What To Consider When Choosing A Medicare Supplement Medigap Plan

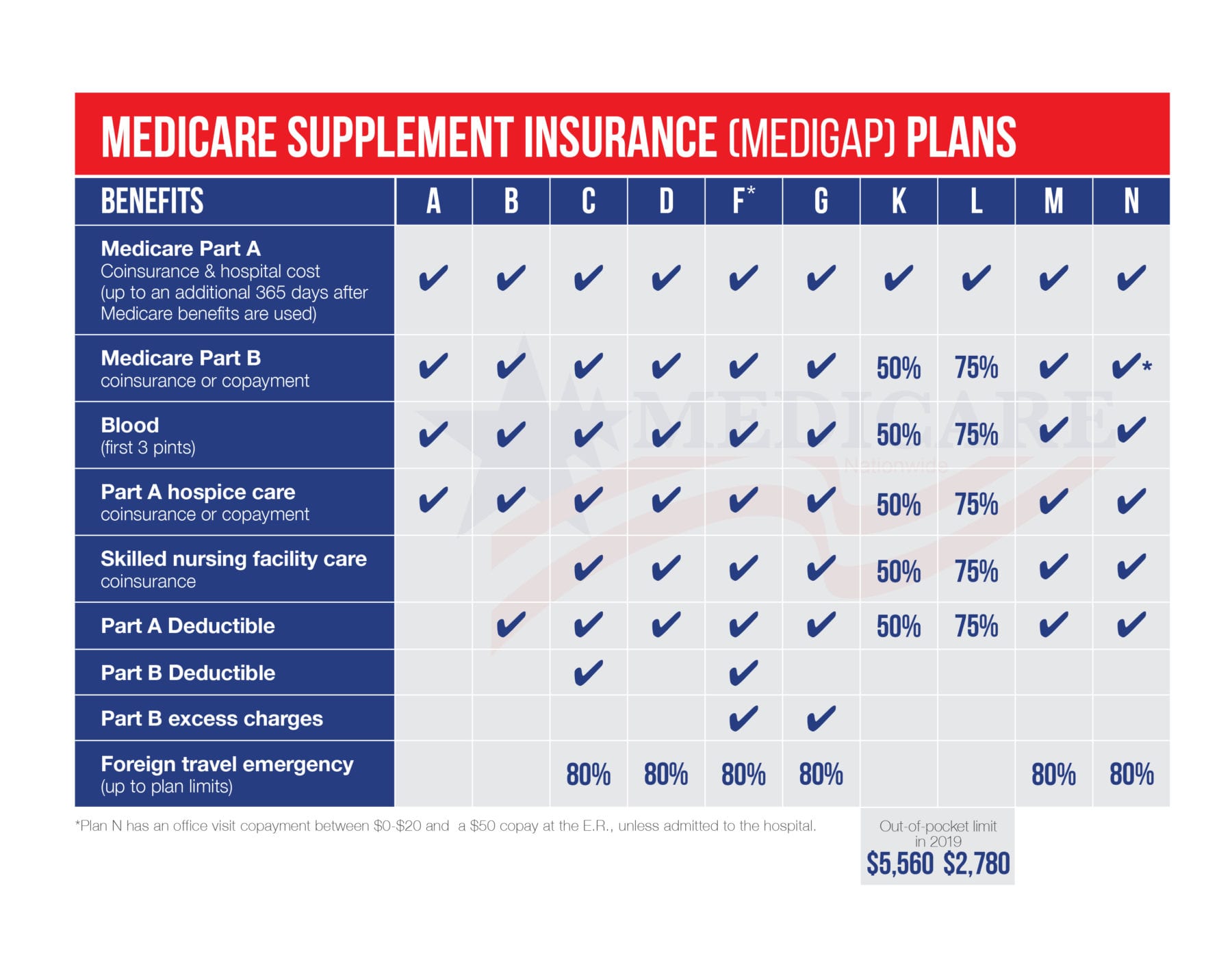

Guide To Choosing A Medicare Supplement Medigap Policy Blue cross blue shield is one of the largest insurance companies offering medigap plans in every state. the company offers a range of plans, including a, c*, d, f*, g, n, and high deductible plans. Medigap plan f is offered by private companies and provides the most comprehensive coverage of the medigap plans. it covers 100% of: part a coinsurance and hospital costs. part b copays and.

What To Consider When Choosing A Medicare Supplement Medigap Plan While the medicare.gov comparison chart gives you an overall view of benefits, it may be a good idea to request information on the full policy and take a look and ask any questions before. If you buy plans f or g with a “high‐deductible option,” you must pay the first $2,800 (in 2024) of deductibles, copayments, and coinsurance for covered services not paid by medicare before the medigap policy pays anything. you also pay a separate deductible ($250 per year) for foreign travel emergency care. The best time to purchase a medigap plan is during your medigap open enrollment period, which starts the first month you are 65 or older and have medicare part b coverage. as you select from the available plans, consider your financial status and health needs, such as if you would benefit from coverage for skilled nursing care or emergency. Medicare supplement plans: key facts. cost premiums range from under $50 to well over $200 per month. varies by company, plan type, age, location and or health. coverage copays, coinsurance and or.

Compare Medicare Supplement Plans In Your Area The best time to purchase a medigap plan is during your medigap open enrollment period, which starts the first month you are 65 or older and have medicare part b coverage. as you select from the available plans, consider your financial status and health needs, such as if you would benefit from coverage for skilled nursing care or emergency. Medicare supplement plans: key facts. cost premiums range from under $50 to well over $200 per month. varies by company, plan type, age, location and or health. coverage copays, coinsurance and or. The information in this guide describes the medicare program at the time this guide was printed. changes may occur after printing. visit medicare.gov, or call 1 800 633 ‐ 4227 to get the most current information. tty users can call 1 877 486 ‐ 2048. the “2021 guide to choosing a medigap policy” isn’t a legal document. A medigap policy is health insurance sold by private insurance companies to fill the “gaps” in original medicare plan coverage. medigap policies help pay some of the health care costs that the original medicare plan doesn't cover. if you are in the original medicare plan and have a medigap policy, then medicare and your medigap policy will.

Best Medicare Supplement Plans Medicare Nationwide The information in this guide describes the medicare program at the time this guide was printed. changes may occur after printing. visit medicare.gov, or call 1 800 633 ‐ 4227 to get the most current information. tty users can call 1 877 486 ‐ 2048. the “2021 guide to choosing a medigap policy” isn’t a legal document. A medigap policy is health insurance sold by private insurance companies to fill the “gaps” in original medicare plan coverage. medigap policies help pay some of the health care costs that the original medicare plan doesn't cover. if you are in the original medicare plan and have a medigap policy, then medicare and your medigap policy will.

Comments are closed.