What Not To Do After You Apply For A Mortgage Mortgage Mistakes To Avoid

Things To Avoid After Applying For A Mortgage Infographic If you’re ready to shop for a new home, a mortgage preapproval letter shows sellers that you’re a serious buyer who can secure financing from a lender. it also gives you a clear idea of how. 5. not having enough saved for a down payment. first, the good news: you don't need to make a 20% down payment to buy a home. in fact, most people don’t. the average down payment on a house.

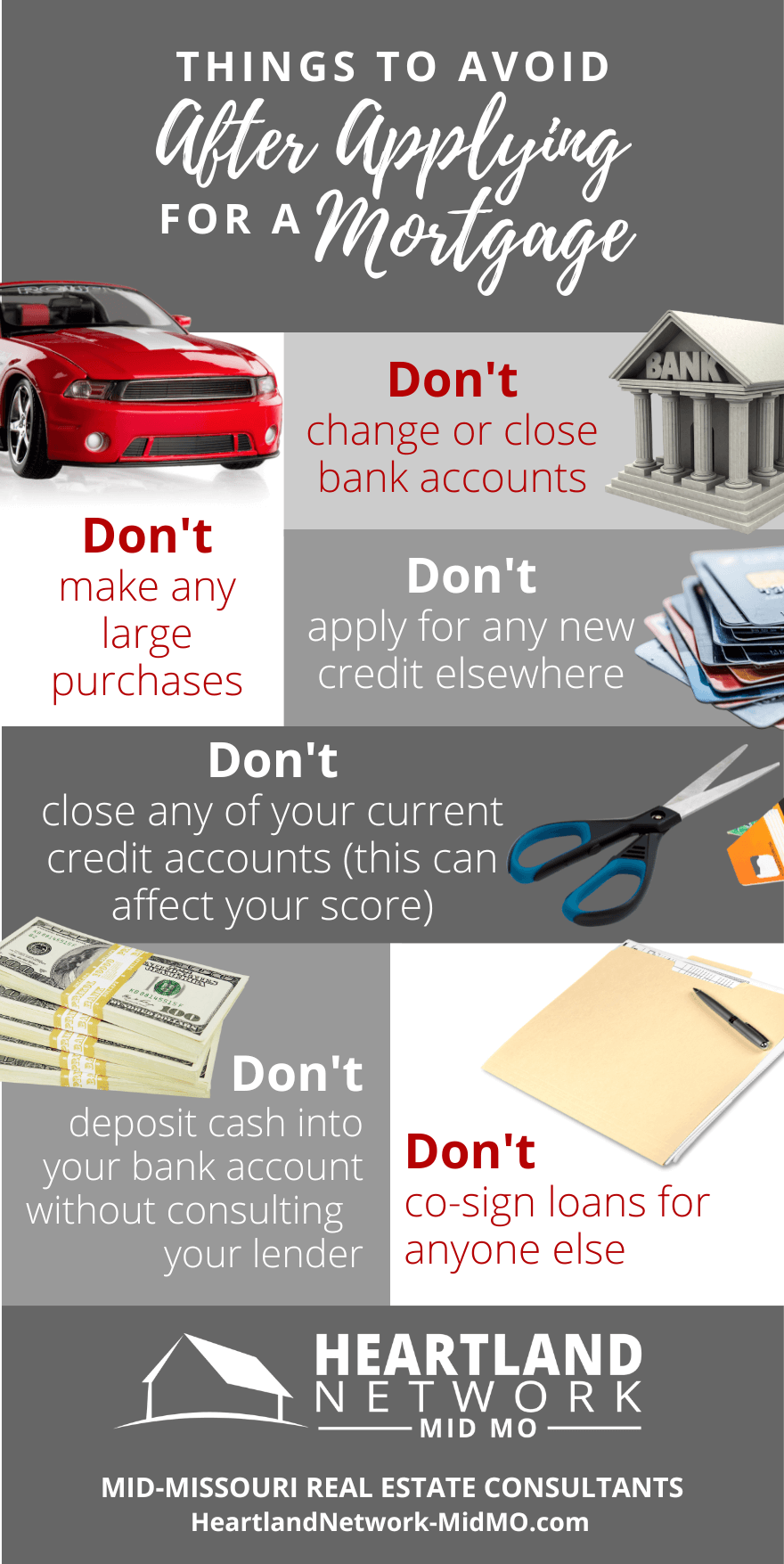

Things To Avoid Do After Applying For A Mortgage Infographic Here are nine mistake to avoid after you have been preapproved: no. 1: applying for new credit. mortgage lenders are required to do a second credit check before a final loan approval, says doug benner, a loan officer with 1 st portfolio lending in rockville, maryland. 5. complete a full mortgage application. after selecting a lender, the next step is to complete a full mortgage loan application. most of this application process was completed during the pre. 7. don’t think you make the rules. the mortgage application process isn’t easy. it comes with (seemingly) never ending amounts of paperwork and can feel like you’re working a second job. but homebuyers must follow directions exactly to make sure the process isn’t delayed. 1. fill out a mortgage application. if you’ve already gone through the preapproval process, you’ll use similar documentation to fill out an application. like with preapproval, applying with.

What Not To Do After You Apply For A Mortgage Mortgage Mistakes To 7. don’t think you make the rules. the mortgage application process isn’t easy. it comes with (seemingly) never ending amounts of paperwork and can feel like you’re working a second job. but homebuyers must follow directions exactly to make sure the process isn’t delayed. 1. fill out a mortgage application. if you’ve already gone through the preapproval process, you’ll use similar documentation to fill out an application. like with preapproval, applying with. Some of the top things to avoid after applying for a mortgage include: 1. don’t deposit large sums of cash into your bank account. lenders need to source your money, and cash is often difficult to trace. before making any large deposits, it’s wise to ask your loan officer how to properly document that money. 2. Closing on a mortgage is time sensitive. even if you’ve locked in your rate, that only guarantees things for so long. it’s important to keep on top of the schedule and make sure to submit all.

What Not To Do After Applying For A Mortgage Some of the top things to avoid after applying for a mortgage include: 1. don’t deposit large sums of cash into your bank account. lenders need to source your money, and cash is often difficult to trace. before making any large deposits, it’s wise to ask your loan officer how to properly document that money. 2. Closing on a mortgage is time sensitive. even if you’ve locked in your rate, that only guarantees things for so long. it’s important to keep on top of the schedule and make sure to submit all.

Things To Avoid Do After Applying For A Mortgage Infographic

Things To Avoid After Applying For A Mortgage Infographic

Comments are closed.