When Should You Refinance Your Mortgage

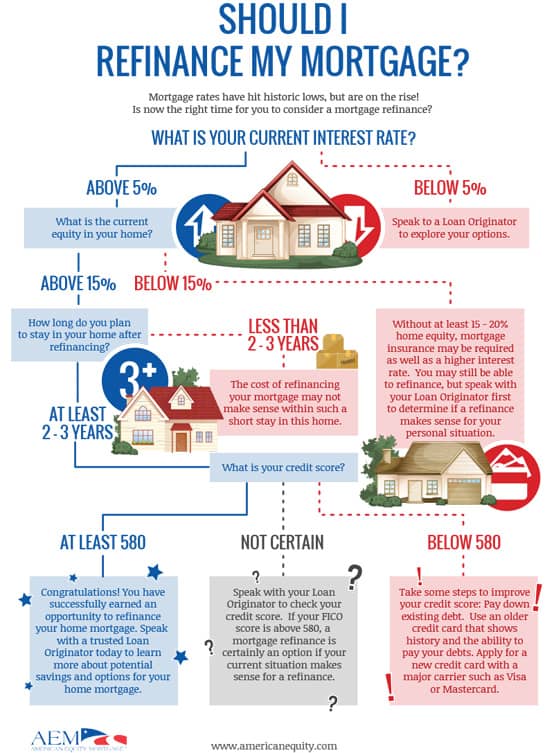

5 Ways To Know When To Refinance Your House Learn the pros and cons of refinancing your mortgage, how to calculate the break even point and the common reasons to refinance. find out how to get a lower interest rate, access your home equity or get rid of mortgage insurance. Learn how to decide if refinancing is right for you based on interest rates, closing costs, loan term and other factors. compare different scenarios and use a refinance calculator to estimate your savings.

The Best Way To Refinance A Mortgage 6 Tips To Save Money Application fee: $75 to $500. origination fee: 0.5% to 1.5% of your loan amount. credit check fee: about $25. title services: $400 to $900. depending on your lender, you might have the option of a. How soon you can refinance a mortgage varies by the loan type. some lenders require you to wait at least six months to refinance a conventional loan, particularly if they were the ones who. Learn what a mortgage refinance is and when to consider it. find out how to lower your interest rate, change your loan terms, take out cash, or make home improvements with a refi. Typically, they cost 2% to 6% of your outstanding principal balance. for example: if you still owe $200,000 on your home, expect to pay $4,000 to $12,000 in refinance fees. costs vary by lender.

When Should You Refinance Your Mortgage Amansad Financial Learn what a mortgage refinance is and when to consider it. find out how to lower your interest rate, change your loan terms, take out cash, or make home improvements with a refi. Typically, they cost 2% to 6% of your outstanding principal balance. for example: if you still owe $200,000 on your home, expect to pay $4,000 to $12,000 in refinance fees. costs vary by lender. Learn the reasons and benefits of refinancing your mortgage, such as lowering your interest rate, changing your loan term, consolidating debt or investing in your home. find out how to decide if refinancing is right for you and what factors to consider. Here’s what to consider: loan term: refinancing to a shorter term helps you pay off the loan faster and pay less interest along the way. however, depending on your new interest rate, your.

Comments are closed.