What Is Margin Requirement

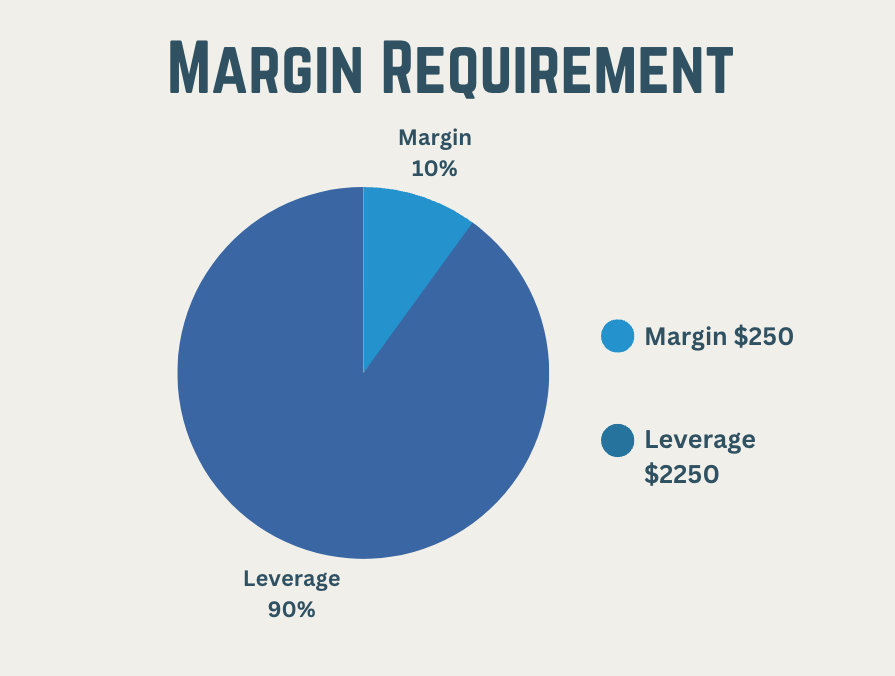

What Is Margin Requirement Margin is the collateral that an investor deposits with a broker to cover the credit risk of buying or selling financial instruments. margin trading is the practice of using borrowed funds from a broker to trade securities, which can amplify both gains and losses. Margin requirements. to begin margin borrowing against securities in a schwab brokerage account, you need at least $2,000 in cash or marginable securities. 1. the amount you can borrow on margin is typically limited to 50% of the value of marginable securities in your account. once you borrow on margin, you are required to maintain a certain.

What Is Margin Babypips The required margin after opening the position is known as the "maintenance margin" level. if the account's available funds fall below the maintenance level, the account would be in a margin call, and you'd be required to add more funds immediately. Learn how to trade on margin and meet the initial and house margin requirements set by regulators and brokers. find out how margin accounts work, what risks are involved, and how to avoid margin calls. Margin is a loan that allows you to buy more securities with your existing ones. learn how margin works, what are the rules and regulations, and what are the potential losses and benefits of margin trading. Learn the difference between initial margin and maintenance margin, and how they affect your stock trading strategy. initial margin is the percentage of the purchase price you need to cover with your own money, while maintenance margin is the minimum equity you need to keep in your margin account.

Margin Requirements Initial Maintenance Margin Requirements Margin is a loan that allows you to buy more securities with your existing ones. learn how margin works, what are the rules and regulations, and what are the potential losses and benefits of margin trading. Learn the difference between initial margin and maintenance margin, and how they affect your stock trading strategy. initial margin is the percentage of the purchase price you need to cover with your own money, while maintenance margin is the minimum equity you need to keep in your margin account. Initial margin is the percentage of the purchase price of a security that must be covered by cash or collateral when using a margin account. learn how initial margin works, how it differs from maintenance margin, and how it applies to futures contracts. A margin requirement is the percentage of marginable securities that an investor must pay for with his her own cash. it can be further broken down into initial margin requirement and maintenance margin requirement. according to regulation t of the federal reserve board, the initial margin requirement for stocks is 50%, and the maintenance.

What Is The Margin Requirement For Options Option Nifty Span Margin Initial margin is the percentage of the purchase price of a security that must be covered by cash or collateral when using a margin account. learn how initial margin works, how it differs from maintenance margin, and how it applies to futures contracts. A margin requirement is the percentage of marginable securities that an investor must pay for with his her own cash. it can be further broken down into initial margin requirement and maintenance margin requirement. according to regulation t of the federal reserve board, the initial margin requirement for stocks is 50%, and the maintenance.

Comments are closed.