What Is Medigap Medicare Supplement Insurance Explained

What Is Medicare Supplement Medigap Coverage Costs Eligibility Medicare supplement insurance (medigap) is extra insurance you can buy from a private health insurance company to help pay your share of out of pocket costs in. original medicare. a fee for service health insurance program that has 2 parts: part a and part b. you typically pay a portion of the costs for covered services as you get them. Medigap, also known as medicare supplement insurance, is an insurance policy that supplements original medicare. it’s designed to cover some or all of the out of pocket costs that a beneficiary would otherwise have to pay for services covered by original medicare. original medicare does not have a cap on out of pocket costs, and most people.

Medicare And Medicare Supplement Insurance Medigap Explained Senior Medicare supplement plans work alongside your original medicare coverage to help cover some of the costs you would otherwise have to pay on your own. these plans, also known as "medigap", are standardized plans. each plan has a letter assigned to it, and offers the same basic benefits. the basic benefit structure for each plan is the same, no. Medigap is medicare supplemental insurance sold by private companies to help cover original medicare costs, such as deductibles, copayments, and coinsurance. in some cases, medigap will also cover. Medicare advantage is a type of private insurance that provides additional coverage to medicare part a and part b, including vision, hearing and dental coverage. most medicare advantage plans. Medigap (medicare supplement health insurance) a medigap policy is health insurance sold by private insurance companies to fill the “gaps” in original medicare plan coverage. medigap policies help pay some of the health care costs that the original medicare plan doesn't cover. if you are in the original medicare plan and have a medigap.

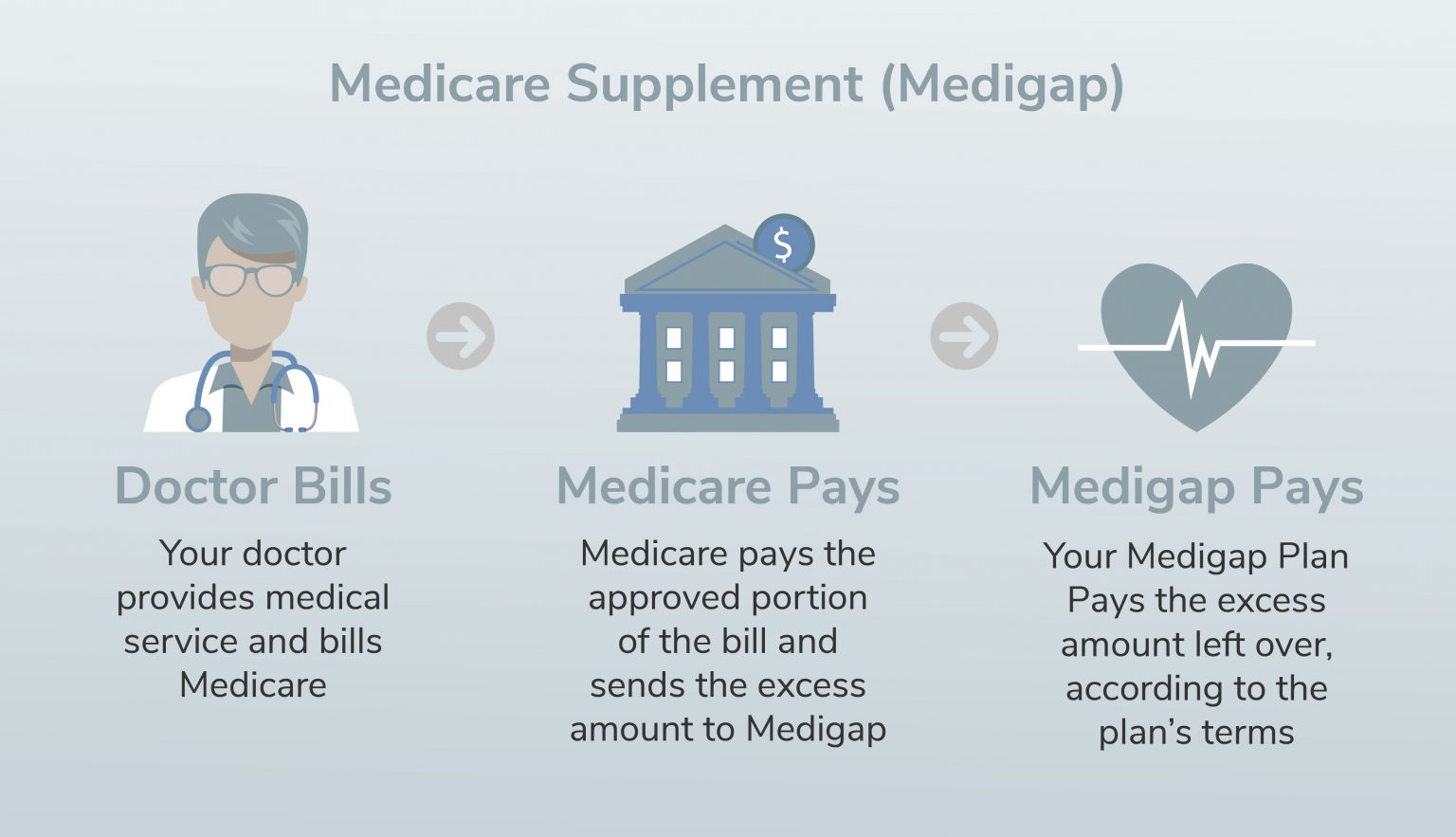

Medicare Supplement Insurance Medigap Medicare advantage is a type of private insurance that provides additional coverage to medicare part a and part b, including vision, hearing and dental coverage. most medicare advantage plans. Medigap (medicare supplement health insurance) a medigap policy is health insurance sold by private insurance companies to fill the “gaps” in original medicare plan coverage. medigap policies help pay some of the health care costs that the original medicare plan doesn't cover. if you are in the original medicare plan and have a medigap. Covers certain doctors’ services, outpatient care, medical supplies, and preventive services. before you can buy a medigap policy. you get a 6 month “medigap open enrollment” period, which starts the first month you have medicare part b and you’re 65 or older. during this time, you can enroll in any medigap policy and the insurance. If you have a medigap policy and get care, medicare will pay its share of the medicare approved amount for covered health care costs. in most medigap policies, you agree to have the medigap insurance company get your part b claim information directly from medicare. then, your medigap policy will pay your doctor whatever amount you owe under.

What Is Medicare Supplement Medigap Senior Healthcare Team Insurance Covers certain doctors’ services, outpatient care, medical supplies, and preventive services. before you can buy a medigap policy. you get a 6 month “medigap open enrollment” period, which starts the first month you have medicare part b and you’re 65 or older. during this time, you can enroll in any medigap policy and the insurance. If you have a medigap policy and get care, medicare will pay its share of the medicare approved amount for covered health care costs. in most medigap policies, you agree to have the medigap insurance company get your part b claim information directly from medicare. then, your medigap policy will pay your doctor whatever amount you owe under.

Comments are closed.