What Not To Tell Your Lender When Applying For A Mortgage Loan

What Not To Tell Your Lender When Applying For A Mortgage Loan Youtube 1) anything untruthful. lying to a mortgage lender can ruin your chances of approval. on top of that, providing misleading info on a loan application is considered mortgage fraud. some try to hide. Fha loans require lenders to manually re approve mortgage borrowers with nsfs, even if a computerized system has already approved them. 2. large, undocumented deposits. outsized or irregular bank.

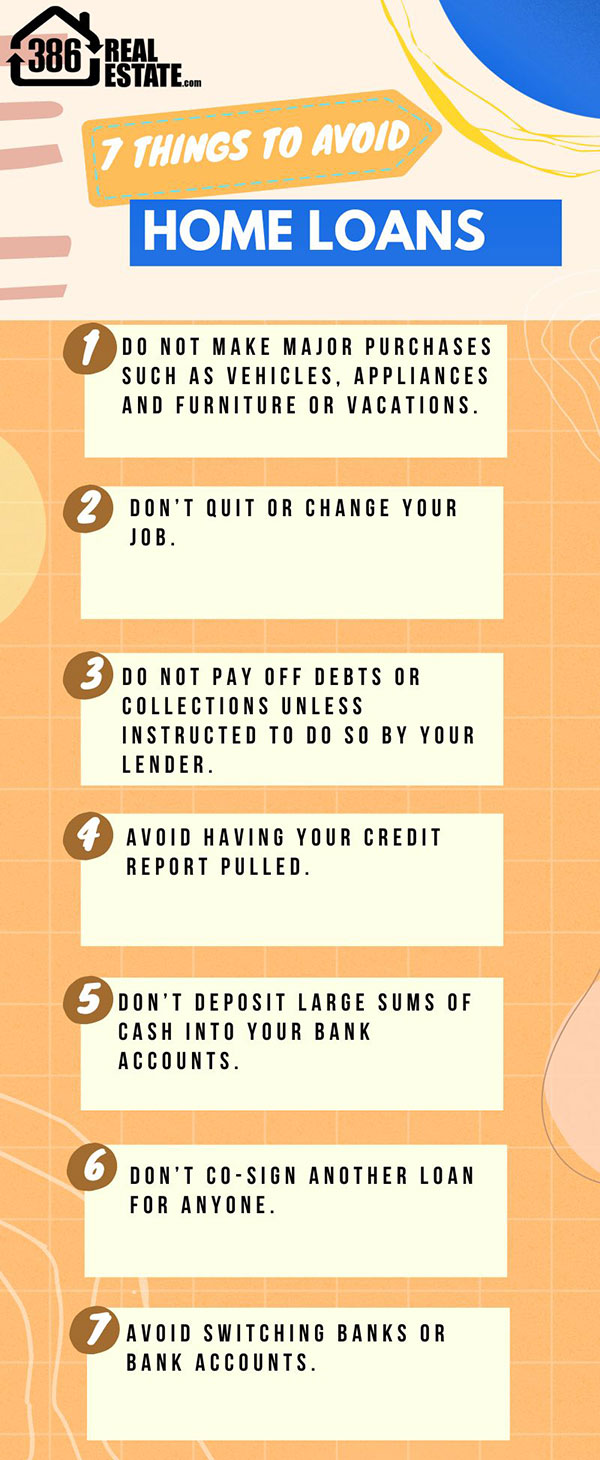

Top 7 Things To Avoid When Applying For A Home Loan Check your inbox for more details. 3. “i can’t believe i forgot to pay my electric bill again.”. consistency is the key to managing a large debt like a mortgage loan. if you mention that certain bills slip your mind from time to time, it won’t inspire confidence in your lender. If you’re ready to shop for a new home, a mortgage preapproval letter shows sellers that you’re a serious buyer who can secure financing from a lender. it also gives you a clear idea of how. 5. complete a full mortgage application. after selecting a lender, the next step is to complete a full mortgage loan application. most of this application process was completed during the pre. In our example of receiving a 6% payment rate, you’re looking for the lowest apr based on that payment rate. maybe one lender offers you a 6.25% apr, and another a 6.5% apr. the 6.25% apr lender.

Applying For A Mortgage Here S What You Should Avoid Once You Do 5. complete a full mortgage application. after selecting a lender, the next step is to complete a full mortgage loan application. most of this application process was completed during the pre. In our example of receiving a 6% payment rate, you’re looking for the lowest apr based on that payment rate. maybe one lender offers you a 6.25% apr, and another a 6.5% apr. the 6.25% apr lender. When you submit a mortgage loan application, you certify that nothing about your credit has changed. so if anyone pulls your credit after signing this certification, your lender will be alerted. If your eligibility in the program does not change and your mortgage loan does not close, you will receive $1,000. this offer does not apply to new purchase loans submitted to rocket mortgage through a mortgage broker. this offer is not valid on jumbo loans or for self employed clients.

Comments are closed.