamic finance system is the prohibition of the payment and the receipt of riba (interest) in a financial transaction. Islamic finance is a method of financing and banking operations that abides by sharia law. with the help of bank of london and middle east we outline the rules that all sharia compliant financial.

Comments are closed.