Within How Many Days Of Requesting An Investigative Consumer Report

Fillable Online Send Within 3 Days Of Requesting An Investigative Study with quizlet and memorize flashcards containing terms like within how many days of requesting an investigative consumer report must an insurer notify the consumer in writing that the report will be obtained? a 3 days b 5 days c 10 days d 14 days, if an insurance company wishes to order a consumer report on an applicant to assist in the underwriting process, and if a notice of insurance. Any person who procures or causes to be prepared an investigative consumer report on any consumer shall, upon written request made by the consumer within a reasonable period of time after the receipt by him of the disclosure required by subsection (a)(1), make a complete and accurate disclosure of the nature and scope of the investigation requested.

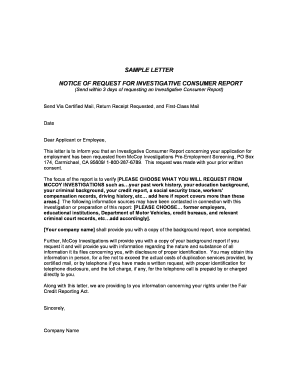

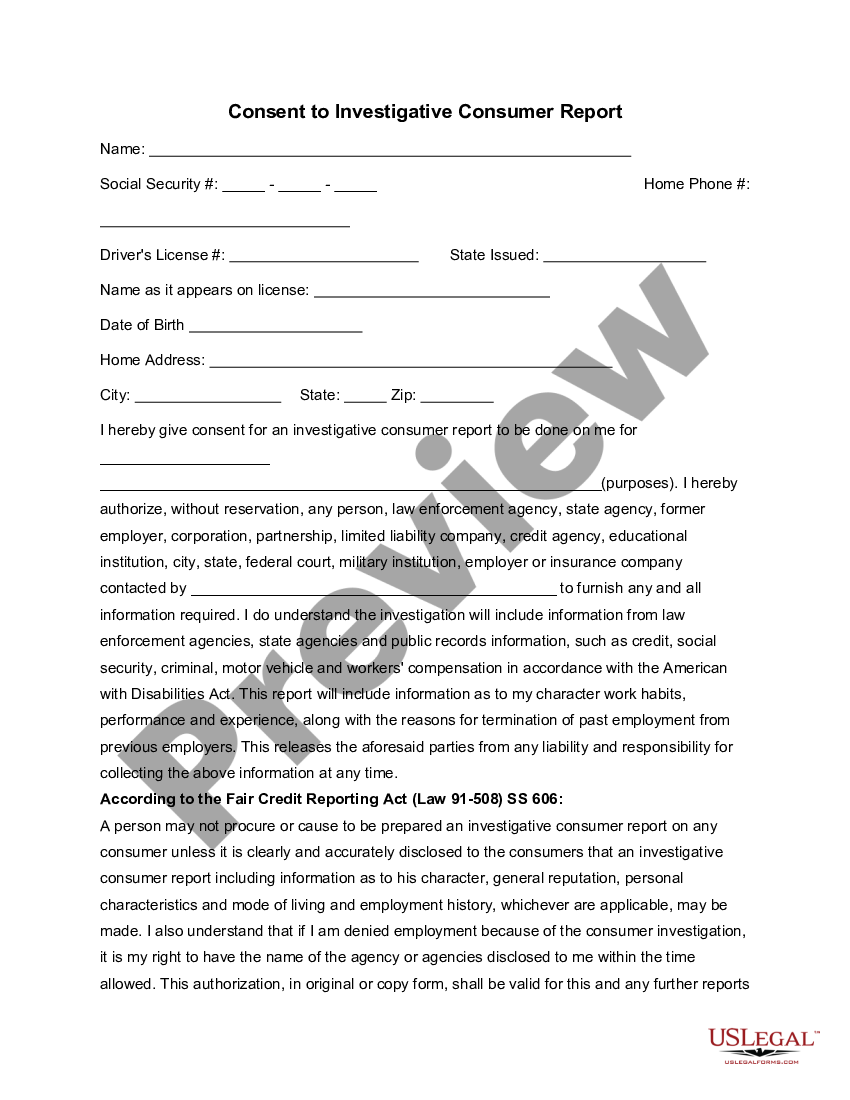

Consent To Investigative Consumer Report Consumer Report Agency Us Study with quizlet and memorize flashcards containing terms like within how many days of requesting an investigative consumer report must an insurer notify the consumer in writing that the report will be obtained a) 3 days b) 5 days c) 10 days d) 14 days, an agent makes a mistake on the application and then corrects his mistake by physically entering the necessary information. Which of the following requires that the insurance company supply the applicant with the name and address of the consumer reporting company? fair credit reporting act. chapter: insurance regulation. question 15 of 15. within how many days of requesting an investigative consumer report must an insurer notify the consumer in writing that the. A report by an investigative consumer report agency that includes personal information on a consumer. investigative consumer reports may be requested when applying for things such as employment or housing. the contents and limits of such reports are defined by civil statutes. for example: section 1681a of the fair credit reporting act defines. Consumer of the bank’s name and address before contacting it to prevent the bank from becoming a consumer reporting agency. investigative consumer report when an investigative consumer report is requested from a consumer reporting agency, the bank must inform the consumer not later than three days after such request that a report may be made.

Investigative Consumer Report Presentation Jun 09 07 Version A report by an investigative consumer report agency that includes personal information on a consumer. investigative consumer reports may be requested when applying for things such as employment or housing. the contents and limits of such reports are defined by civil statutes. for example: section 1681a of the fair credit reporting act defines. Consumer of the bank’s name and address before contacting it to prevent the bank from becoming a consumer reporting agency. investigative consumer report when an investigative consumer report is requested from a consumer reporting agency, the bank must inform the consumer not later than three days after such request that a report may be made. Clearly and accurately disclose to the employee or applicant in writing that it may obtain an investigative consumer report, including information from the referenced personal interviews as to their character, general reputation, personal characteristics, and mode of living. be provided to the candidate within three days of requesting the report. Key takeaways. credit reports contain information on an individual's credit history and are primarily used by lenders. investigative consumer reports contain information on an individual that is.

Consumer Reports Vs Investigative Consumer Reports One Source Clearly and accurately disclose to the employee or applicant in writing that it may obtain an investigative consumer report, including information from the referenced personal interviews as to their character, general reputation, personal characteristics, and mode of living. be provided to the candidate within three days of requesting the report. Key takeaways. credit reports contain information on an individual's credit history and are primarily used by lenders. investigative consumer reports contain information on an individual that is.

Comments are closed.