What To Expect From Digital Banking In 2023 Jpmorgan Chase Co

What To Expect From Digital Banking In 2023 Jpmorgan Chase Co Three trends you can expect to see in digital banking this year with chase's head of digital products and channels, sonali divilek.subscribe: jpm. Digital banking was more popular than ever in 2021, and we expect that small business owners and consumers’ digital engagement with banks will continue to accelerate in 2022 because of four key trends. 1. technology that puts consumers & small business owners in control. more than ever, our customers are empowered to track their money habits.

Digital Banking In 2023 What To Expect Exist Software Labs Indeed, jpmorgan chase said it will spend $15.3 billion on technology investments in 2023. jpmorgan chase's technology budget has grown at a 7% compound annual growth rate over the last four years. feinsmith said the bank's ai ml strategy is one of the big reasons jpmorgan chase migrated to the public cloud. In the united states, bank deposit accounts and related services, such as checking, savings and bank lending, are offered by jpmorgan chase bank, n.a. member fdic. j.p. morgan wealth management is a business of jpmorgan chase & co., which offers investment products and services through j.p. morgan securities llc (jpms) , a registered broker. New york, feb. 13, 2024 —a new survey from chase found 62% of consumers said they can’t live without their mobile banking app, and 78% are using it weekly. banking app users are doing more than just transacting and the majority would prefer one app to manage all their money needs. the survey also found increased interest in financial health. Moneylion's revenue increased 34% to $93.7 million in q1 2023 from $70 million in q1 2022. tearsheet spoke with moneylion's dee choubey about the increased revenue for the quarter, the advancing role of ai in banking, and how the banking crisis is affecting fintechs. sara khairi | may 18, 2023.

Digital Banking In 2023 What To Expect Exist Software Labs New york, feb. 13, 2024 —a new survey from chase found 62% of consumers said they can’t live without their mobile banking app, and 78% are using it weekly. banking app users are doing more than just transacting and the majority would prefer one app to manage all their money needs. the survey also found increased interest in financial health. Moneylion's revenue increased 34% to $93.7 million in q1 2023 from $70 million in q1 2022. tearsheet spoke with moneylion's dee choubey about the increased revenue for the quarter, the advancing role of ai in banking, and how the banking crisis is affecting fintechs. sara khairi | may 18, 2023. In the united states, bank deposit accounts and related services, such as checking, savings and bank lending, are offered by jpmorgan chase bank, n.a. member fdic. jpmorgan chase bank, n.a. and its affiliates (collectively “jpmcb”) offer investment products, which may include bank managed investment accounts and custody, as part of its. Impact. while jpmorgan chase stock is . owned by large institutions, pension plans, mutual funds and directly by single investors, in almost all cases the ultimate beneficiaries are individuals in our com munities. more than 100 million people in the united states own stocks; many, in one way or another, own jpmorgan chase stock.

Jpmorgan Chase Digital Transformation Ai And Data Strategy Sets Up In the united states, bank deposit accounts and related services, such as checking, savings and bank lending, are offered by jpmorgan chase bank, n.a. member fdic. jpmorgan chase bank, n.a. and its affiliates (collectively “jpmcb”) offer investment products, which may include bank managed investment accounts and custody, as part of its. Impact. while jpmorgan chase stock is . owned by large institutions, pension plans, mutual funds and directly by single investors, in almost all cases the ultimate beneficiaries are individuals in our com munities. more than 100 million people in the united states own stocks; many, in one way or another, own jpmorgan chase stock.

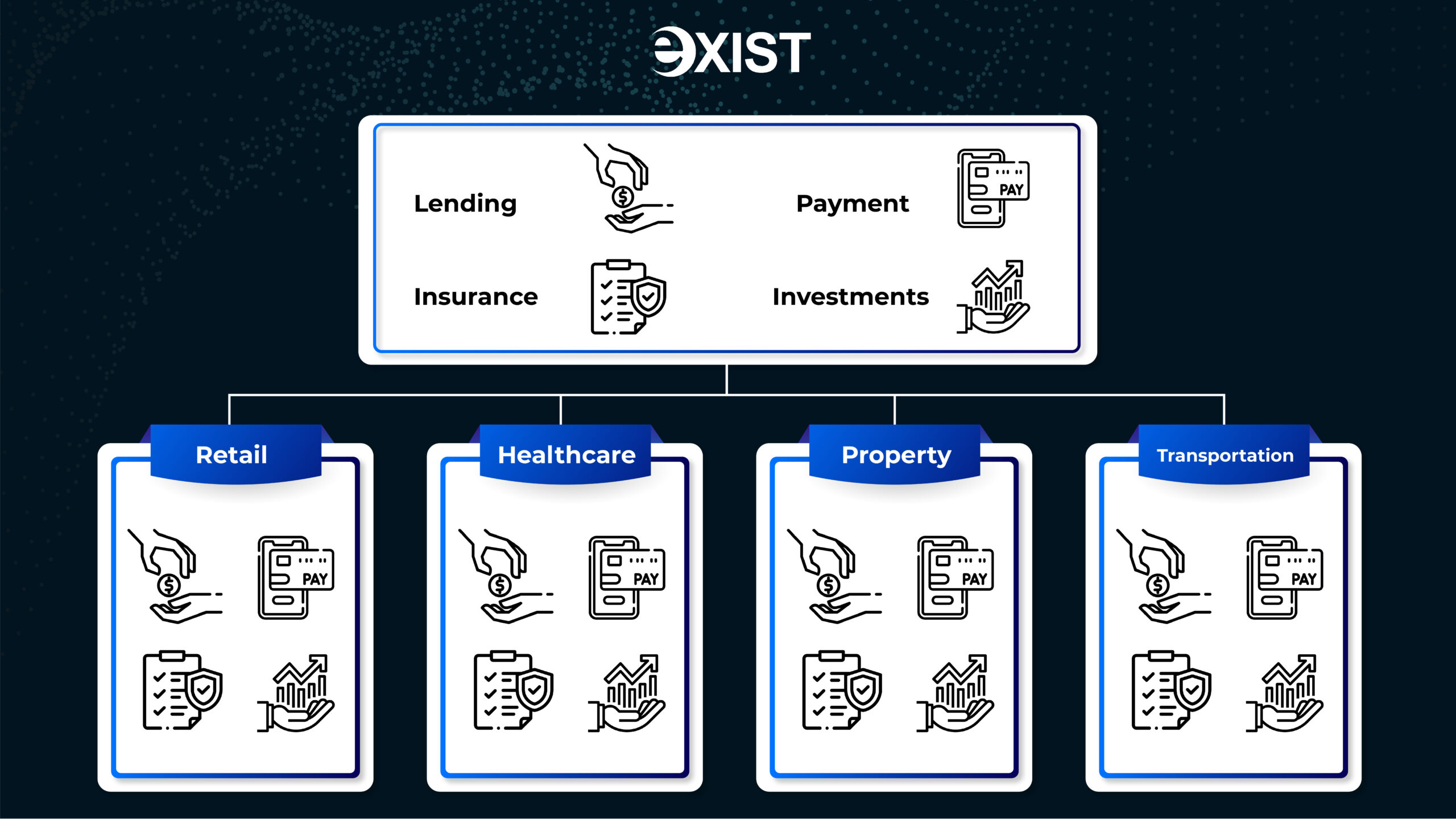

Digital Banking In 2023 Industry Trends For The Year Ahead

Banking On Digital Transformation How Jpmorgan Chase Co Is Winning

Comments are closed.