What Is Macd Moving Average Convergence Divergence Britannica Money

What Is Macd Moving Average Convergence Divergence Britannica Money Moving average convergence divergence (macd) is a momentum indicator that shows the relationship between two moving averages of a security’s price. Say its 26 day exponential moving average is 400 and the 12 day exponential moving average is 395; you would have a macd of 5. a few days later, the 12 day ema is higher than the 26 day one.

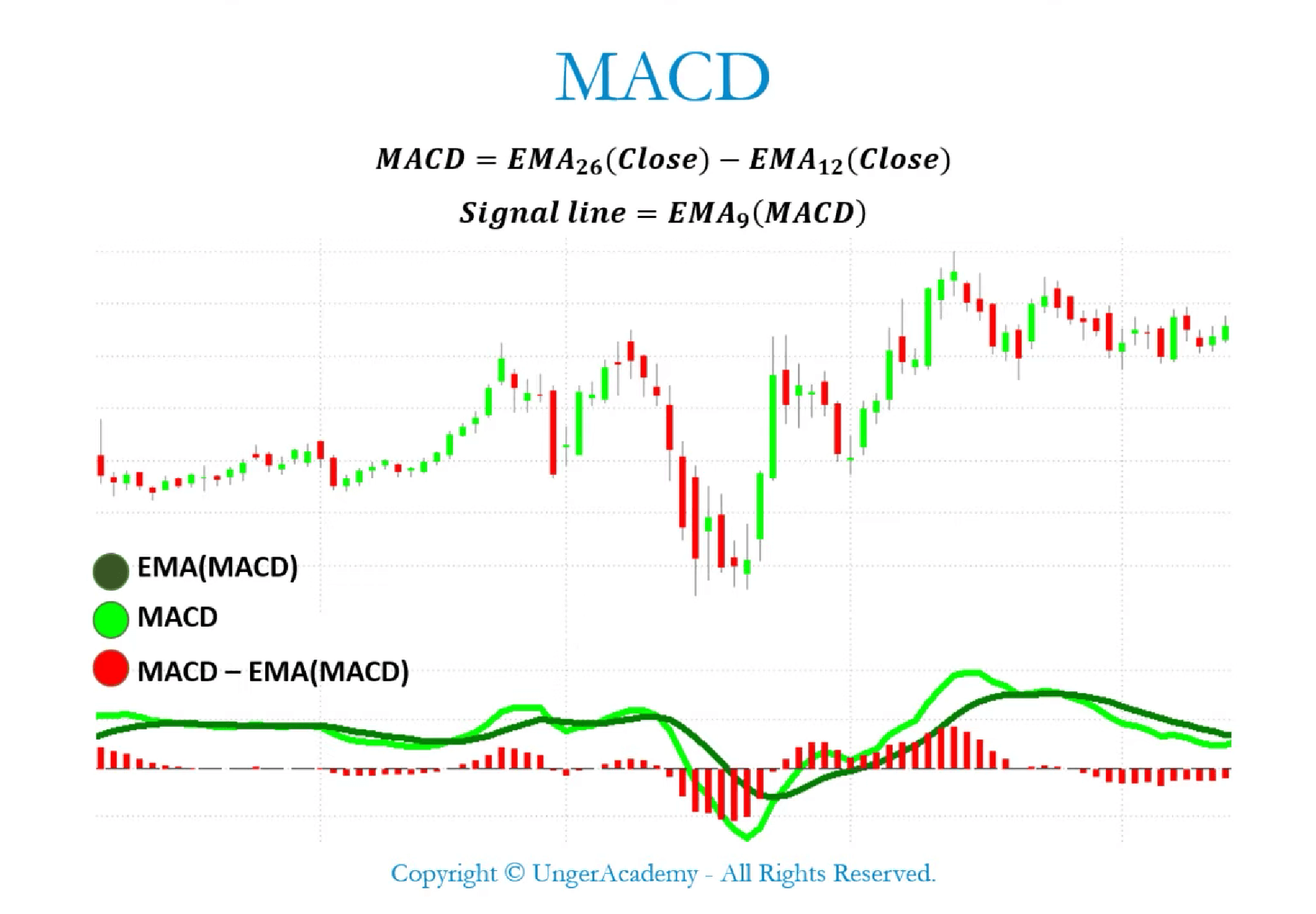

What Is Macd Moving Average Convergence Divergence Britannica Money Macd can either be positive or negative. macd value is positive when the 12 day ema (blue line) is above the 26 day ema. it is important to know that when the stock price is rising, the short term. The moving average convergence divergence is a technical analysis tool used in stock trading created by gerald appel in the late 1970s. the macd is both a trend and momentum indicator oscillator that shows the relationship between two moving averages (ma) of an asset’s price. The macd indicator, also known as the macd oscillator, is one of the most popular technical analysis tools. there are three main components of the macd shown in the picture below: macd: the 12 period exponential moving average (ema) minus the 26 period ema. macd signal line: a 9 period ema of the macd. macd histogram: the macd minus the macd. The moving average convergence divergence triggers technical signals when the macd line crosses above the signal line (to buy) or falls below it (to sell). (macd) moving average convergence divergence is calculated by subtracting the 26 period exponential moving average (ema) from the 12 period ema.

Trading With The Macd Indicator Moving Average Convergence Divergence The macd indicator, also known as the macd oscillator, is one of the most popular technical analysis tools. there are three main components of the macd shown in the picture below: macd: the 12 period exponential moving average (ema) minus the 26 period ema. macd signal line: a 9 period ema of the macd. macd histogram: the macd minus the macd. The moving average convergence divergence triggers technical signals when the macd line crosses above the signal line (to buy) or falls below it (to sell). (macd) moving average convergence divergence is calculated by subtracting the 26 period exponential moving average (ema) from the 12 period ema. What macd says now. the moving average convergence divergence indicator, commonly known as macd, is a technical indicator consisting of 2 lines—the macd line and the signal line—as well as a bar chart. 1 it is used to generate buy and sell signals with readings that suggest something is overbought (i.e., potentially expensive) or oversold (i.e., potentially cheap). The moving average convergence divergence is a robust and versatile trend following momentum indicator in technical analysis that reveals changes in the strength, direction, momentum, and duration of a trend in a stock's price. developed by gerald appel in the late 1970s, macd is calculated by subtracting the 26 period exponential moving.

What Is Macd Moving Average Convergence Divergence Britannica Money What macd says now. the moving average convergence divergence indicator, commonly known as macd, is a technical indicator consisting of 2 lines—the macd line and the signal line—as well as a bar chart. 1 it is used to generate buy and sell signals with readings that suggest something is overbought (i.e., potentially expensive) or oversold (i.e., potentially cheap). The moving average convergence divergence is a robust and versatile trend following momentum indicator in technical analysis that reveals changes in the strength, direction, momentum, and duration of a trend in a stock's price. developed by gerald appel in the late 1970s, macd is calculated by subtracting the 26 period exponential moving.

:max_bytes(150000):strip_icc()/dotdash_Final_Moving_Average_Convergence_Divergence_MACD_Aug_2020-07-02bed1449d1b43ffaa45eb9c848e6b37.jpg)

Moving Average Convergence Divergence Macd Definition

Comments are closed.