What Is Macd Indicator Meaning Formula Examples Finschool

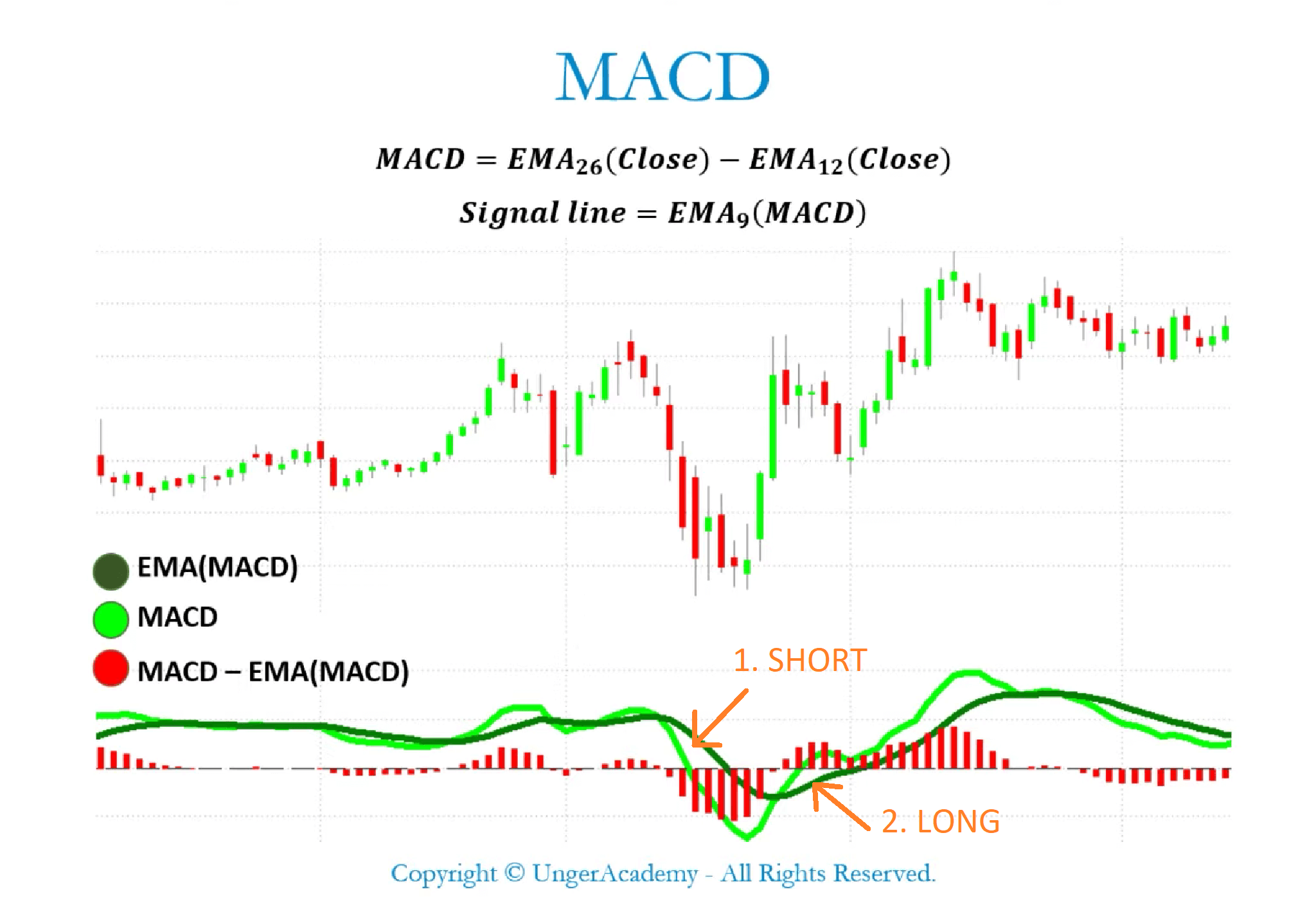

What Is Macd Indicator Meaning Formula Examples Finschool Macd stands for moving average convergence and divergence. as the name implies, the two moving averages’ convergence and divergence make up the majority of the macd. convergence occurs when two moving averages move in opposition to one another, and divergence occurs when they move apart. a typical macd is produced using a 12 day ema and a 26. Macd indicator explained. the macd indicator consists of three components: the macd line: the main macd line is generated by subtracting the longer moving average (26 period) from the shorter one (12 period). the macd line helps determine upward or downward momentum, i.e., market trend; the signal line: the signal line is the ema (typically 9.

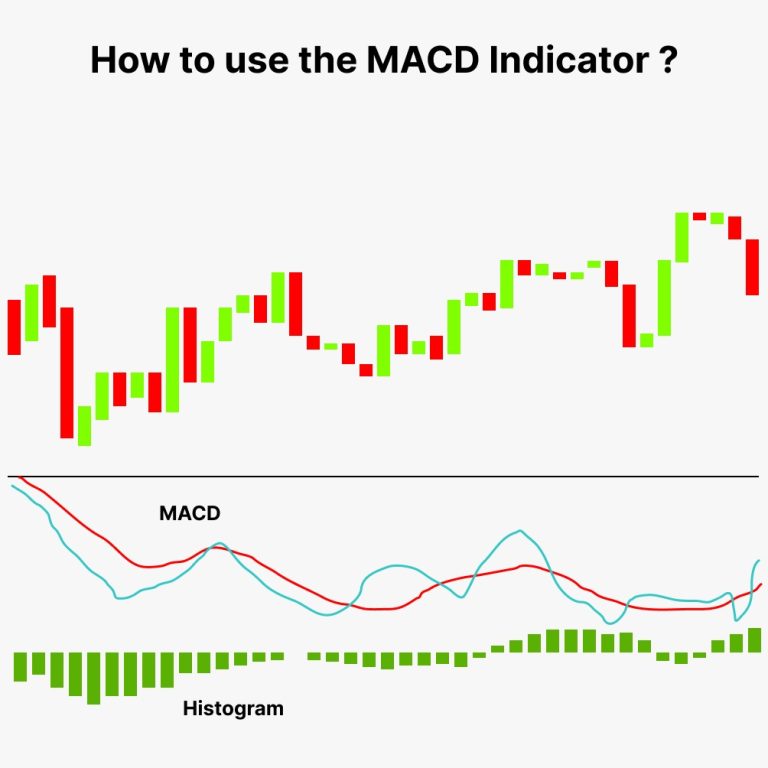

What Is Macd Indicator Meaning Formula Examples Finschool The macd indicator, also known as the macd oscillator, is one of the most popular technical analysis tools. there are three main components of the macd shown in the picture below: macd: the 12 period exponential moving average (ema) minus the 26 period ema. macd signal line: a 9 period ema of the macd. macd histogram: the macd minus the macd. Price rate of change (roc) indicator: definition and formula the price rate of change (roc) is a technical indicator that measures the percent change between the most recent price and a price in. The moving average convergence divergence (macd) is a popular technical momentum indicator, calculated for use with a variety of exponential moving averages (emas) and used to assess the power of. The macd was designed to profit from this divergence by analyzing the difference between the two exponential moving averages (emas). specifically, the value for the long term moving average is.

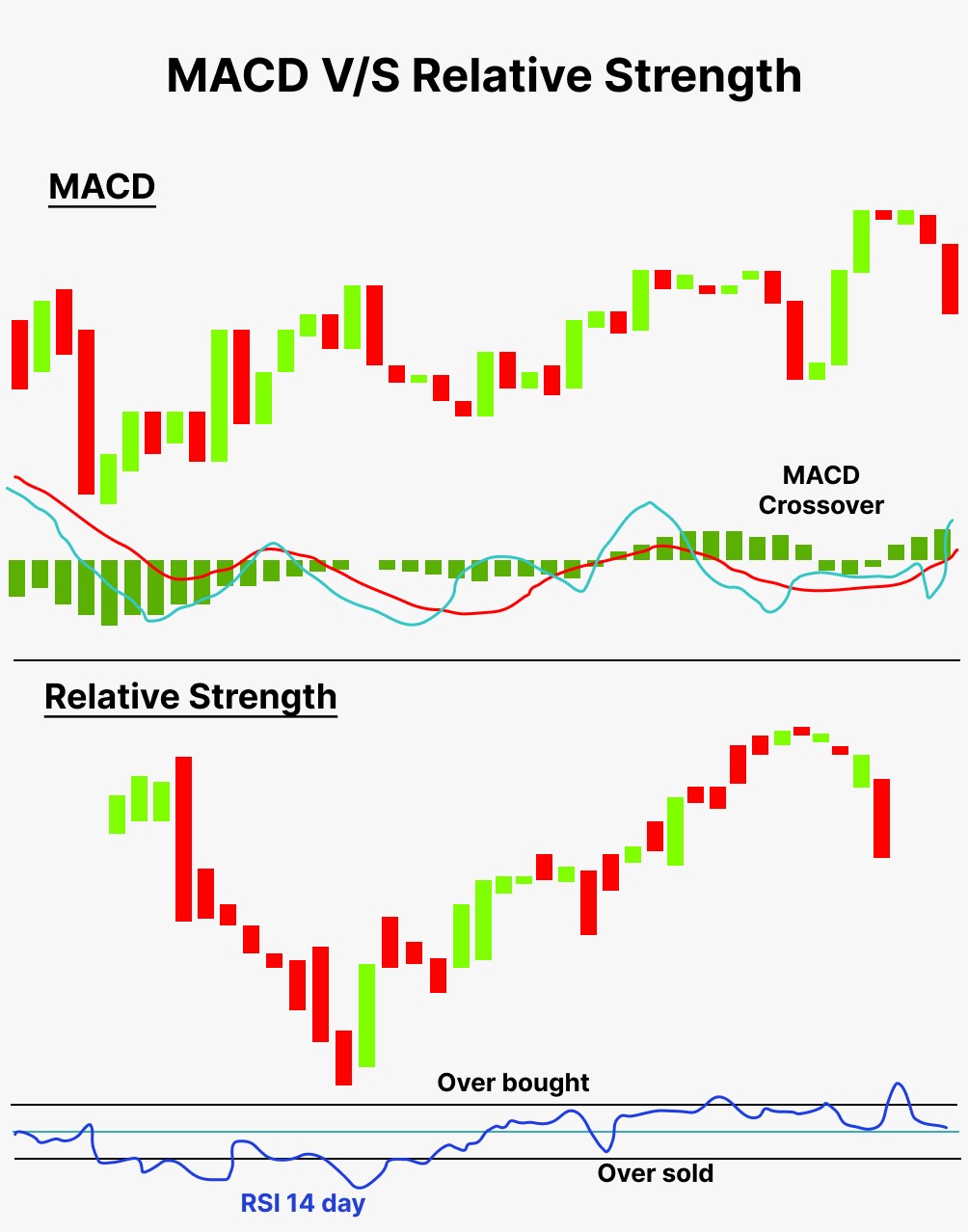

What The Macd Indicator Is And How It Works The moving average convergence divergence (macd) is a popular technical momentum indicator, calculated for use with a variety of exponential moving averages (emas) and used to assess the power of. The macd was designed to profit from this divergence by analyzing the difference between the two exponential moving averages (emas). specifically, the value for the long term moving average is. The macd line is the difference (or distance) between two moving averages. these two moving averages are usually exponential moving averages (emas). when looking at the indicator, the macd line is considered the “faster” moving average. in our example above, the macd line is the difference between the 12 and 26 period moving averages. When combined with macd crossover and divergence, macd is a valuable trend and momentum indicator that offers obvious buy and sell signals. for more clarity, this indicator can also be used with.

Intraday Trading Guide Macd Indicator Meaning And Calculation Formula The macd line is the difference (or distance) between two moving averages. these two moving averages are usually exponential moving averages (emas). when looking at the indicator, the macd line is considered the “faster” moving average. in our example above, the macd line is the difference between the 12 and 26 period moving averages. When combined with macd crossover and divergence, macd is a valuable trend and momentum indicator that offers obvious buy and sell signals. for more clarity, this indicator can also be used with.

Trading With The Macd Indicator Moving Average Convergence Divergence

Comments are closed.