Why Should We Teach Everyone How To Use Money Nurjakhon Makhmudova Andijan Development Center

Andijan Development Center Linkedin Everfi, a digital instructional company, offers a free seven session program for high school financial literacy. students take interactive, self guided lessons in topics like banking, budgeting. The national center for education statistics indicates that the high school dropout rate (the percentage of people ages 16 through 24 who are not enrolled in school and have not earned a high school credential) was about 6% in 2015. 2. the center’s high school report card focuses on each state’s financial literacy education policy because.

Learning To Use Money The first steps into the world of money start with awareness about the need to be educated and immersed into good money habits, and then with education on how to do so. banking, budgeting, saving. Financial literacy is the ability to understand and effectively use various financial skills, including personal financial management, budgeting, and investing. when you are financially literate. The rush we feel when spending money is temporary; being more intentional about what we buy can reduce our stress and boost our well being. understanding the psychological barriers against saving. In the market, you make or lose money depending on the purchase and sale price of whatever you buy. if you buy a stock at $10 and sell it at $15, you make $5. if you buy at $15 and sell at $10.

Why We Need To Teach Kids About Money Money Skills Money Lessons The rush we feel when spending money is temporary; being more intentional about what we buy can reduce our stress and boost our well being. understanding the psychological barriers against saving. In the market, you make or lose money depending on the purchase and sale price of whatever you buy. if you buy a stock at $10 and sell it at $15, you make $5. if you buy at $15 and sell at $10. However, the *rough* money development path they follow typically looks like this: 1. become fascinated with the power of money. your kid thinks money grows on trees – it’s limitless. kids make some decisions about how they spend any money they can get, and they want to make all the decisions about it. Financial literacy is a vital life skill, and as parents, we can guide our children towards a financially secure future. by tailoring our approach to their age, we can introduce money concepts gradually, empowering them to develop good money habits. from preschoolers learning about coins to school age children saving for long term goals, each.

Teaching Children About Money Healthy Life Essex However, the *rough* money development path they follow typically looks like this: 1. become fascinated with the power of money. your kid thinks money grows on trees – it’s limitless. kids make some decisions about how they spend any money they can get, and they want to make all the decisions about it. Financial literacy is a vital life skill, and as parents, we can guide our children towards a financially secure future. by tailoring our approach to their age, we can introduce money concepts gradually, empowering them to develop good money habits. from preschoolers learning about coins to school age children saving for long term goals, each.

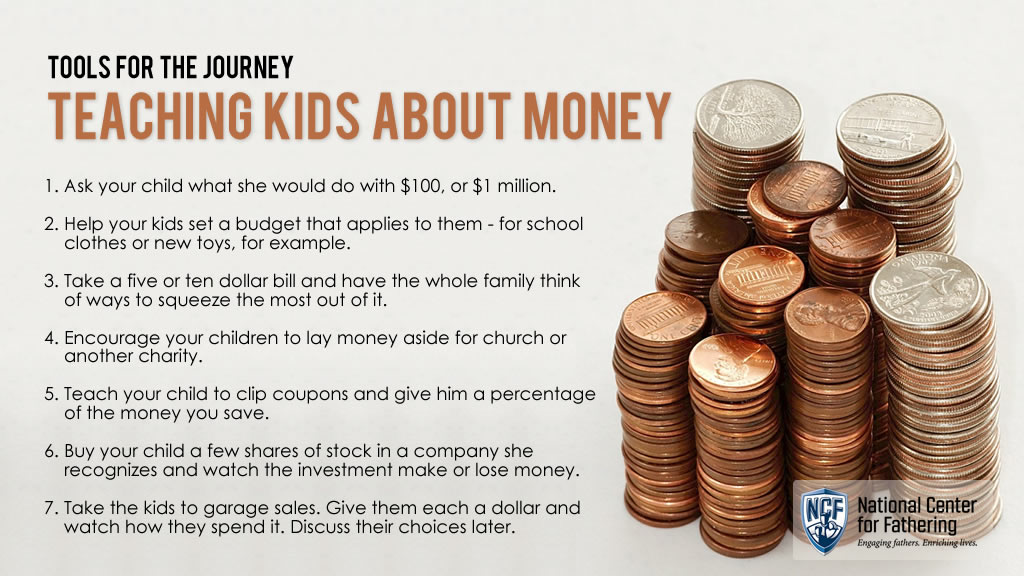

Teaching Kids About Money National Center For Fathering

Comments are closed.